Central bank monetary system failed: Diagnosis and prescription. Treatment is urgent and difficult.

Article's background

The purpose of this article is to reveal how the failure of the monetary concept that has been pursued for the past 73 years has caused the bankruptcy of Sri Lankan economy in 2022. Economic or business bankruptcy is essentially a monetary phenomenon. The background of this view is as follows.

- Central banks world-wide rest on the concept of old quantity theory of money to carry out their money printing operations despite the long rhetoric of underlying stories.

- This theory simply predicts that if the growth of money supply or stock runs faster than the growth of output (or real GDP), the economy will confront an inflation equal to the difference between money supply growth and output growth. For example, if money supply grows annually by 15% while output grows by 7%, inflation will be 8%. This is the famous monetary belief that inflation is always a result of too much quantity of money chasing after too little quantity of goods. This states that inflation is always everywhere a monetary phenomenon.

- This concept is supported by another monetary belief. First, money is nothing but an intermediary among economic transactions or trades serving as a medium of exchange. Second, as economic transactions or markets operate through money, central banks can intervene in the economy through regulation of monetary side of the economy.

- As such, lawmakers have given wide public mandates to central banks over the stability of respective economies, i.e., enhancing the growth of output and controlling inflation at an appropriate balance through the control or regulation of money supply.

- The core of this mandate is the money printing monopoly licensed by the government to central banks where such printed money serves as reserves behind the creation of money in present factional reserve monetary systems.

- The common conduct of all central banks is the belief of the quantity theory behind all monetary operations to bring the stability to respective economies irrespective of diverse causes behind instabilities even if they are natural disasters, wars, pandemics and political crises.

- As such, central banks have seized enormous powers over societies and governments where they even destabilize not only economies but also public governments. Therefore, central banks usually contradict with economic and fiscal policies of elected governments where some country leaders offer even statutory autonomy to central banks to carry out money printing in any manner central bank individuals prefer at a the cost to the public by believing like those individuals are error free and fall from divine world.

- The fact of the matter is all economies in the world confront large instabilities cyclically despite public mandates of central banks while the blame as well as responsibility are passed on to governments as central bank managers have no public accountability except public powers.

- This article uses central bank monetary, price and output statistics for the past 7 decades, a fairly long period, to establish the monetary irregularity of the Central Bank of Sri Lanka that has caused the present catastrophe of bankruptcy to the economy and general public.

- Broad Money Supply M2 is used as the most liquid and popular money while consumer price index (CPI) is used for measurement of inflation.

Four key economic test results

(Note: consumer price index is reconstructed for 1952 CPI series by applying annual average inflation rates of differently based indices. Domestic exchange rate is price of an index point based on the 1952 based consumer basket. Nominal GDP per Capita is deflated by the new CPI to estimate the real GDP per Capita.)

- Domestic exchange rate, i.e., price of one unit of consumer price index (adjusted for 1952 prices), has risen from Rs. 2 in 1952 to Rs. 439 in 2023.

- Foreign exchange rate for US$ has risen from Rs. 4 in 1952 to Rs 327 in 2023.

- As predicted by the monetary theory, this is the direct result of the failure of the central bank to control the money supply in order to protect the stability of the economy. As a result, the value of currency/money held by the public has unbearably eroded and devalued.

- This value erosion is harmful as the real GDP per Capita has been stagnant and has lagged behind the general price level.

2. Money supply growth inconsistent with Q theory

- Large deviations between the actual money supply growth and estimated money supply growth under the quantity theory (i.e., inflation plus real GDP growth) shows that the monetary policy concept has miserably failed.

3. Inflation control or economic stability

Price stability or inflation control and economic stability failed.

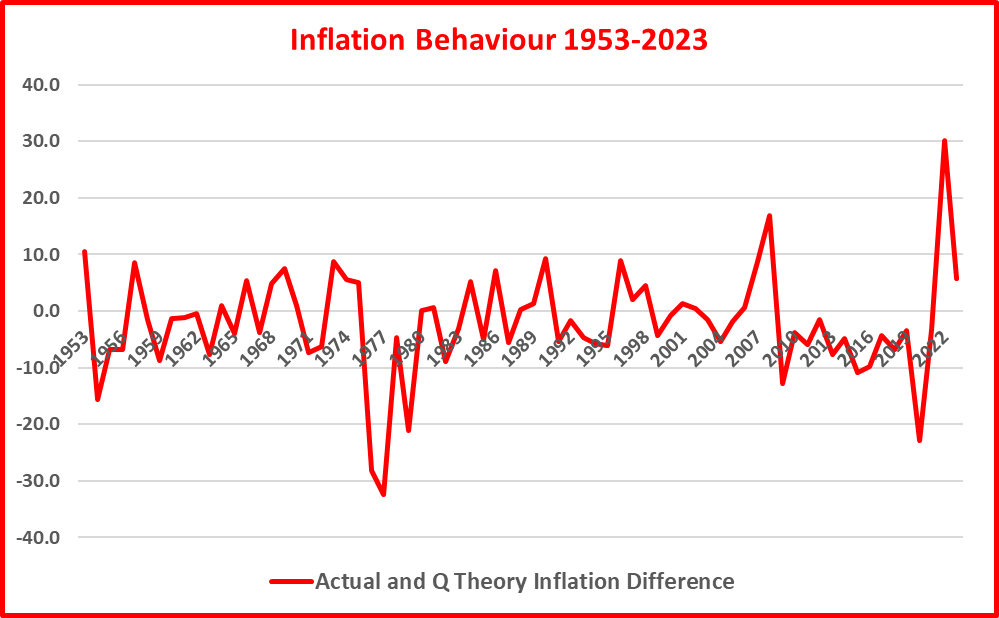

- Inflation control has failed as shown by large variations in inflation.

- The quantity theory concept has failed as shown by large dispersion between actual inflation and Q theory based inflation estimate (money supply growth less real GDP growth).

- Real GDP growth has shown large volatilities.

- Money supply growth is largely an outlier from inflation and GDP growth as quantity theory is not established in actual data.

4. Supply of monetary resources

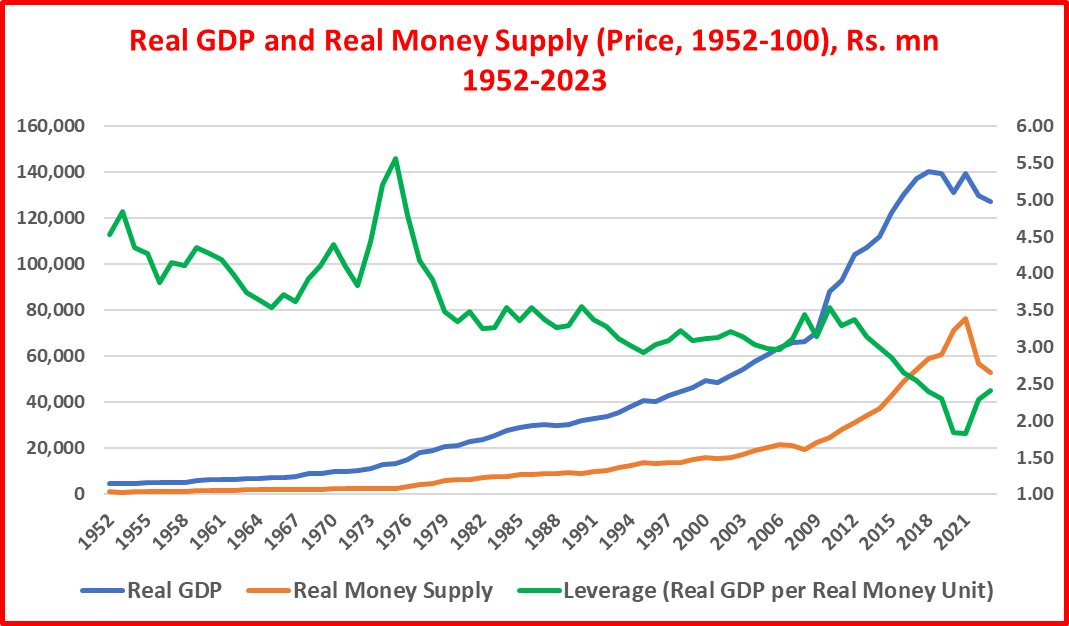

(Note: Real money supply and real GDP are estimated by deflating nominal money supply and GDP by the newly constructed CPI.)

Failed to supply monetary resources adequately.

- Real money supply has significantly fallen behind real output indicating that the real quantity of monetary resources supplied to the economy was not sufficient to broadbase productive investments and output across the sectors of the economy.

- According to the Monetary Law Act, the public duty of the central bank was to provide monetary resources to meet requirements of the economy as a whole and specific sectors to promote utilization of productive resources and output while maintaining the value of money.

- Therefore, if the central bank had pursued a faster monetary expansion in real terms to to mobilize productive resources, output and employment with a sectoral basis, the resulting expansion of the supply side (output, capacity and productivity) would have helped the development and stability of the economy while protecting the value of currency.

- The quantity theory-based monetary control for the stability of the economy has failed.

- Dollarization of the monetary system for balance of payment and exchange rate stability has caused the failure of the currency to be used for domestic economic development and improvement of living standards to comply with the requirements laid down in the Monetary Law Act.

- The resulting structural weakness and under-development of the economy were the cause of the economic and political crisis 2022 that bankrupted the government and public.

- In response, the establishment of a new central bank in September 2023 for the object of domestic price stability by blaming the government for printing money as the cause of the crisis is another historic error in economic management of Sri Lanka. As the central bank will continue to use the failed quantity theory, the new price stability object also will fail as already reported from the highly volatile inflation and deflation path due to unnecessarily tightness of the monetary front despite the contraction and bankruptcy of the economy. In addition, the new central bank also has fundamentally restricted the fiscal arm of the government available as the last resort to recover the economy and living standards.

- Economists can provide complex statistical models and micro stories behind monetary policies to show the validity of the monetary inflation faith without any convincing conclusions. However, test results I provided above for 73 years are real ground facts that are not easy to reject outright. Further, I do not wish to write here hidden motives inside used to run monetary operations from time to time under the cover of monetary hypotheses.

- Therefore, any government in the foreseeable future will definitely fail due to severe lack of monetary resources unless it

- fixes the monetary front problem founded on unrealistic monetary faith on old quantity theory,

- makes distant itself from the dollarization of the currency and fiscal policy and frees the domestic currency from dollarization, and

- arranges to print at least Rs. 3,000 bn planned for sectoral distribution of credit and monetary resources targeted for expansion of production, capacity and productivity with a specific focus of generating a foreign currency income sufficient to finance the productive import bill.

- However, even the system-change-motivated new government does not seem to have a clear vison for this kind of macroeconomic management strategy other than adhering to monetary status quo (i.e., dollarization through govt foreign borrowing and economically irrelevant monetary control) to satisfy its agents of dollarization and central bank autonomy. This may shorten the lifespan of the new government as the promised recovery of living standards will get derailed.

- Other two options are;

- either to privatize the central bank and monetary system subject to penal provisions similar to the European system in the 17th to early 20th century, or

- resume the old kingdom style money printing by the government for its public services as part of tax administration.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(35 years of staff grade service in the Central Bank, a former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment