CB is back on forex gamble that bankrupted the state? What can govt do? Wait & see?

Article's Background

The economic slogan of the country's top policymakers nowadays is the divine-driven stabilization of the economy after the crash in 2022. The two of few leading figures they cite are the foreign currency reserve of the central bank (CB) and the exchange rate.

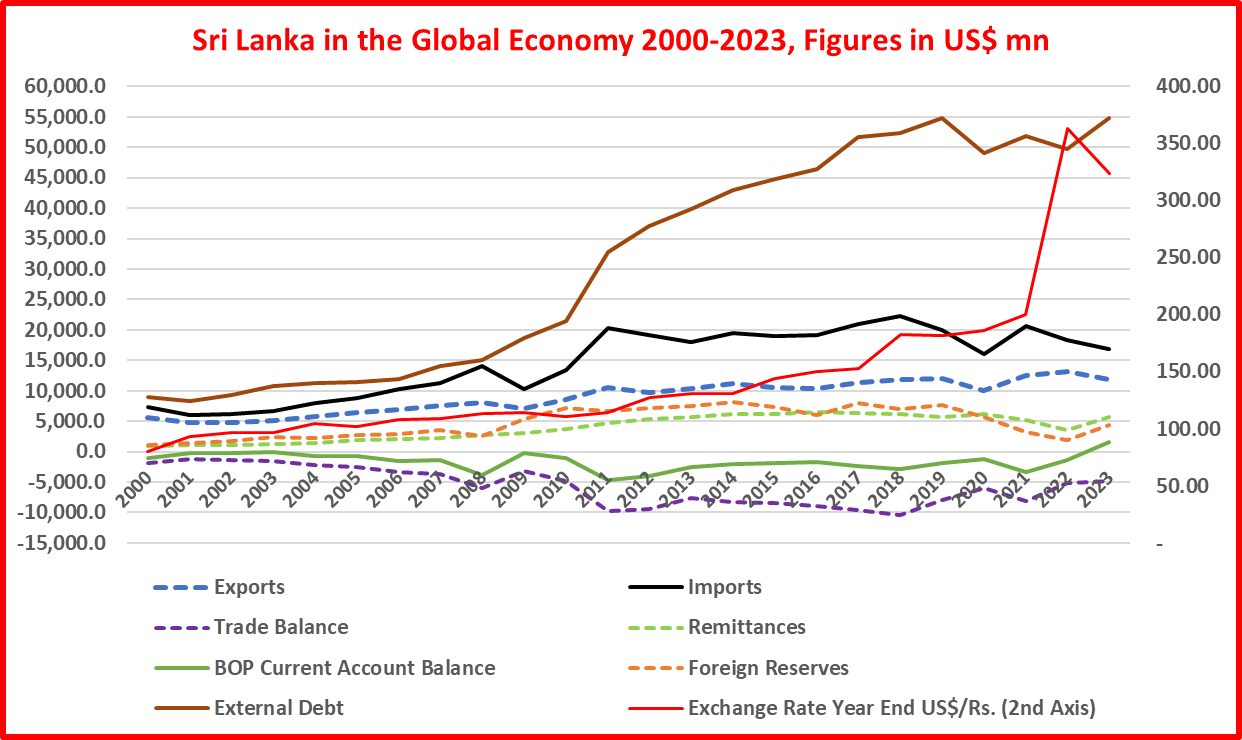

The media is full of news praising that the CB has now rebuilt the foreign reserve from almost zero liquidity to US$ 5.4 bn while the rupee has appreciated to around Rs. 300 a US$ from its historic lowest of Rs. 370 in April 2022 as compared to pre-crash rate of Rs. 200 (see Chart below). The favorable BOP behind the two figures is cited as a result of the prudent monetary policy. This is not strange as Economics is such that any good thing under the sun can be attributed to the monetary policy and central banks whilst all bad are passed to the governments and markets.

There is no controversy even among the laymen that the crash of the economy was the direct result of the bankruptcy of the CB in its foreign currency balance sheet that led to restrict imports and default government foreign debt. The CB's foreign currency, imports and foreign debt were the three key drivers of the economy and macroeconomic management during the past several decades (See Chart below). Everybody still has the short memory of the pain felt from the economic crash.

Therefore, the two new numbers, the CB foreign reserve and exchange rate, provide a significant stimulus to even those who somehow live on a day to day basis without any ambitions and plans for living standards of their children in the future.

In addition, everybody is now amused by the sweeping statement made by the CB Governor at the last monetary policy press conference held on 28 May 2024 that the CB's foreign reserve is now manageable to finance even recommencement of imports of vehicles if the government decides to permit imports. To a layman this is not the kind of stabilization of the economy back from the crash but seems like a movement of the economy to a development status.

However, facts show that both economy and living standards are still struggling around the crash although markets have resumed operations with signs of political stability seen around.

Therefore, this article is to shed light on the two numbers of the foreign reserve and exchange rate are nothing to do with stabilization of the economy but reflect the resumption of the CB's foreign currency gamble centered at the two numbers.

What is the CB's forex gamble that caused bankruptcy?

- It is the model of financing the import economy through the CB's foreign reserve.

- The gambling was the build-up and maintenance of the foreign reserve through foreign market borrowing of the government. This was facilitated by the CB's statutory role as the official debt manger and the fiscal agent plus adviser. International Sovereign bonds (ISBs), Sri Lanka Development Bonds and sale of local bonds to foreign investors were the leading instruments used in the play.

- In addition, the CB's short-term foreign borrowings known as currency swaps were routinely used to top up the foreign reserve. In fact, nearly US$ 1.5 bn (28%) of the current foreign reserve is the unusable Chinese currency swap.

- IMF programmes were emergency supports to top up the foreign reserve when macroeconomic environment was not conducive for borrowing and to revitalize the foreign investor network behind foreign debt.

- The systemic risk of the gamble as usual was the service of debt through rollovers and new debt as the country's real sector was not capable of generating a foreign currency surplus.

Three fundamental risks:

- The CB did not drive the monetary policy to generate a foreign currency surplus on the real economy that can fund the foreign reserve sustainability for its statutory purpose set out in the Monetary Law Act.

- The monetary system lost the domestic economic policy independence as nearly 70%-90% of assets and money printing of the CB depended on the foreign reserve.

- The foreign reserve was used to fund imports, BOP current account deficit and debt service to prevent the rupee depreciation (or highly over-valued currency) which was instrumental in the control of inflation. Therefore, the foreign reserve was not a buffer for bad days but a daily operating debt fund to finance foreign currency deficits of the economy.

This forex gamble crashed in the economic environment of the global Corona pandemic and political crisis as the CB could not continue with the foreign borrowing-based reserve model. Therefore, a significant volume of trade credit provided by the governments of China and India was not able to help revive the gamble. The outcome is the economic crash that bankrupted the economy.

The chart below presents annual numbers behind the evolution and crash of the debt-financed gamble during the past two decades.

As revealed from the post-appointment press release dated 8 April 2022, the incumbent CB Governor has been extensively engaged in monetary policy, exchange rate and foreign reserve management in the CB for about one and half decade until the end of 2020 running towards the gate of crash. His leading role in issuance of all ISBs and currency swaps is well documented in the CB's institutional correspondence. Therefore, he is not a stranger to the CB's forex gamble then and now.

How is the CB's forex gamble back?

The CB data reveals it as follows.

- In 2023, foreign debt has increased by nearly US$ 5.2 bn. Among this are the IMF loan release of US$ 663 mn (out of total 2.98 bn) and several funding supports by the World Bank and ADB (The IMF projected US$ 900 mn in 2023). The second IMF loan installment of US$ 665 mn and US$ 950 mn from World Bank and ADB for 2024 are being awaited.

- The CB has introduced currency swap auctions to buy Dollars through local banks. In 2023, the CB's net forex purchase is US$ 1.9 bn. against net forex sale of US$ 579 mn in 2022. As reported in the CB financial statements, foreign liabilities under swaps and forwards for managing foreign currency liquidity in the market at the end of 2023 stood at Rs. 48.9 bn with a notional value of Rs. 469.7 bn. The increase in the CB's interest cost on non-IMF and non-ACU foreign liabilities from Rs. 4.8 bn in 2022 to Rs. 31.1 bn (by 548%) in 2023 could be reflective of the interest payment on such currency swaps. Information on the turnover of currency swaps and interest rates/exchange rates is not traceable from CB data sources. How underlying interest rates/exchange rates on currency swaps and forward contracts were determined is a serious governance concern.

- The BOP surplus of US$ 2,826 mn for 2023 and US$ 1,288 mn for first four months of 2024 is a result of such foreign debt and non-service of foreign debt under default since 12 April 2022. Therefore, the historic BOP current account surplus of US$ 1,559 mn in 2023 and around estimated US$ 1,900 mn for first four months of 2024 is not a macroeconomic management success but debt-based forex gamble that has now become a part of country politics.

- The fabricated foreign reserve of US$ 5.4 bn at present falls to US$ 4.0 bn due to the unusable Chinese currency swap counted in the reserve figure.

Therefore, the stabilization policy rhetoric is nothing but the CB's forex gamble back in a new dress stitched by the IMF (sere chart below).

If any sensible person who knows basics of business sees above charts that reflect the country's performance in the global economy will tell that this country can never come out of the economic crash if the present forex gamble of economic governance tends to persist.

Gambles are good for private dealers and not for national institutions like central banks.

The best that general public can expect from the present economic governance model

- The economic transformation law pending in the Parliament has got no solution to the stated forex gamble. In fact, the CB's policy responsibilities are kept out of it probably due to the Parliament's fear of divine independence given to the CB to do anything that its managers wish to do for them on public funds. I am at loss to understand how the government transforms the economy without transforming the monetary system to enable supportive funding for the economic transformation.

- No economists who understand the macroeconomic governance reflected in above charts seem to comment on the real truth behind CB's foreign reserve and connected systemic risks.

- No political party seems to present a new policy framework to fix the fundamental problem of foreign currency and real sector growth sufficient to lift the public to a decent living standard comparable with those of developed countries. Therefore, their promises to offer the happiness, prosperity and social safety net to the public are unfounded promises.

- Therefore, as many crack a joke, this country can never be developed if such policy gambles persist on existing office files held at hands of the deep bureaucracy in which any national leaders get lost as soon as they are elected.

- Therefore, the general public has no option as usual but to be happy with what ever they get for daily life through what ever imports and new foreign debt at what ever prices while the younger generation migrates in searching for employment to begin a decent life. This will be the life style for generations to come in this very old country.

- The country will be loosing this century too due to the lack of younger generation with skills and education driven to compete in the evolving global supply chains and the technology whereas malnourished and less educated child population in the crashed economy will cripple the quality of labour force in next 20 years' time.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

Comments

Post a Comment