Why new govt's borrowing also is high? For debt service or high local interest rates?

Article's purpose and background

This short article highlights how high domestic interest rates inappropriate for the economy have become the key reason for continuously high borrowing by the new government.

- The media is full of comments why the new government also borrows in large amounts despite its anti-borrowing stance.

- Analyst's provide reasons of own fantasy. The borrowing to repay debt and interest raised by previous governments, mismanagement of debt by past governments and high exchange rates involved in repayment of foreign debt are cited as popular reasons.

- Although the Ministry of Finance has the full set of information, it does not provide clarifications to the public on the facts.

Real reason - high domestic interest rates

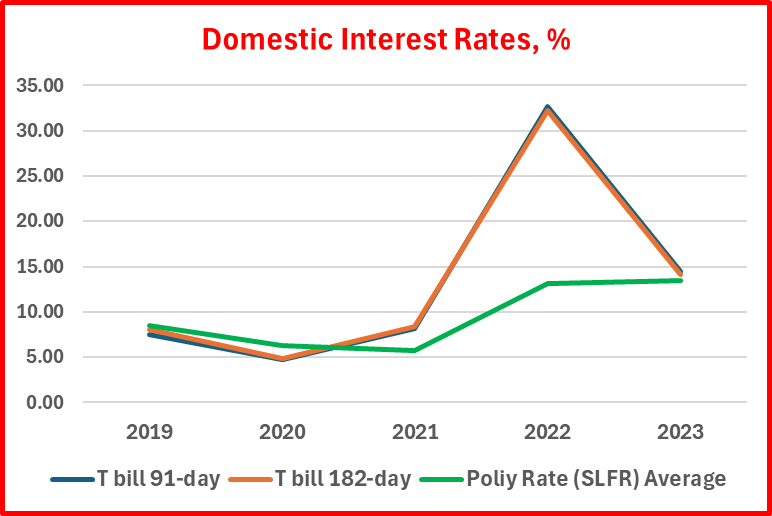

I provide high domestic interest rates as the prime reason for rising indebtedness of the new government. A graphical presentation is given below based in statistics published by the Central Bank (CB).

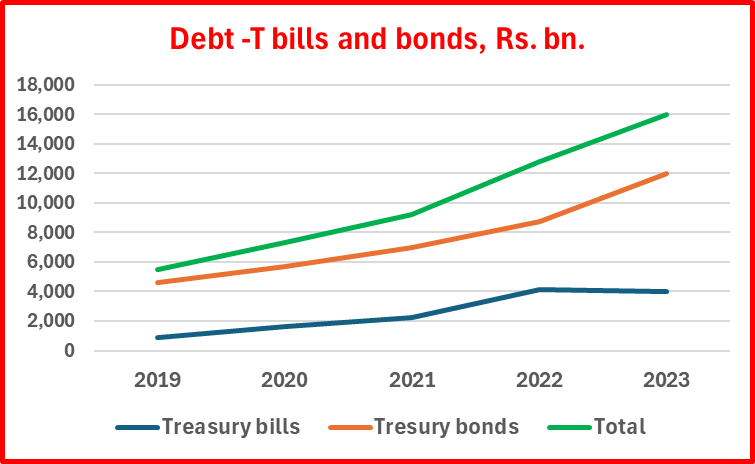

- Domestic debt holds a dominant share in total debt. Treasury bills and bonds which face market interest rates in line with the CB monetary policy are the major debt categories.

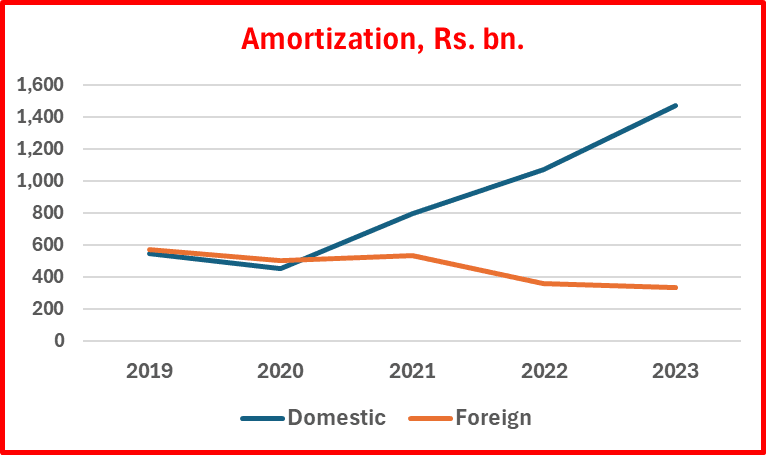

- Therefore, interest payment on domestic debt led by Treasury bills and bonds is the burden on the government which has to borrow newly for interest payment in addition to amortization (or debt repayment). Domestic debt amortization is the biggest component. In fact, foreign debt service (interest and amortization has declined in the recent past. The trend will continue till 2028 due to ongoing default and restructuring of foreign debt. In general, foreign debt is repaid by proceeds of new foreign debt. Therefore, domestic borrowing is necessary only when foreign debt is repaid through the CB foreign reserve. If so, foreign debt stock should decline. That happened in 2021 and 2023. However, borrowing to repay debt at the maturity or to amortize cannot be separately identified as borrowing for repayment of debt is not a budgetary expenditure that is counted in the deficit. Therefore, only the borrowing for budget deficit including interest payment is budgetary.

- The budget deficit which is the cause for new debt is almost the interest cost. However, the debt stock has increased in 2022 unreasonably, mainly due to increase in foreign debt, without any association with budget deficit, interest payment and amortization.

- Therefore, unusually high interest rates maintained by the CB for its monetary policy in 2022 and 2023 as well as in many years in the past two decades are behind the significant rise in borrowing. Interest rates around 10% or above have been the key burden to successive governments in their fiscal operations.

- The interest paid at red hot rates (i.e.,15% to 33%) on huge volume of borrowing through Treasury bills in 2022 and 2023 (Total Treasury bill turnover of around Rs. 9,970 bn) (and Treasury bonds) should be accumulating as new borrowing while the govt. does not have income or a fiscal space to retire these Treasury bills.

- Information on maturity profile of debt with contractual interest rates is necessary do assess the extent of the problem. This information is not publicly available.

- As such, high exchange rate (or currency depreciation) is not a noteworthy reason for new borrowing as the need for the government to service foreign debt is low while same exchange rate is a good source of domestic proceeds on continued foreign borrowing from supra-national institutions for fiscal operations.

- Inappropriately high domestic interest rates are the prime cause of high debt burden. Interest rates are driven by the CB's monetary policy which has no consideration over fiscal and supply side requirements of the economy. The monetary policy effectiveness for the price stability or inflation control through the demand side of the economy is also not established, other than the citation of the old monetary hypothesis.

- However, nobody is dare to question the appropriateness of the CB's interest rate policy, possibly thinking that such interest rates are divine-determined with no room for any policy error.

- Therefore, whatever the vision of the new government for a new economic system to replace the old system, the heritage of debt problem will no doubt cripple the new government too as already seen from political comments on continued borrowing. The newly cleaned up Parliament expected in the middle of November will not be able to fix this economic governance problem as nobody can lawfully influence in the CB's independence or the fiscal space fixed by the IMF network. Therefore, as the new public debt law provides for non-market borrowing, the new government also may resort to such borrowings to reduce the cost in the similar manner of pre-2015 placement systems that were highly regarded by CB's front-running economists as supportive of the control of interest rates.

- However, no government can recover the presently bankrupted economy under the current fiscal and monetary system unless, at least, Rs. 3 trillion of new money is created at low interest rates for credit distribution required across the priority sectors over few years ahead.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(35 years of staff grade service in the Central Bank, a former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment