Central Bank Independence and Prudent Economic Fundamentals - Will the Public come out of the present bankruptcy?

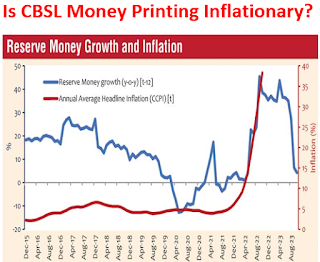

Lanka News Web has reported two news items given below. 1. State Finance Minister Shehan Semasinghe assets "that prudent economic fundamentals are being deployed towards economic stabilization and to raise the economic growth rate to around 7%-8% in the next two years." 2. CB Governor Nandalal Weerasinghe says new Act to "strengthen Central Bank Independence" and thereby curb monetary financing of the budget and place a check on inflation" is to be enacted shortly: new law said to be a "prior action" to unlock the IMF deal that is yet to take place even after 8-1/2 months of negotiation. The purpose of this article is to educate readers of some of public issues involved in the two news items as highlighted below. Prudent Economic Fundamentals It would be better if the Minister states; What are those prudent economic fundamentals, at least a list, From where those are bought to be deployed? What is their link to economic stabilization and to econo