Sri Lankan debt book - Both cover and pages were wrong? Can we ever recover?

Article's background

- Sri Lankan economic crisis is primarily a result of bankruptcy of the government on default of foreign debt and central bank of foreign currency reserve. Both debt and foreign reserve were managed by professional economists of the central bank for the past since 1950.

- I saw a Parliamentary debate recently on an extraordinary 75% increase in wages of the central bank. The ruling party members justified the wage increase as required to retain professional experts at the central bank, given its independence to take such decisions. The opposition responded that same experts caused the economy's bankrupt in 2022 and questioned the rationale of the wage increase while the rest of the economy is timed. Most do not understand that the central bank can make any spending by simply printing money digitally in its computers.

- Therefore, this short article will explain how the central bank and its experts should be held responsible for the economic crisis confronted by the general public since 2022.

- The crisis is necessarily the chronic failure of government policies on its management of foreign debt and foreign currency. The management of the economy on short-term basis without a long-term vision on the real sector of the economy was the primary cause.

The article is presented with following 06 charts that may help understand the story in short. However, in economics details are naturally disputable on both macro and micro bases.

Presentation basis

- Most analysts find reasons for the crisis from the period after 1977 on the basis of the open economy policies. The policy regime before 1977 was the fixed exchange rate-based closed economy in line with contemporary global macroeconomic management system supervised by the IMF and World Bank.

- However, after the collapse of the IMF Dollar-gold based-fixed exchange rate system (1944 Bretton Woods Agreement) in 1971 as a result of the US abolishing its US Dollar convertibility into gold, developed countries started flexible exchange rate systems. Since early 1980s developing countries also started practicing various exchange rate regimes and open economic policies as an approach to development open to the global trade and finance. It is in this global drive, Sri Lankan governments also resorted to such new economic management models.

- Therefore, blaming the open economy after 1977 for the present crisis is baseless. These analysts do not consider the level of human development achieved in Sri Lanka after 1977 through the new model.

Therefore, this presentation only focuses on trends of debt and foreign currency after 1980s.

Foreign debt rising faster - We never cared?

- Rising foreign debt of the government is the major contributor to faster rising debt stock.

- In certain years, foreign debt has been the major conduit for fiscal funding and creation of money.

- The structural risk in high share of foreign debt is the dollarization and loss of sovereign currency power of the government, i.e., the ability to run budget deficits and debt through creation of state-backed local currency.

- Before 1980s, this was not a problem as the fiscal front was more domestic currency funded with limited foreign debt received official assistance.

- The fiscal dollarization seems to have commenced sounding the arm after 2005.

- While government foreign debt stock was rising faster, foreign currency resource base managed by the central bank to service debt and other BOP obligations was away below the rising debt levels. In fact, the source of the foreign reserve of the central bank was the proceeds of the government foreign debt. The story became riskier when the source of debt was moved to Euro dollar market and currency swaps from official sources. The sale of local debt to foreign investors also was a significant source. As such, the monetary system was largely dollarized on debt.

- Therefore, debt rollovers was the mechanism used to replenish the foreign reserve to meet debt service on a regular basis. Nobody thought about systemic risks underlying such a high level of market-based foreign debt on such a low level of foreign reserve.

- Therefore, the pandemic and political crisis in 2020/22 disrupted the foreign debt rollover model resulting an acute erosion of the foreign reserve and the default of debt.

- The exchange rate that was managed highly overvalued through debt-financed foreign reserve in ad-hoc policies of the central bank for decades overshot out of any control once the foreign reserve collapsed.

- This is how the government and central bank became bankrupt pushing the country into the debt and foreign currency crisis.

- Same foreign debt model was followed by many developing countries. Some of them now have defaulted while others struggling in the verge of the default. The World Bank recently disclosed that 28 developing countries are stuck in a debt trap with no hope of escape anytime soon.

- All analysts are scary of the debt stock by looking at various crunching of numbers. Further, they are not adequately knowledgeable of the macroeconomic and human development performance delivered by the fiscal front and debt in modern monetary economies.

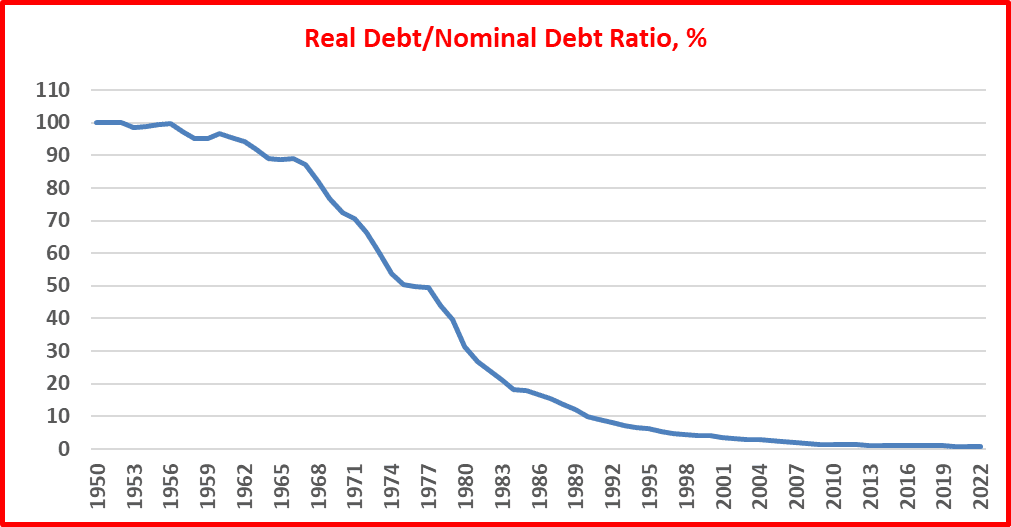

- However, if the changes in the general price level compiled in terms of consumer price index are adjusted, the growth of the real debt stock is significantly lower than the growth of nominal debt stock, i.e., real debt stock rose 227 times as compared to 42,036 times in nominal debt stock, from 1950 to 2022.

- Therefore, one can question is why the government has not created spending and money adequately to upgrade living standards of the general public in real terms.

- Sri Lanka does not have a debt unsustainability problem in domestic currency debt, given its extraordinary role in macroeconomic management for human development funded through creation of money. Therefore, debt-GDP ratio is a meaningless number to assess debt unsustainability. However, debt in market-based foreign currency is unsustainable as the central bank does not have a monetary policy to drive the real sector of the economy to generate a net quality inflow of foreign currency that can be used to service foreign debt. This a common problem in many developing countries who run a foreign reserve on government debt sold to foreign investors.

- Trends and swings shown by above charts can be used to fabricate various political stories behind the macroeconomic management approaches pursued in different regimes.

- The fact of the matter is the loss of a long-term vision and approach to real sector-based human development, despite the well-documented knowledge of all sorts of economic crises, i.e., debt, foreign currency, financial, inflation and recession, arising from risks of short-term visions and strategies.

- Therefore, what we all have accomplished is to manage the economy and living standards on a daily basis in accounting cashflow models, despite those macroeconomic experts living in the central bank in an IMF-based global environment.

- However, those experts trying to get the collapsed debt and foreign currency models back for their survival is the pathetic exercise that the general public has to pay in coming decades because there is no doubt that tinker of failed models will not help recover the economy.

- The Central Bank Governor recently educated a group of Parliamentarians that elected members do not understand how an economy operates in macro. If that is correct, unelected experts/officials who have managed the economy should be held responsible for the crisis and government bankruptcy.

- Former UK Prime Minister Liz Truss disclosed at a recent conference that her government coming with a mini budget proposal-tax cut and household energy cap based growth model- collapsed in less than 50 days because of the protest fabricated by deep establishment/bureaucracy in the UK. She also said that the power used to be in hands of politicians has been moved to bureaucrats and lawyers where elected governments actually are unable to enact policies. She named Environment Agency, Office for Budget Responsibility, Bank of England and Judicial Appointments Commission at the top of the list who like the status quo because they are doing quite fine out of it.

- Therefore, I wish that the government of Sri Lanka will accept the macroeconomic policy failure, fix its deep establishment system and rewrite the debt management book shown in 06 charts above to help the general public to recover from the current mess.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment