Failed & Crashed - Monetary Mismanagement in 2022 and Beyond

This article is a short presentation of the failed monetary front of the economy in 2022 and expectations in 2023 and beyond. This article is supported by the daily monetary statistics available in the Central Bank website.

The economic crisis and bankruptcy being confronted by the government, business sector and households since the end of 2021 consequent to the mismanaged and collapsed monetary front require no analysis.

As the economy is the sum of real sector and monetary sector inter-dependent, the mismanaged monetary sector invariably causes crises and bankruptcies.

Selected Monetary Highlights in 2022

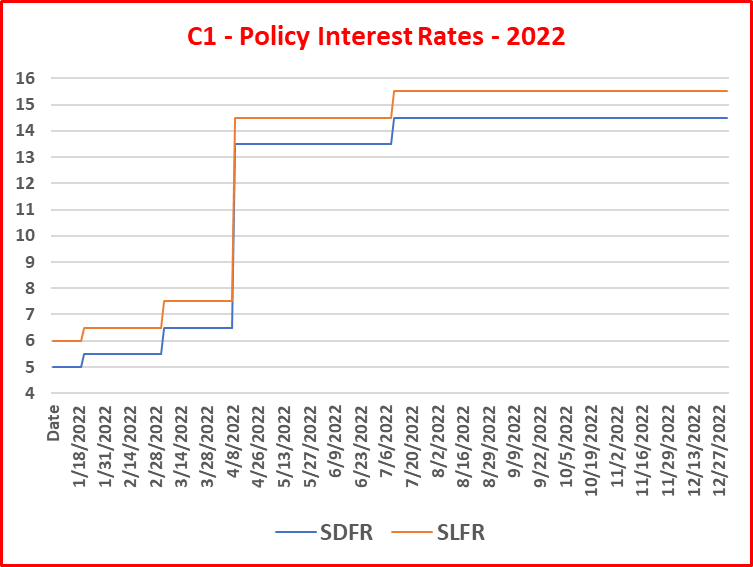

- The increase in the policy interest rates from 5%-6% to 14.5%-15.5% without any macroeconomic rationale is the key root of the monetary mismanagement (see C1). This has tightened monetary conditions unreasonably across all sectors of the economy.

- The daily volume of overnight standing deposit and standing lending operations has risen to significant levels to maintain the policy interest rates at sky high levels (see C2). Total volume during the year is Rs. 54.5 trillion for standing deposits and Rs.163.1 trillion for standing lending with a daily average of Rs. 227.2 bn and Rs. 679.4 bn, respectively.

- The huge liquidity shortage in the banking system on overnight basis and outstanding basis is a reflection of the unusual tightness of the monetary policy (see C2). However, the Central Bank has conducted several term-auctions of reverse repos and repos in an ad hoc manner (i.e., 28 term-reverse repo/outright purchase auctions, 37 term-repo/outright sale auctions and 25 overnight repo auctions) whose motives are seen like helping pre-identified dealers.

- Therefore, money market operations (overnight inter-bank call money and repo) have fallen to zero and near zero levels, partly due to the loss of trust in market participants' financial soundness, given the availability of standing lending facility (see C3).

- Overnight call money rates have reached the SLFR (top of the policy rates corridor) for the most part of the year due to the grave liquidity tightness. In many days of the latter part of the year, i.e., 58 days from July 2022, the call money market has been zero (see C4). This reflects the loss of purpose of the policy rates corridor-based monetary policy model as there was no call money rate to be targeted.

- The sky-rocketed primary Treasury bill yield rates towards 30%-32% immediately after the unrationalized level of policy rates increase and unconstitutional default of government foreign debt in early April 2022 are the real indicators the country's bankruptcy (see C5). This level of a hike in the short end of the yield curve way above policy rates (a 100% higher) is a real indication of monetary mismanagement.

- The government bankrupted by the monetary mismanagement has been further pushed to the grave through funding it through the sale of mostly 91-day Treasury bills with a high degree of rollover risks. The acceptance of bids for 91-day bills at excessively higher volumes than the offer to weekly auctions reflects sugar high losses on funding at huge discounted prices (see C6 - C9). In many auctions, the acceptance is 2-4 times the offered amount which is the ground for losses to the government in terms of the loss trigger point followed by the Auditor General with the agreement of the Monetary Board in respect of Treasury bond auctions. Therefore, domestic deficit financing of the government also has virtually reached the default level. In 2022, Rs. 3,675 bn of funds have been raised from Treasury bills through weekly auctions.

- The tight monetary policy has been contravened by the Central Bank itself by printing a historic volume of money to fund the government on short-term basis at high yield rates outside the market (see C10). The fondly private placement system also has been re-introduced to solicit funds from money dealers without exposing them to bidding risks in the market. The increase in Treasury bill holdings (FV) of the Central Banks in 2022 is Rs. 1,181 bn and, therefore, total holding reached at Rs. 2,598 bn at the end of the year. This has resulted in government securities to account for nearly 70% of the Central Bank balance sheet. The total volume of subscription by the Central Bank through the new system introduced from 6 May to fund the government whenever the Treasury requests funds amounted to Rs. 755 bn (FV) at an overall lower discount of 9.2%. Further, Rs. 212.7 bn was raised from the post-auction private placement system.

- Macroeconomic results are the negative GDP growth of 11.8% and inflation of 57.2% in December 2022 compared to consumer prices in December 2021 and 72.6% compared to prices in December 2020. Present consumer prices are so high that even if the so-called inflation falls to 5% in future, the level of inflation at that time from prices in December 2020 will be 85%.

The year 2023 commenced with a new open market operation (OMO) rule issued by the Director, Domestic Operations, for commercial banks to limit the policy rates corridor-based monetary policy as follows.

- Limiting the overnight standing deposit facility to a maximum of five times/days in any month to any bank.

- limiting the overnight standing lending facility to a maximum of 90% of the statutory reserves of each bank on the day.

A few major comments on the new OMO rule are given below.

- This virtually abandons the present monetary policy model adopted by the Monetary Board since 2013. As the overnight standing deposit facility and lending facility are now not freely available to banks, overnight call money rates will not stay within the policy rates corridor, i.e., 14.5%-15.5% at present. Therefore, the legality of this rule to go above the authority of the Monetary Board on the monetary policy is a subject for examination by the Auditor General as the Central Bank autonomy does not apply to the Auditor General. In fact, the present monetary policy model was approved by the Monetary Board in 2013 as an improved version over the overnight repo rate and reverse repo rate based policy model followed since 1997.

- The immediate expectation is to fluctuate the overnight call money rate beyond the policy rates corridor, i.e., to decline below the SDFR at times of high market liquidity and to rise above the SLFR at times of acute shortages of market liquidity. However, as the market liquidity has been a large deficit throughout the year 2022 with a deficit of Rs. 230-350 bn at the end of the year (see C2 above), overnight call money rate prevailing at the top of the corridor at present cannot expected to come down within the current tight monetary policy stance and, therefore, it has to rise above the corridor.

- However, if the Central Bank frequently conducts OMO on overnight and term repos and reverse repos, or forces banks to not to deal above the corridor, the call money rates will fluctuate within the corridor.

- Therefore, the new rule facilitates the Central Bank to mismanage OMO to drive call money rates and Treasury bill yield rates as it wishes and also to facilitate the liquidity management of friendly dealers. This will happen through the conduct of repo and reverse repo auctions in an arbitrary manner.

- The discrimination between commercial banks and primary dealers in Govt. Securities is clear as the new rule does not apply to primary dealers.

The possibility of OMO mismanagement is seen on the second day of the new year as well from the outright purchase auction of Treasury bonds as shown below.

- The questionability of the auction is the offer of such lower yield rates for a profit to those dealers at a loss to the Central Bank.

- The first bond (coupon 22.5%) was auctioned on 13.12.2022 to raise funds for the government and Rs. 32.2 bn was accepted at 33.01%. The same bond was announced for sale at the auction held on 29.12.2022 for Rs. 30 bn, but all bids were rejected due to higher bid yield rates.

- However, the Central Bank has bought back this bond at a lower yield rate of 30.80% by injecting Rs. 3.7 bn out of offered Rs. 20 bn. Therefore, successful bidders have received more than they paid at the auction held on 13.12.2022. This could be an insider deal to known parties at a loss to public funds .

- The second bond has been bought back for Rs. 500 mn (a very small amount) at the yield of 29% from a single dealer. A bond with a maturity of 15 May 2026 (coupon 22.5%) (maturity 12 months more than the above bond) was sold at yield rates of 31.5% (Rs. 70 bn) at the auction on 13.12.2022 and of 31.36% (Rs. 53.1 bn) on 29.12.2022. Another bond of maturity on 01 July 2025 (15 days less than the above bond, coupon 18%) was sold at 32.63% (Rs. 638 mn) at the auction held on 28.10.2022. Therefore, the Central Bank buying back the second bond at a yield of 29% significantly lower than yields of three recent auction yields of close maturities is a loss to public funds.

- Therefore, these OMO deals are against normal trading norms where a dealer buys bonds at a lower price (higher yields) than the selling price (lower yields) for profit during same market conditions. In these deals, the Central Bank has purchased those bonds at a higher price than the price of of those bonds sold at recent auctions.

- The buyback auction is not justifiable as Central Bank's policy strategy is to restrict market liquidity and keep high interest rates. Accordingly, government securities remain at yield rates 31%-32%. The new OMO restriction on daily lending facility to banks only up to 90% of the statutory reserve also is intended to further tighten the liquidity. Further, these are the longest term auctions (741 days and 878 days) announced in the recent history of the Central Bank's OMO.

- Further, the real rationale of the injection of Rs. 40 bn through 31-day reverse repo auction at yield rates between 28%-29% on 5 January as shown below is questionable on the ground of tight monetary policy prevailing with inflation running at around 60%.

- The basis of such long-term injection of funds is questionable in present monetary policy principles too. First, it is against the present overnight call money based monetary policy model (standing facilities). Second, such purchases of government securities by the Central Bank add to money printing and provide the market/private sector with a new space for budgetary financing through credit creation which is against the present monetary policy strategy. Accordingly, the immediate increase in money printing and the new space for budgetary financing through above two auctions is Rs. 44.2 bn.

- Central banks conduct such term OMO auctions as part of yield curve control at various points/segments as announced under the monetary policy in addition to policy rates-based inter bank interest rate targets. For example, the Bank of Japan's OMO are targeted for 10-year government securities yield around 0.25%-0.50% while the policy interest rate is negative 0.10%. Therefore, targeted OMO volumes and benchmark rates are decided by the relevant monetary policymaking authority and delegated to the Governor with limited discretion.

- However, OMO of the Central Bank of Sri Lanka are part of internal bureaucracy not falling under the monetary policy determined by the Monetary Board. Therefore, the OMO are unpublic operations on public funds that could be abused for personal benefits. Two instances stated above are evidence for possible mismanagement of OMO auctions in 2023 and beyond. It is the constitutional duty of the Auditor General to audit OMOs to ensure good governance and internal controls in public funds especially because such monetary operations involve in trillions of money printing and abuse for personal gain under the cover of arbitrary autonomy.

According to the circular issued by the Director, Domestic Operations, on 3 November 2022, the Central Bank will charge the Bank Rate for emergency lending granted to commercial banks. The Bank Rate is fixed as the Weighted Average New Deposit Rate plus 7% at the time of grant of such loans.

- The grant of emergency lending known as the Lender of Last Resort (LOLR) is to be decided by the Monetary Board under sections 86 and 87 of the MLA. Accordingly, the amount, collaterals and the interest and discount rates are to be decided by the Monetary Board.

- Under section 86, such lending is granted to banks in period of emergency or imminent financial panic which directly threatens monetary and banking stability. Therefore, Director of Domestic Operations to decide the interest rate on such lending in 2023 and beyond is the bypass of the statutory mandate and authority of the Monetary Board.

- The interest rate is already decided by the Director as indicated above. If a bank confronting a liquidity crisis will definitely fail if it is to receive LOLR at such a high interest rate irrespective of the quality of collaterals provided. The latest Bank Rate so estimated is 30.63% (23.63% +7%). Later on 02 January 2023, the margin has been cut to 3% arbitrarily. However, the LOLR/Bank rate is still high at 26.63% and reflects LOLR like a Ponzi scheme.

- Therefore, given the current economic crisis and resulting deterioration of the financial conditions of banks and banking system, the public can expect banking crises in 2023 and beyond if the Central Bank follows such a bureaucratic approach to deal with crisis-hit banks. In that event, the government will have to inject public funds and guarantee operations of banks to protect the public trust in the banking system.

- If the Central Bank had behaved in this manner in the case of liquidity crisis hit on Seylan Bank in 2008, the Central Bank still would have been struggling to resolve it like in other bankrupt finance companies.

In view of above information presented, official and unofficial comments made on market interest rates to fall in the new year are not acceptable if the Central Bank's inflation control monetary policy rhetoric is correct.

Central banks in developed countries have already stated that they would continue to raise policy interest rates and tighten the monetary policy even though inflation has peaked in view of the historically high levels of prevailing inflation rates.

Therefore, it is highly likely that the Central Bank will manipulate OMO auctions through various insider techniques (similar to private placements of bonds used in 2008-2014) to show that market interest rates are now falling. The ground has been set with the new OMO rule in violation of the Monetary Policy model adopted by the Monetary Board since 2013.

However, common sense in monetary policy and money market is that interest rates will not fall from such high levels unless the Central Bank cuts interest rates and injects new liquidity to the banking system. Therefore, if the Central Bank wishes market interest rates to fall in the new year and beyond, the simple action is to cut the policy rates in a reverse cycle in transparent manner without resorting to insider OMO deals.

In view of the current level of economic contraction, hyper inflation and bankruptcy, the economy will not recover even in the next decade unless the Central Bank cuts policy interest rates to below 10%.

Therefore, the religious blessings sought in the new year for any other form of monetary operations of the Central Bank cannot be expected to serve the economy and public in the new year and beyond.

It is surprised that such new monetary operations highlighted above are carried out on the sanction of the IMF as part of 2.9 bn USD facility to Sri Lanka pending since April 2022.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment