Monetary policy blunder in Japan

The Bank of Japan (BOJ), the Japanese central bank, today (19 March 2024) announced a landmark change in its monetary policy by raising the policy interest rates first time in 17 years along with several tool amendments to its monetary policy.

Therefore, the purpose of this article is to express my views that the BOJ decision today is another point in its monetary policy blunder that has existed miserably in the past 30 years to get the economy out from deflation trap.

BOJ monetary policy focus - Inflation control

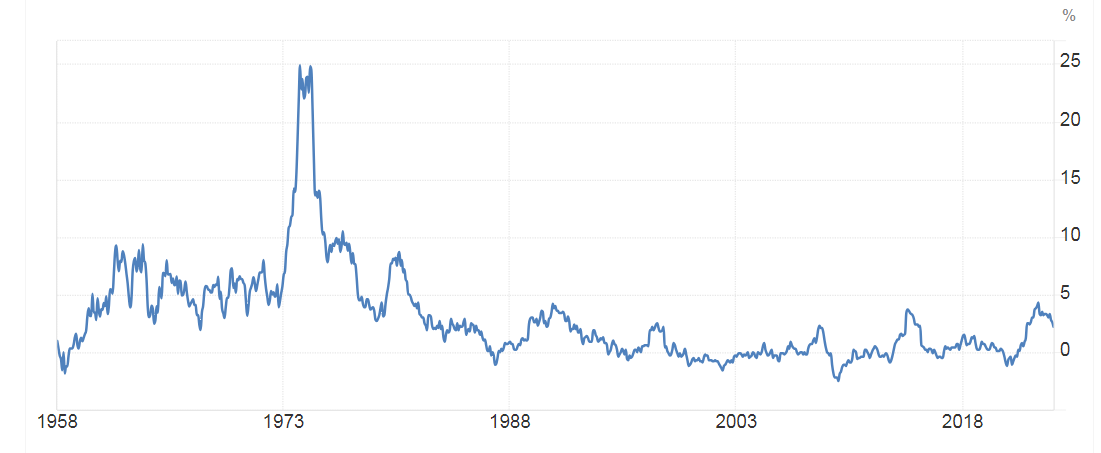

In line with the old tradition of central banks, the BOJ also follows monetary policy to drive inflation towards a target in the medium to long term. For the past two decades, its inflation target has been 2% parallel to other developed countries.

However, Japan has been confronting a deflation trap during the past 2-3 decades. Therefore, unlike in other countries, the BOJ has been pursuing the monetary policy to boost inflation.

BOJ monetary policy models

- Policy interest rate for excess reserves of banks

Policy Rates and Inflation in Japan

- Monetary base control

Monetary base is the concept used by many central banks to estimate the amount of printed by them. Accordingly, the sum of currency in circulation and reserve balances of banks held at the central bank is the monetary base.

Accordingly, BOJ printed money through the purchase of securities, mainly government securities, to meet monetary base target. The BOJ announced monetary base target used for money printing at its policy meetings.

- Quantitative and Qualitative Easing (QQE) and yield curve control

This is the new version of QE followed liberally since April 2013. Accordingly, BOJ pursued a large scale of purchases of securities, i.e., government securities, Exchange Traded Funds (ETSs), Japan real estate investment funds (J-REIFs), commercial papers and corporate bonds at proportions as announced from time to time. The monetary base control was used to measure the scale of money printing.

In September 2016, the yield curve control tool was added to QQE. Accordingly, the BOJ purchased government securities to keep10-year government yield around zero. In 2023, 10-year yield target was raised to 0.25% and then to 0.50% as a measure of signaling of a market interest rate hike. Therefore, monetary base control became an irrelevant policy tool.

Meanwhile, policy rate was kept at negative 0.10% to penalize banks for parking excess liquidity at the BOJ and to guide short-term market interest rates.

The BOJ ended the QQE with yield curve control and negative interest rates model and announced the new model with following guideline for market operations.

- Uncollateralized overnight call money rate target of 0-0.10%. This is to guide short-term interest rates as primary policy tool.

- BOJ paying interest at 0.10% on excess reserve balances of banks held at BOJ current accounts. This is to achieve the above guideline.

- BOJ continuing with government securities purchase broadly same amount as before, i.e., monthly around 6 trillion yen, as required to stabilize long-term interest rates.

- Other asset purchases

- Discontinue purchase of ETFs and J-REITs

- Reduce gradually purchase of Commercial Papers and corporate bonds and discontinue purchases in about one year.

- BOJ new loan disbursement at 0.10% interest rate for duration of one year to stimulate bank lending

- loans under Funds-Provisioning Measure to stimulate bank lending

- loans under Funds-Supplying Operation to support financial institutions in disaster areas

- loans under Funds-Supplying Operation to support financing for climate change responses

- BOJ has failed to boost inflation towards 2% from zero or negative territory during the past 2-3 decades, despite liberal money printing through various policy models highlighted above.

- Inflation seems to have risen comfortably above 2% target in 2023 due to global supply chain disruptions and cost escalation. However, inflation now has commenced falling again and seems not achieved the target sustainably. With global inflationary pressures now falling notably, the risk of Japanese disinflation again below 2% target seems to be very high.

- Therefore, the new monetary policy model announced today is nothing but another money printing model introduced by the new BOJ Governor similar to those in the past. He, at a recent press meting participated by Central Bank Governor of US, UK and Europe, cracked a joke that the transmission of the QE followed by the BOJ during the past 25 years will continue for at least another 25 years in the future.

- The BOJ has been keeping monetary policy extra loose during the past 2-3 decades although other central banks had several policy cycles of tightening and loosening. Therefore, BOJ does not belong to the global club of monetary policy.

- Inflation control-based monetary policy is disproved by Japanese economy beyond doubt as it has failed to boost inflation, despite so much money printing and government debt reaching the largest 252% of GDP with a significant portion funded by the BOJ, where no IMF or economists raise concerns over inflationary pressures or unsustainability behind such a huge debt pile.

- What BOJ has been doing in its monetary policy of varied versions introduced from time to time has been to print money liberally to provide liquidity/reserves to the economy, i.e., government, banks and financial institutions, corporates and investors. This is because what is necessary from a modern central bank is the extension of the day-to-day support to manage liquidity needs of the economy by different sectors. All monetary tools and models are not part of any science but arbitary ways of money printing. Therefore, inflation control story preached by central banks and their followers is only a tribal cloth of central banks to hide behind money printing.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have not intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment