Central Bank Interventions in Money Market : Beware of Systemic Risks

This short article highlights Central Bank (CB) interventions in money market for the period 02 January - 03 February 2023 and resulting panic volatility in the market.

Such monetary interventions were carried out to reactivate money market and show a reduction in interest rates as part of new OMO rule imposed by Director, Domestic Operations, on 02 January 2023.

However, systemic risks behind such questionable interventions in the current context could be considerable.

Highlights

OMO and Liquidity

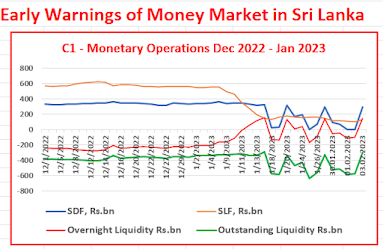

- Market liquidity in terms of both overnight and outstanding became highly volatile along with the volatility and reduction in volumes of standing deposits and standing lending (See image C1 and Table 01).

- Consequent to the new OMO rule, standing lending plummeted while standing deposits became highly volatile where deposits were zero on three days. SDFR is meaningless when deposits are zero.

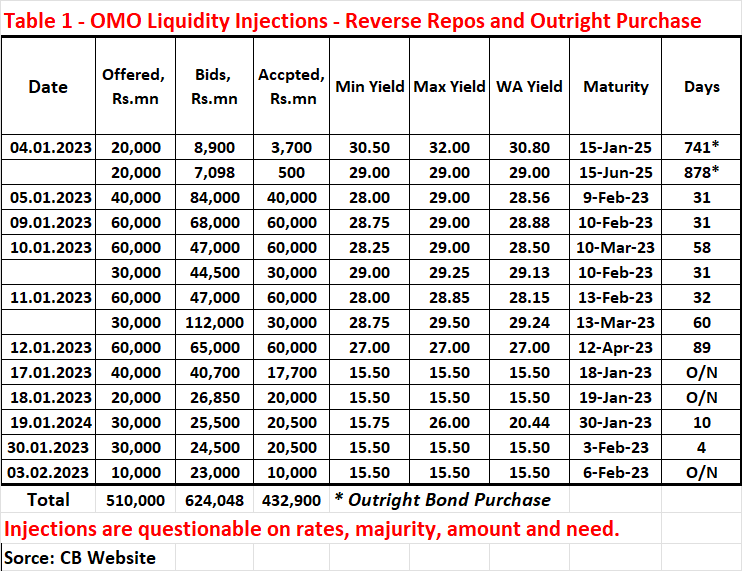

- Although the CB injected a total of Rs. 432.9 bn of liquidity through outright and reverse repo auctions, the liquidity continued to be negative and highly volatile. Such liquidity injections were seen to cover up the reduction in standing lending under the new OMO rule. Four overnight reverse repo auctions which are same as standing lending also were conducted at interest rate of 15.5%.

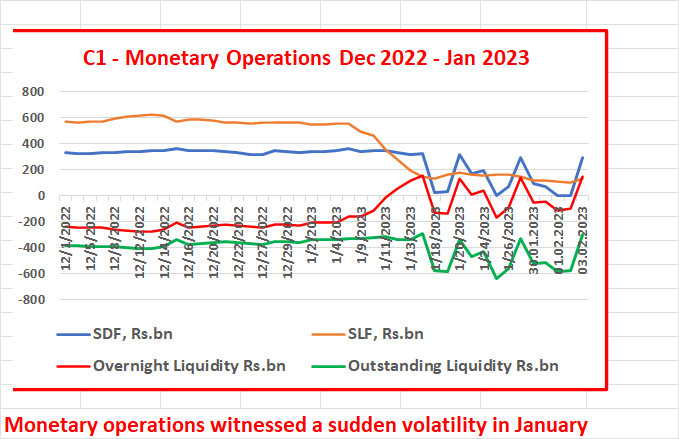

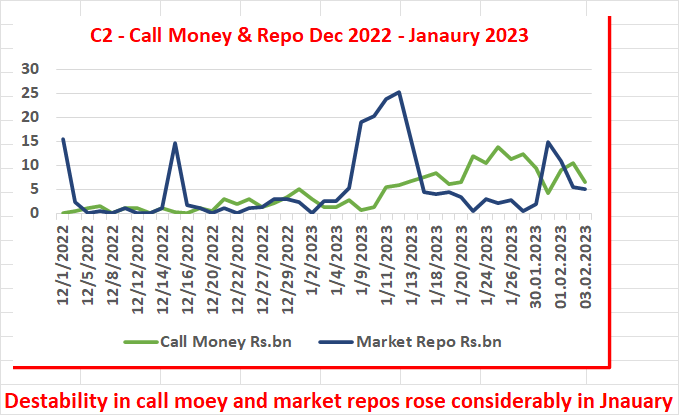

- Volumes of both overnight call money and market repos continued to be volatile (See images C2 and C3 and Table 02).

- Call money interest rates were volatile close to SLFR (15.5%) while market repo rates were largely at 15.5%.

- Such a panic volatility might trigger a systemic risk if it continues without corrective actions.

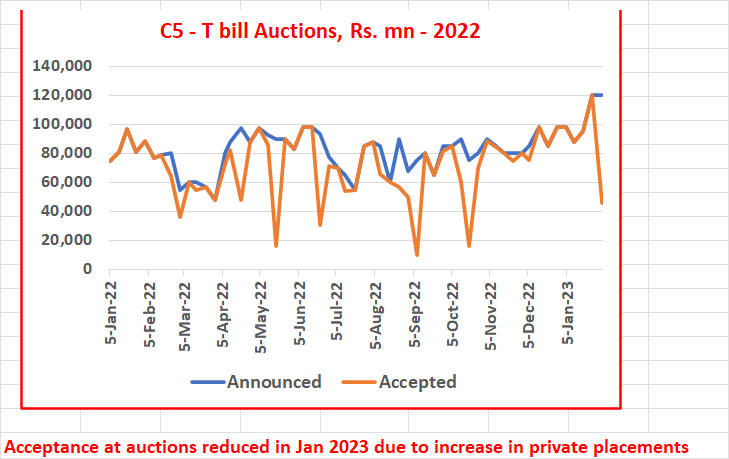

- Yield rates were pulled down by a reduction in acceptance from auctions (see image C4). This strategy was facilitated by significant increase in private placement window at auction weighted average yield offered to dealers free from bidding risk. Current concerns and proposals over domestic debt restructuring could reverse this downward trend of yield rates very soon.

- As a result, total private placements accepted from the past five auctions rose to Rs. 170.2 bn as compared to Rs. 33.3 bn in December 2022. It is questionable how private placement window accepted Rs. 83.8 bn exceeding Rs. 45.6 bn accepted at the auction held on 02 February 2023. As a result, total acceptance stood at Rs. 616.8 bn which exceeded the offered amount of Rs. 521 bn. (see image C5).

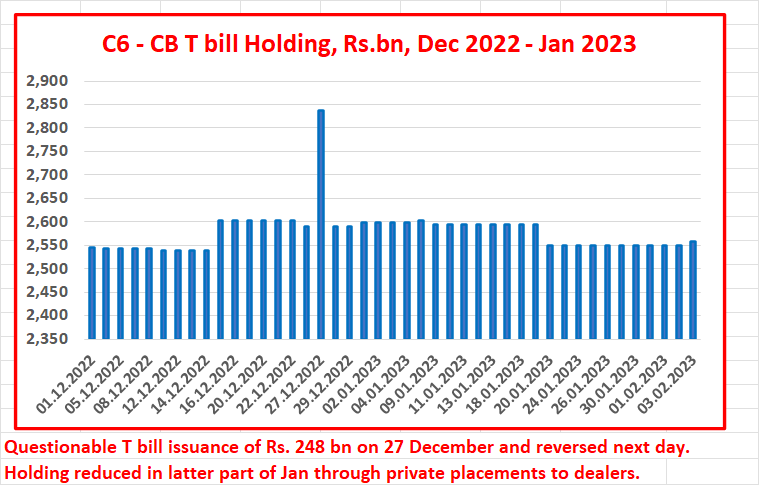

- CB Treasury bills holding was marginally reduced through private placements. The CB subscription of Rs. 248 bn on 27 December and reversal it on the following day are questionable market manipulations. A CB direct subscription of Rs. 9.6 bn at a discount of 5.7% on 3 February was reported as the first instance in 2023. The CB holding stood at Rs. 2,558.6 bn on 3 February 2023 (see image C6).

Authorities are warned that irregularities/manipulations seen in money market intervention and resulting panic volatility may have potential of triggering a systemic risk, given the country's bankrupt economy and financial system.

Intervention of insider type to fix money market operation to show easing liquidity and interest rates without relaxing the monetary policy could also be a possible trigger for a systemic risk.

If authorities believe that the new instability created by them in the money market is prudent, they must state so and be ready to accept the responsibility in the event of possible bank runs.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment