Is govt a victim of monetary policy? Is there any bailout?

Article's Background

It is the long tradition of the CB to use public debt management as the conduit for the monetary policy. The major reason is the inherent ineffectiveness of policy interest rates to drive interest rates in the economy. The ineffectiveness mainly arises as policy rates target the levels of overnight inter-bank interest rates whose lending volume is insignificant, as compared to the total flow of credit and money created by the banking system, to affect other interest rates. In addition, the policy rates system from the beginning of this year has restricted the CB's standing facilities and, therefore, policy rates are a dormant policy instrument.

In this context, given the large size and credit quality, the CB uses T bill yield rates as de-facto policy interest rates. This strategy is aided by the legal requirement for issuance of government securities through the CB as the fiscal agent of the government where the CB conducts weekly auctions of T bills and determines yield rates and acceptance of bids.

The particular tender board chaired by a Deputy Governor who is also an ex-officio member of the Monetary Policy Board (MPB) caries a mandate to decide on auction in consideration of both government funding requirements and monetary policy requirements. The Governor being the Chairman of the MPB is to approve the tender board recommendation in this line along with additional and strategic information he has on the monetary policy priorities and future directions. Therefore, the governance and transparency behind the conduct of the monetary policy must be subject to public concerns.

Accordingly, even after 76 years of independence from the British rule, the government has been unable to decide independently the amounts it borrows from money market and the interest rates it pays for such borrowing in the interest of fiscal discipline and fairness to the general public who shoulders the debt service burden.

Therefore, this article is to shed light on the public questionability of the last two T bill auctions in view of the cost to public funds at the time of fiscal bankruptcy and underlying issues in monetary policy governance that has victimized the government.

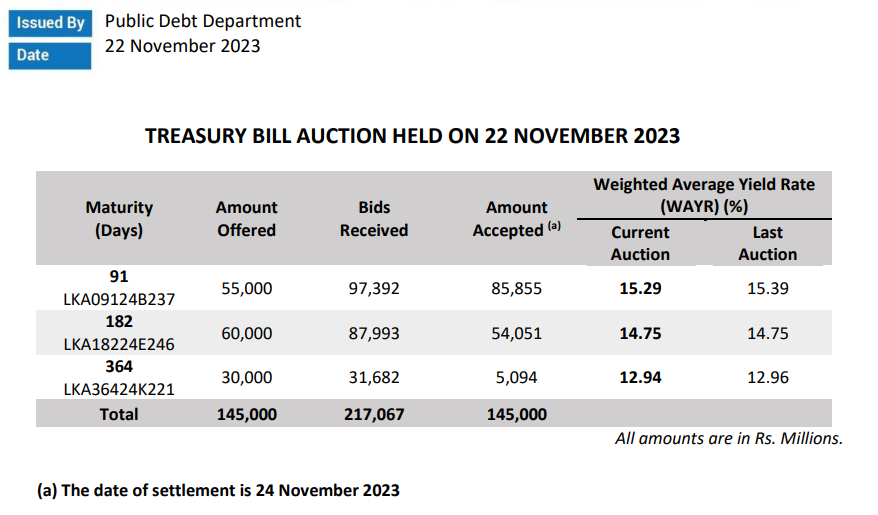

Auction held on 22 November 2023

- On this day, there was 1% policy rate cut on the table of the MPB for next day. The Governor, tender board Chairman, Director of Economic Research (a member of the tender board) and Assistant Governor supervising the Research (a member of the tender board) knew it as MPB papers are circulated in advance. Therefore, 1% rate cut did not come from the ceiling of the MPB room without the prior knowledge of the tender board. However, tender board kept auction T bill yields almost unchanged.

- The settlement of accepted bids took place on 24th after effecting the policy rate cut. Therefore, successful bidders settled funds for the auction at yield rates higher than market yield rates on the settlement date.

- Further, even if the auction was fully subscribed (R. 145 bn), the placement window was open at higher yields unnecessarily to facilitate a set of dealers. An amount of Rs. 9,214 bn has been raised at yields higher than market yields prevailing on the settlement date.

- The correct option that the CB should have pursued was to cut-off bids at yields lowers than the previous auction and raised the balance from the placement window.

- The acceptance of significantly higher volume of bids than the auctioned amount in the case of 91-day bills has resulted its yield rate to prevail at considerably higher levels than yield rates of other two longer maturities.

- Accordingly, additional interest cost to the public funds from the auction alone is about Rs. 1 bn.

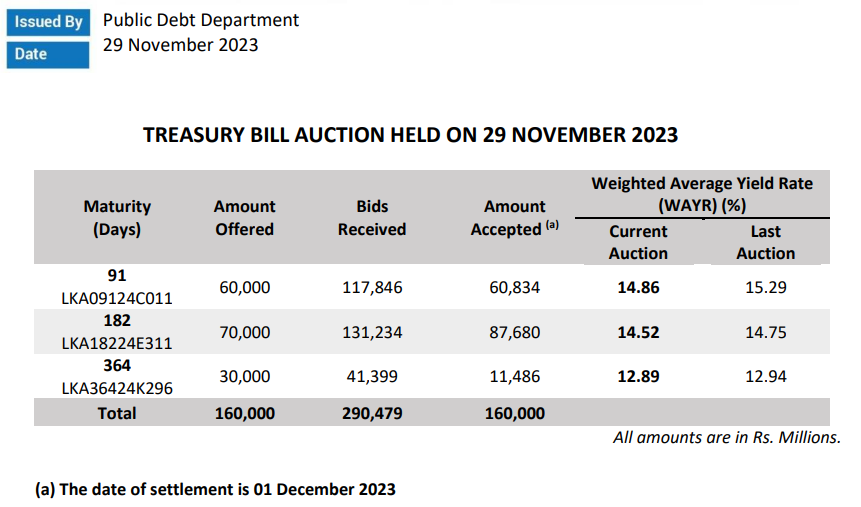

Auction held on 29 November 2023

- This is the first T bill auction held after the policy rates cut on 23rd. However, the cut in yields rates is only marginal and not consistent with the policy rates cut of 1%.

- Bids for two bills were accepted more than the announced amount. Therefore, yields continued to remain higher. However, placements window also was open for raising funds beyond the announced funding requirement. Therefore, another set of dealers will benefit from higher yields on the settlement day (1st December) despite lower market rates. This means that dealers can borrow at lower rates on 01 December to settle bids and pocket a profit twice, i.e., higher yields at the auction and lower borrowing rates two days later. Two days are there for them to look for investors for disposal of bills at lower yields.

- The correct option that the CB should have pursued was to cut-off bids at yields at least 1% lowers than the previous auction and raised the balance from the placement window at such lower yield rates.

- If the tender board had cut yield rates by 1% at the previous auction, the yields at this auction could have fallen further and helped reduce market interest rates to support the economic recovery while easing the fiscal financing cost.

- Accordingly, additional interest cost to the public funds from this auction alone is about Rs. 1.5 bn.

- The MPB has announced a pause in policy rates cut at the last meeting held on 23 November. This may be due to high inflationary pressure witnessed in terms of the level of Consumer Price Index (CPI). The MPB policy statement also mentioned about inflationary pressure due to proposed VAT increase. However, the direct inflationary pressure coming from the significant wage hike and increased budget deficit of Rs. 2,851 bn (by Rs. 500 bn) to be funded by the increased monetary financing (gross borrowing limit raised to Rs. 7,350 bn by 48% from 2023 level) is easy to understand without any macroeconomic research and inflation projection models.

- Therefore, the CB that follows hard core monetary theory of inflation on monetary financing of budget deficit would not like benchmark interest rates to fall. The policy rates cuts are only superficial acts because they do not have a noticeable impact on interest rates and credit creation, given the fact that the demand for credit lags behind in the bankrupted economy where banks also are not willing to take credit risks while sitting on a large bed of non-preforming loans without any effective resolution or restructuring.

- Therefore, the CB has not taken action to reduce T bill yield rates to be consistent with policy rates cuts. This shows that, although the MPB insists on banks to reduce lending interest rates to pass benefits of the series of the monetary easing measures to businesses and households, the CB is not interested in providing same benefits to the government struggling with fiscal bankruptcy. In addition, the CB offered to print nearly Rs. 30 bn to 80 bn on a daily basis to lend to banks through reverse repos mostly at rates lower than inter-bank rates to support their creation of credit for the private sector. However, the CB does not carry out lawful open market operations to push down the yield rates in line with monetary easing and around zero inflation. This is the only central bank which runs interest rates at a cost to the government while leaving out monetary policy instruments. This is real hypocrisy.

- In this background, the reduction in yield rates at last two auctions has been suppressed to few basis points (i.e., 53, 23 and 7). In contrast, the overnight inter-bank rate has fallen exactly by 1% together with market repo rate fallen by 0.92% between 22nd and 29th. Therefore, the CB's insider act to keep T bill yield rates inflated is clear from published data.

- This insider act is easily evident from the rise in yield rates faster in the monetary policy tightening cycle and from slower reduction in the monetary policy easing cycle (see Chart below).

- Therefore, the cost of CB's insider act is the additional interest cost to public funds, especially as the fiscal front is mainly financed by Treasury bills consequent to unconstitutional default of foreign debt by the CB. Interest payment is the single highest expenditure item in 2024 budget accounting for 28% of total expenditure and 64% of income. Therefore, it is the CB's interest rate policy that keeps the government bankrupt uninterruptedly. We need to question the rationale for printing of money at an interest rate of 10% for the private sector and inflating government securities yields at 14%-15% at the time of inflation close to zero. Therefore, taxing the public to pay high interest on debt without controlling the interest rates on borrowing that the government has a full control is an undemocratic act of the government.

- Overall, unless the government lays Chinese walls between the monetary policy and fiscal debt management and requires the MPB to carry out the monetary policy strictly within goals and instruments provided for in the legislation and the government takes control of its debt management, the government will continue to be a hostage in the monetary Gaza Strip in Sri Lanka.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment