CB's Monetary Operations in 1st Half 2023 - Helping the recovery or money dealers?

The CB carries out monetary operations to maintain monetary and financial conditions of the economy in line with the prevailing monetary policy stance to achieve the target of inflation. Therefore, monetary operations primarily target the inter-bank market liquidity and overnight inter-bank interest rates within the policy interest rates corridor as decided by the Monetary Board from time to time.

Accordingly, key instruments of monetary operations are policy interest rates, standing deposits and standing lending facilities, reverse repo lending, overnight inter-bank loans and repos, inter-bank liquidity, inter-bank interest rates, Treasury bill yields, private issuances of Treasury bills and CB's direct purchase of Treasury bills.

These instruments are managed though money printing affecting the CB's balance sheet which transmit the monetary policy to affect the monetary and financial conditions of the economy with unidentified lags.

Accordingly, the purpose of this short article is to highlight the monetary operations in the 1st half of 2023 through a graphical presentation and raise concerns over possible irregularities and objectives of such monetary operations.

Market Liquidity Management

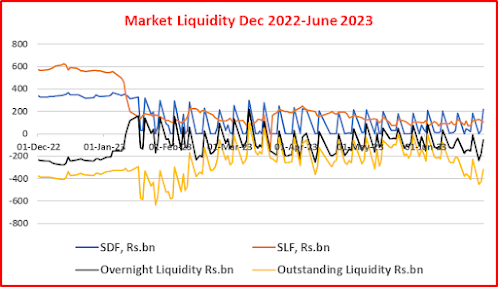

- As the CB has restricted the standing deposit and standing lending windows with effect from 16th January 2023 (new OMO policy), the banking sector liquidity managed through standing facilities has been highly volatile. Restrictions are the maximum five days to standing deposit facility and up to 90% of the statutory reserve requirement to standing lending facility.

- As a result, the CB has had to regularly inject the liquidity through reverse repo auctions to keep inter-bank interest rates within the policy rates corridor. Therefore, the CB's liquidity injection through both overnight and outstanding basis has been highly volatile. Although the amount of liquidity injection (negative liquidity shown in the chart below)has declined in February and March, it has significantly risen in May and June.

Inter-bank Market Operations

- Although the purpose of new OMO policy is to activate the inter-bank market, the market volume has risen only on some days. Therefore, daily inter-bank market activity (call money and repos) has generally been less than Rs. 10 bn.

- Further, the market has been highly volatile and unpredictable.

- As standing facilities have been restricted in violation of the policy rates based monetary policy model, the CB has actively carried out injection of liquidity through reserve repo auctions of all three categories, overnight, short-term and long-term. The total reverse repo turnover was Rs. 2.6 tn. against the offer of Rs. 3.5 tn. Of the gross reverse repo volume, 52% has been term basis while 48% on overnight basis.

- Therefore, the banking sector has had the opportunity to manage the liquidity through long-term funds provided by the CB at lower rates. Most overnight as well as many term reverse repos have been offered at interest rates lower than the standing lending facility rate under restriction. Therefore, the loss to public fund due to such lower interest rates on reverse repos favouring money dealers is a salient feature of the CB's monetary operations which cannot be justified in economics and business.

Money Market Rates

- Policy rates were raised by 1% to 15.5% and 16.5% on 3 March in compliance with with the IMF requirement.

- Although the purpose of the CB's new OMO policy is to reduce inter-bank interest rates through an active inter-bank market which less depend on the CB's standing facilities, inter-bank interest rates mostly have been around the standing lending facility rate, the upper bound of the corridor, due to crunched liquidity position.

- Therefore, if not for the the CB's active reverse repo auctions offered, inter-bank interest rates would have exceeded the upper bound of the corridor, signaling a failure of the interest rate target of the monetary policy.

Treasury bill Primary Issuances and Yield Rates

- T bill yield rate are de facto policy rates to drive term credit markets. Therefore, the CB controls yield rates through various devices outside weekly auctions such as private placements at auction weighted average yields and CB's direct purchases of Treasury bills.

- In the recent past, yield rates have been managed within or around the policy rates corridor. However, since 2022 yield rates were kept at levels of twice or thrice the policy rates. The rationale for the irregular deviation of T bill yields from policy interest rates is questionable.

- Further, the reason for the reduction in yield rates when policy rates remain constant or increase is not clear. Meantime, a faster reduction in yield rates after the policy rates cut of 2.5% on 31 May is an outlier. It is clear that the T bill Tender Board has resorted to fixing T bill yields to drive monetary tightening and relaxation without the direct use of policy rates.

- A policy irregularity was reported at the auction held on 31 May by keeping yield rates unchanged at previous week auction levels, despite the policy rate cut of 2.5% on same day after noon and the knowledge of Tender Board members on the policy rate cut.

- From April onwards, acceptance of T bill bids has risen over the amount offered. This is a result of rising volume of private placements accepted at auction weighted average yields that provides bidding risk free investments to dealers where market development and fiscal discipline are suppressed.

- Acceptance of bids for 91D bills and private placements have mainly contributed to fund raising.

- Monetary financing through direct purchase of T bills by the CB in violation of the section 111 of the Monetary Law Act is a prime device used for the control of yield rates.

- Therefore, the CB's T bill holding has risen from Rs. 2.5 tn to Rs. 2.8 tn in mid-May and has fallen back to Rs. 2.5 tn at the end of June.

- In 1st half of 2023, the CB has made special issuance of T bills to the CB to provide funds on Treasury's request on four instances totaling Rs. 221.8 bn. Accordingly, the total funding though this method newly introduced by the present CB Governor on 6 May 2022 has risen to Rs. 977 bn at the end of the 1st half 2023. The issuance of Rs. 189.4 bn on 17 May has been a record amount.

Overall Public Concerns

- The CB's new OMO policy has failed to serve intended policy objectives, i.e., to activate the inter-bank market and reduce market interest rates without policy rate cuts.

- In response to the new OMO policy, the CB has been compelled to inject liquidity through reverse repo lending to protect the policy rates corridor. As a result, banks had the opportunity to borrow term funds from the CB at interest rates lower than policy rates casing a loss to public funds.

- Monetary financing and private placements have been the major devices to control T bill yield rates. However, the salient irregularity in the behaviour of T bill yield rates raises serious concerns over the policymaking rationale of the T bill Tender Board.

- Monetary operations presented above are connected with ad-hoc money printing and monetary interventions in the money market and do not show any connection with the monetary policy objectives.

- Policy irregularity reported on T bill issuance on 31 May by not reducing yield rates in accordance with the policy rate cut by 2.5% on same day evening and resulting loss to the public need to be investigated by audit and law enforcement authorities. This irregularity is proved by the T bill issuance on 5 July by reducing yield rates 3%-4% by the Tender Board in accordance with the policy rate cut of 2% on same day evening.

- CB officials use public funds in the name of monetary policy as if their private money and private business policy. Therefore, transparency and personal accountability must be assured to minimze policy abuse of public funds.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment