Central bank without an annual report - Is this the independence offered by lawmakers?

Article's Background

The CB has released its inaugural reports as required in sections 80 and 99 of the Act on 25 April 2024 as follows.

- Annual Economic Review 2023 - in terms of section 80

- Financial Statements and Operations of the Central Bank 2023 - in terms of section 99

This is in contrast to the requirement of the annual report of the Monetary Board under the Monetary Law Act that governed the Monetary Board/CB up to 14 September 2023 since its inception in 1950.

By looking at two new reports, I wonder whether this is the independence consciously given by lawmakers to the Governing Board/CB to operate even without a standard annual report. The annual report is a requirement in good corporate governance of institutions whether private or public or business or non-business, irrespective of their incorporation.

The annual report is an official means to the general public to know the objectives, business operations, management system, business performance, financial outcome and public accountability of formally incorporated institutions on annual basis. How the information is presented in the annual report in a public friendly manner is a different expertise of respective institutions. However, instances of annual reports prepared to hide the truth, especially of financial operations and outcomes, through creative accounting and disclosures are not rare. Anyhow, annual report is a good means of transparency of institutions.

However, Sri Lankan lawmakers do not wish the public to read a standard annual report of the CB except two other reports relating to the economy and CB.

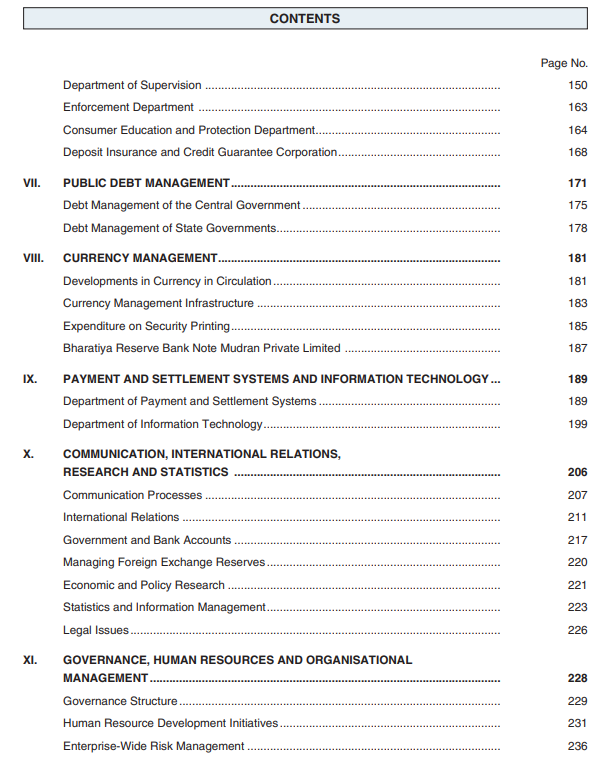

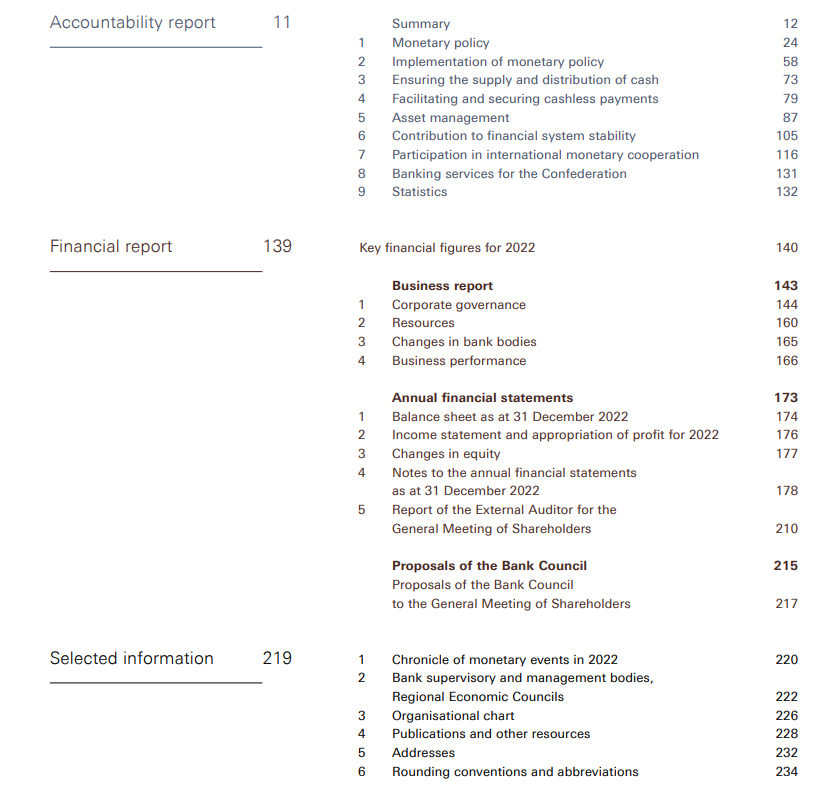

I give below sources of annual reports of several central banks for information of the readers.

Therefore, this short article is intended to draw the attention of lawmakers to question themselves whether this is the kind of independence they offered to the managers of the CB.

Annual reports of 5 leading central banks

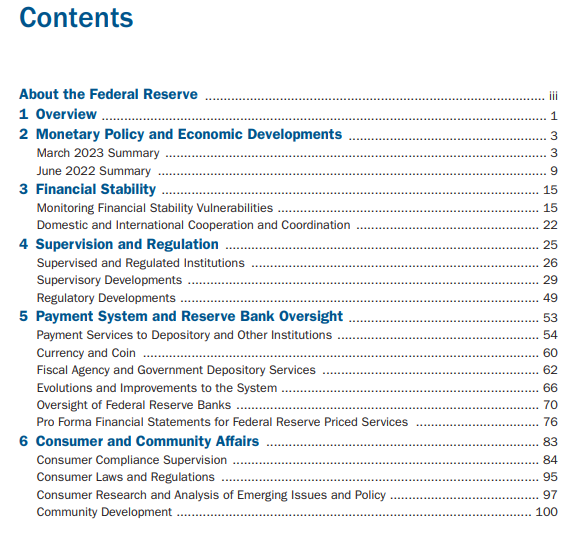

Readers may access these reports and see what is the nature of annual reports of central banks.- US Federal Reserve System (See 2022 Report here) (See annual financial statements 2023)

- Bank of England (Read 2023 report here)

- Bank Negara Malaysia (Read 2023 Report here)

1. Annual Economic Review 2023 (Read the Report here)

- Requirement of section 80(3) - Within four months after the close of each financial year, the Governor of the CB to publish and lay before Parliament through the Minister a report approved by the Governing Board on the state of the economy during each financial year emphasizing its policy objectives and the condition of the financial system. The report shall include a review and assessment of the policies of the CB followed during the year.

- This report is nothing but a generic representation of the part I of the annual report model followed by the CB under the Monetary Law Act.

- The CB has a long history of writing such reports on the economy. However, the missing core is an assessment of how CB policies have served the public through the economy and the condition of the financial system. This is the reason why the CB is required to submit a report on the state of the economy and financial system and not because they are exclusively run by the CB. Therefore, it is questionable why the Governor is required to submit a report on the status of the economy, given the fact that the state of the economy is not an exclusive outcome of the Governor but of all stakeholders such as the governments, markets and political/country governance players.

- However, based on the report of the Economic Review 2023, the CB press release has taken every good things of the economy to its credit of policies as stated "The Central Bank implemented an array of policies in 2023, initially to bring stability to the economy and then to buttress the economic recovery. This encompassed the shift from a tight monetary policy stance to an accommodative stance since June 2023, allowing greater flexibility in exchange rate determination and progressive removal of administrative restrictions imposed on certain foreign exchange transactions. The Central Bank guided the financial sector with prudential regulatory measures, preserving domestic financial system stability..."

- This is the usual policy mania of the CB management that every good things under the sun are their outcomes and the bad rest is due to the government and markets. I wonder why these economists do not have the common economic sense to understand that everybody from the beggar on the road to the rich in the society contributed to the present recovery of the economy through both earning and spending in what ever the way they could. The contribution of expatriates looking for a light for life abroad has been the major source of the policymakers to boast on so-called prudent policies for the recovery of the economy from the foreign currency crisis created by the CB in the past.

- However, the much-attracted foreign debt restructuring as the core of the recovery policy package of the IMF-assisted policymakers is still staggering after two years without any light seen in the tunnel and, therefore, the country's bankruptcy continues despite CB's prudent monetary and financial policies presented in the report.

- Overall, I am at loss to understand why this report is named as "Economic Review 2003" rather than "Report of the State of the Economy and Financial System of Sri Lanka 2023" in line with the statutory requirement.

- Requirement of section 99 - Within four months after close of each financial year, the Central Bank submits to the Minister, financial statements approved by the Governing Board, signed by the Governor and Chief Accountant and audited by the Auditor General.

- This report is primarily presented to please European accounting industry that the CB follows International Accounting Standards in their favour without any real purpose for central bank operations. Therefore, the report does not help the general public to understand the financial results arising from public mandates of the CB, primarily the impact and justification of CB operations on its monopoly printing of money or legal tender.

- Operations of the CB are indicated in the report in generic forms of mandates although it is not statutorily required. Therefore, the name of the report is questionable. As the CB's operations are highlighted in generic or theoretical form, specific services provided by various Committees and Departments of the CB to the public during the year are not traceable. Therefore, next year's report will be the same report except numbers in the financial statements.

- At present, there is a big controversy among lawmakers and public whether money spent by the CB is a part of public finance falling under the control of the Parliament because of the unethical and unlawful wage policy attempted by the CB Governing Board and suspended by the Parliament. Therefore, it is the question to be asked from lawmakers whether they want a central bank to print money as presented in these financial statements for the country.

- For example, the loss of the CB operations in 2023 is Rs. 114 bn. When the profit distributable to the government is estimated in terms of the Act, the loss is Rs. 313.7 bn. No body has any idea of how this will be reported in financial statements or what is the rationale for a sperate accounting for profit transfer to the government outside the standard financial statements or how will the CB distribute profit next year notwithstanding this year's loss if there will be a profit and who will be accountable for such a massive losses to public finance despite the CB operates on money printing.

- The Auditor General states as follows.

- However, Auditor General does not disclose what evidence and the procedure were used to determine that the CB has procured and utilized resources (especially the printing of money) economically, efficiently and effectively as stated in the para 2.2.4 of his report highlighted above. If somebody sees CB's reverse repo auctions heavily used by the CB on a daily basis to inject reserves to banks and primary dealers, it provides funds through overnight reverse auctions at a significantly lower interest rates than the overnight standing reverse repo facility (standing lending facility) where the loss to the CB is material. Does the Auditor General's confirmation means that the CB has utilized money printing economically, efficiently and effectively on reverse repo auctions upon his examination or he has not examined relevant auction process and information which is a material operation under the monetary policy of the CB?

- As found from the report, a significant irregularity exists in making monetary policy decision as disclosed in the page 89 of the report. Accordingly, the Governor sits as the Chairman of the staff level Monetary Policy Committee (MPC) meeting attended by member of the Monetary Policy Board (MPB) as observers. It is the MPC that submits relevant monetary policy proposals to the MPB. Therefore, this is a clear breach of the separation between the technical staff and decision-makers as the Governor chairs both Committees. Therefore, technical staff have become slaves of the Governor and MPB, given their excessive public powers. Instead, it is required that MPB members sit at MPB meetings with own studies, forecasts and comments independent from the technical staff. Therefore, this type of irresponsible policy governance is a significant public irregularity and conflict of interest. The classic example is the intervention of the Governor with two Deputy Governors in the staff of Public Debt Department on the conduct of the 30-year bond auction held on 27 February 2015 which burst a national corruption issue. However, nobody knows effects of such intervention in interest rate decisions as no investigations or audit are held.

- An important declaration of the Governing Board is as follows (page 83). "The financial statements of CBSL has been prepared on the going concern basis. The Governing Board has assessed the key financial risks impacting the Bank as disclosed in the financial statements and has determined that there are no material uncertainties that may cast significant doubt about the Bank’s ability to continue as a going concern and that therefore the going concern basis is an appropriate assumption to use in preparing the financial statements." I am at loss to understand how this going concern accounting basis is applicable to central banks operating on the monopoly power of printing money to spend in any way they want being independent from public finance control. Therefore, central banks do not confront any financial risks to be assessed governing boards. This is nothing but a direct copy of corporate business accounting policies.

Given the nature and scope of the information released in the two reports to lawmakers, it is essential that they do not just leave the two reports as just another two reports they receive but peruse them carefully with the help of persons who understand them whether this is the central bank they wanted for the economy and general public welfare of the country. If they are satisfied, we will have to wait for the future to enjoy the results.

It will be a national mistake if they believe that the CB complies with public accountability through such reports because the public accountability is about the contribution of the CB to the living standards.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment