Vandalized and Lost : The Plight of Sri Lankan Unpublic Monetary Policy

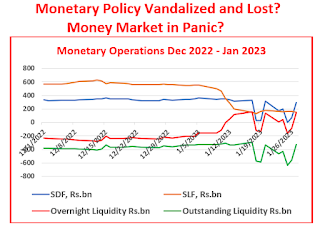

The objective of this article is to highlight how the Sri Lankan monetary policy has lost its purpose by being unable to provide contemporary monetary needs of the economy and sectors towards recovering from the economic crisis. The highlights are based on the information released by the Central Bank (CB) in its monetary policy press release on 25 January and recent monetary and money market statistics available on the CB website. Five Highlights of Monetary Mismanagement in Brief The policy interest rates-based monetary policy model pursued for inflation targeting has collapsed since 2 January this year, leading to a bureaucratically induced black money market. Therefore, policy decision to keep policy interest rates unchanged at 14.5% and 15.5% serves no purpose. Money market shows a irregular and panic volatility and near-term instability caused by new OMO manipulations. The story of disinflation is only a statistical illusion and a public policy fraud as the public does not