Politics of policy interest rates - Is 25 bps cut meaningful? Is MPB competent? Public to pay?

Article's Background

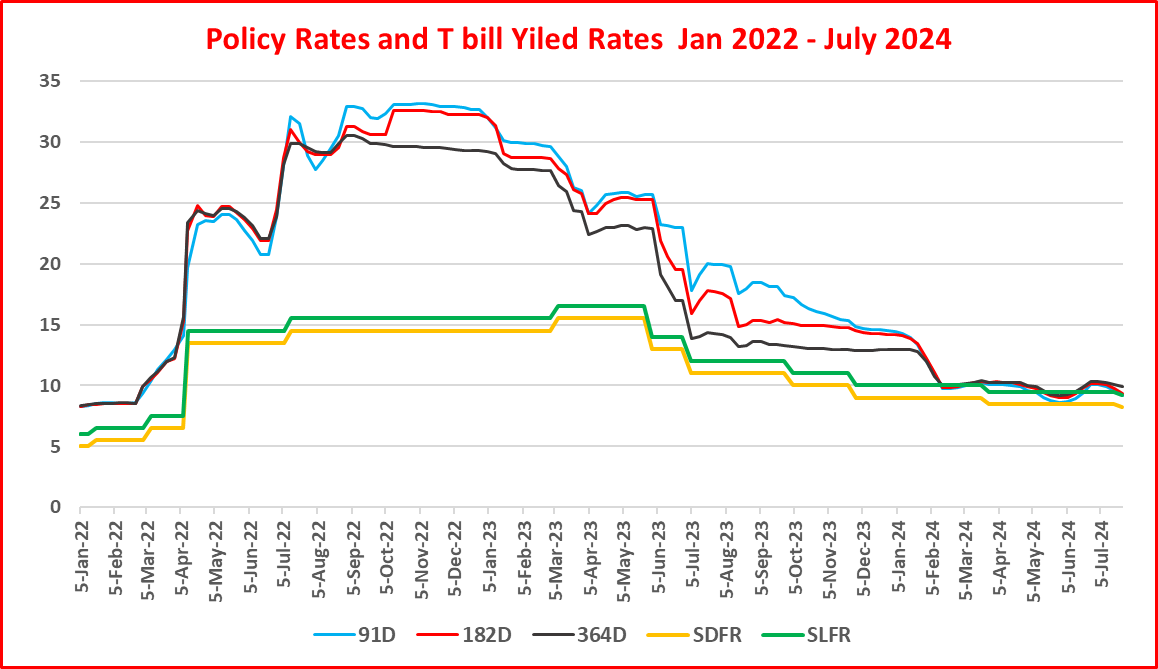

The Monetary Policy Board (MPB) of the Central Bank (CB) at its meeting held on 24 July at 7.00 am as announced decided to reduce policy rates by 25 basis points to 8.25% (standing deposit facility rate-SDFR) and 9.25% (standing lending facility rate-SLFR) (Read the MPB policy statement here).

I predicted on 21 July that the MPB would cut policy rates at least by 100 bps in consideration of the present set of data flow relating to the stabilization of the economy with inflation being close to zero and support the government for the pending Presidential Election. Such a rate cut is a valuable item of information for the government to justify the stability of the stabilization. I also predicted that the MPB could even keep policy rates unchanged and provide a policy story to support its (read the article here).

However, the MPB cut rates by 25 bps and provided a just story unrelated to inflation path or the price stability.

Therefore, this article is to reveal that the MPB does not have a conceptual or practical perception to conduct the policy rates-based monetary policy in the current context.

Inflation target in the monetary policy framework agreement (MPFA) with the Minister

- The MBP first time disclosed the statutory inflation target as 5% based on CCPI over the medium-term. This is incorrect.

- As per MPFA (Read the Gazette here), the target is 5% on quarterly average of the year-on-year CCPI monthly headline inflation for the three months of the corresponding quarter, with a margin up to 2%. This means that the MPB has to comply with the target on a quarterly basis (three months moving average) for the past. Therefore, the MPB statement the public by hiding facts.

- As per MPFA , the MPB can tolerate a quarterly inflation of 3% to 7% in any quarter. This is an unjustifiably high variation. One cannot imagine a quarterly average inflation up to 7% continuing for months and quarters in the economy as being legitimate with the presence of monetary policy. Therefore, such a high range of permitted inflation casts doubts on the competence of the MPB to maintain the domestic price stability as set out in law.

- Quarterly average inflation has been considerable higher than the year-on-year inflation in the most part of the period since early 2023 of the present rate cutting cycle. Therefore, the MPB has the space to operate with a inflation outlook of a higher magnitude.

- Quarterly average inflation target is nothing but simple algebra. It does not represent actual price levels consumers confront in reality. All central banks follow a simple year-on-year inflation target on the inflation path. Therefore, the MPB's monetary policy is just data point dependent. The European Central Bank President at the last press conference held on 18 July stated that its monetary policy was not dependent on data points but on data (i.e. the path or flow of data).

- The date of the gazette of the MPFA is 3 October 2023. However, the MPB communicated the inflation target as envisaged inflation of 5% over the medium-term in all policy statements including it on 5 October 2023. The MPFA does not refer to maintenance of inflation at 5% over the medium-term. It is for the past on a quarterly average basis. Therefore, the MPB has misled the public.

- As per section 26(3) of the Central Bank Act, the gazette should contain both inflation target and other parameters relating to the target. However, no parameters are contained in the gazette. Therefore, the public cannot know the economic rationale behind the inflation target. In this regard, relevant senior officials of the Ministry have not educated the Minister to incorporate those parameters. The inflation target cannot come from the heaven.

- As per section 26(5) of the Central Bank Act, the MPB should submit a report to the Parliament if the CB fails to meet the target by the margin of more than 2% for two consecutive quarters. Accordingly, the MPB has failed in quarters ending April, May and June this year and October and November last year. However, the public is unaware whether the report was submitted to the Parliament.

- The policy statement states that the deviation of margin during the second quarter 2024 is blow 2%. However, data show that it is more than 2% for three months ending April (-2.2), May (-3.9) and June (-3.6).

Questionable contents in the policy statement

I present following contents of the policy statements to establish further that the MPB is incompetent in managing the monetary policy in the present bankrupt and contracted economy.

- Need to signal its desire to continue eased monetary conditions to sustain the revival of economic activity towards the full potential.

Further, the monetary policy cannot be labelled as tight or eased at particular time because policy interest rates are set to suit the present or expected credit/financial conditions of the economy in line with the inflation target.

- The economy operates below its full capacity presently and the forecast to reach its potential over the medium term horizon.

- Reference to downward revision of electricity tariff, fuel and LP gas prices for considerably below-target headline inflation.

- Headline inflation is likely to be notably below the target in the forthcoming months due to the combined impact of downward adjustments to electricity tariffs and domestic fuel prices and the statistical base.

- The external current account is likely to have recorded a surplus in the first half of the year.

- Lending interest rates, other than on prime lending, remained weaker than the adjustments to deposit interest rates.

- Inflation forecast is neither a promise nor a commitment.

Therefore, inflation forecast is not accepted even by the MPB. Further, the forecast is not for average inflation for the quarter basis for each three months, which is used for monetary policy target. The forecasts published in the past policy statements are significantly different to each other.

In a recent review of the Bank of England inflation forecasting by the former Fed Chainman Professor Ben Bernanke, it is now agreed that the forecasting is highly defective. The Bank of England has been the most accredited inflation forecaster for the monetary policy. The same is now accepted as the position for the Fed inflation forecasting.

Therefore, economist believe that central banks cannot forecast anything more than a month or a quarter. The MPB does not explain reasons why inflation forecast for 2026 is in a wide range of negative 5% to 15%. All central banks failed to forecast the present wave of inflationary pressures despite all those technical forecasting methods.

It is strange that the MPB has forgotten this time to mention about conditions of inflation expectations whether they are well-anchored around the inflation target by the monetary policy in the short-term or long-term. In general, the policy statement is unrelated to justify 25 bps cut in policy rates.

General concerns

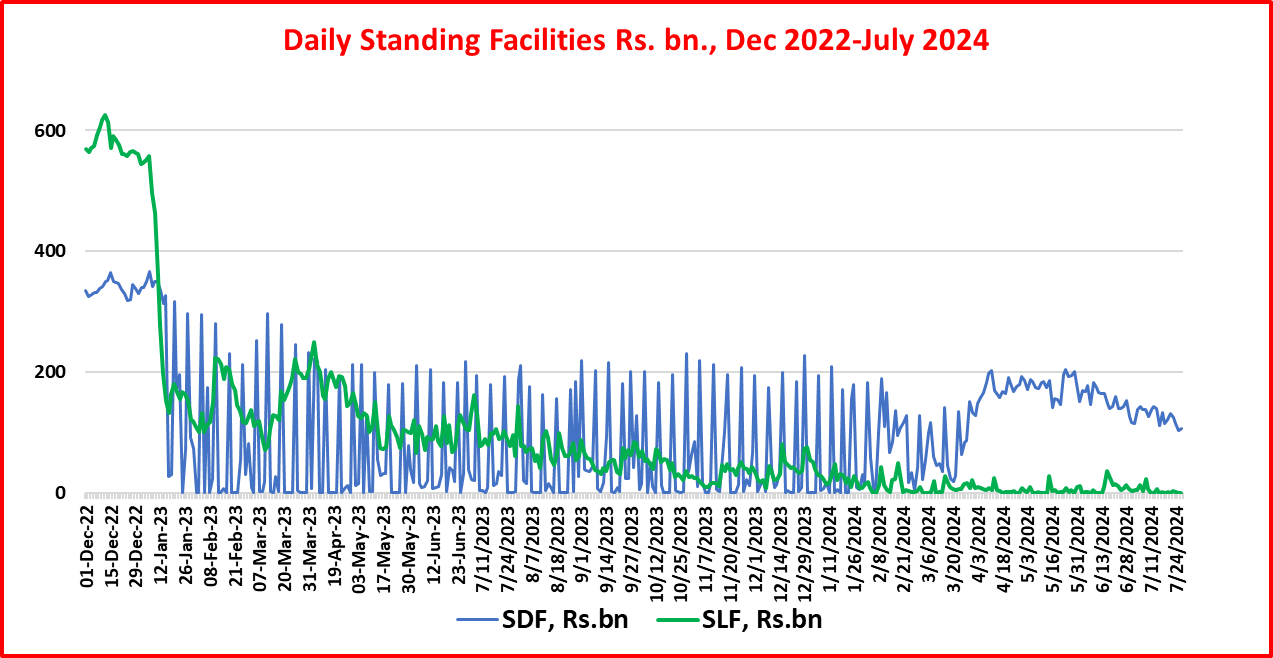

- With a high level of liquidity in the present banking system, a policy rate cut is not justified.

- Despite the liquidity surplus, the CB provides further liquidity through regular reverse repo auctions throughout the period from January 2023.

- Banks are inclined to park the excess liquidity at the SDFR while not borrowing on SLFR.

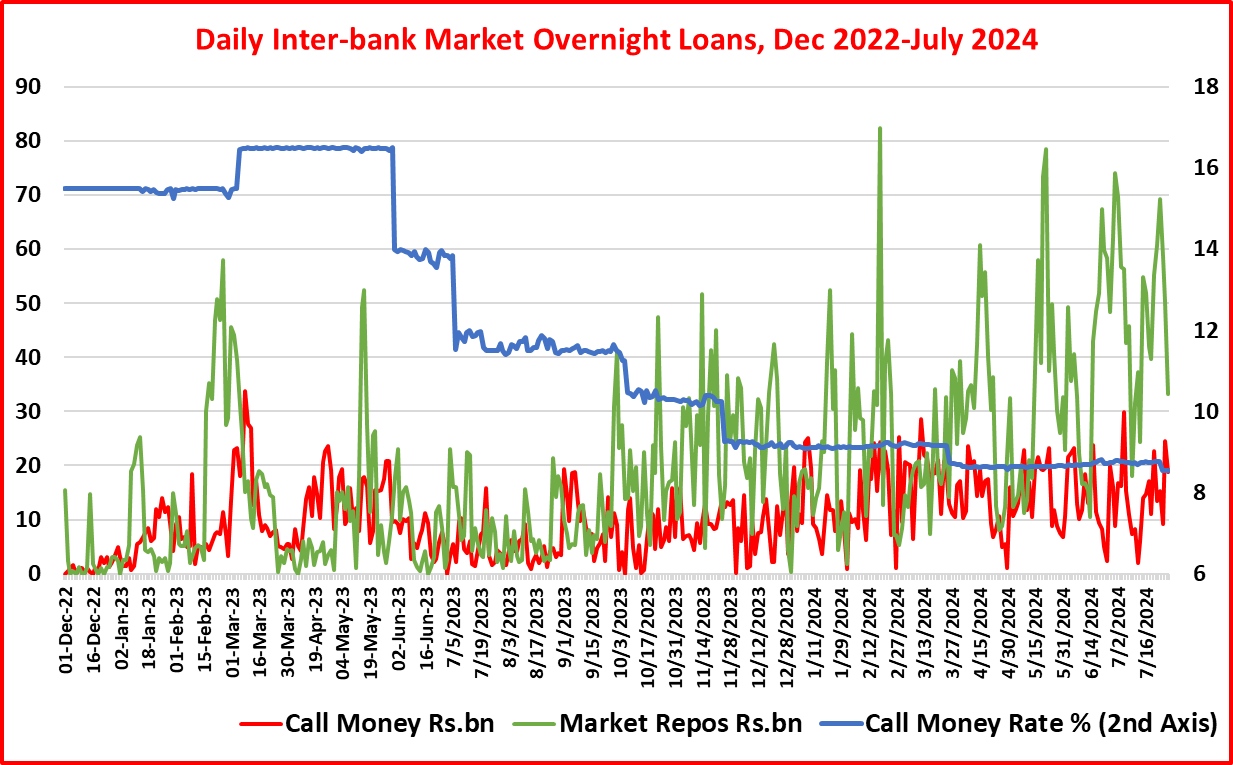

- Market rates quickly adjust to policy rates (call money, market repos and Treasury bills). However, past data on adjustments of market volumes whether they respond to policy rates or correlate with inflation are not available.

- Sri Lankan monetary system is about 8%-10% fractional reserve system (reserve money in percent of broader money stock) as compared to 27% in the US. It reduces to just 4% when the wider financial system's asset base is considered. Therefore, changes in policy interest rates or reserve operations do not seem to have any significant impact on credit and financial conditions. Data show that banks now tend to borrow/lend on exiting surplus reserves within the banking system without resorting to fresh reserves through the CB. Anyway, the CB's only tangible role is to provide reserve management facilities to banks upon demand through standing facilities or repo/reverse operations.

- Year-on-year inflation has been close to zero for the past three months and fast falling since early 2023.The CB as well as others predict further decline in inflation in coming months, consequent to govt price policies pending the Presidential election and statistical base effects. However, prices or cost of living does not decline.

- Therefore, the MPB is mandatory to cut policy rates in a significant amount to maintain the domestic price stability in coming months by boosting the demand across the economy. However, 25 bps cut is the return to the old policy game for not taking any macroeconomic risks. Recently, the Governor of Swedish Central Bank stated that the preparation of months through meetings and research for a rate change of few basis point was useless and a significant change should be made at once if the underlying economic problem is clear.

- Therefore, 25 bps cut means that the MPB has saved the policy space for another rate cut nearing the Presidential election to support the government. Everybody knows that the brand new independence of the CB has lost at its infancy as the Parliament did not allow the CB Governing Board to implement its independent decision on the salary hike in February.

- Policy rates are risk-free interest rates determined arbitrarily by the MPB without any economic rationale supported by data. Inflation target is also set arbitrarily. However, market interest rates are risk prices based on various risk perceptions by lenders and investors. Accordingly, any interest rate is effectively the sum of pricing of risks such as credit, tax, exchange rate, wages, domestic prices and other market uncertainties expected in the future. Therefore, the MPB has no economic basis to assume that all market interest rates, prices, inflation and the real economy will move in desired direction when ever it decides policy rates. At least, if the MPB has empirical research as to how various risk components determine interest rates at different market layers, there can be some confidence on the MPB policy process. Therefore, policy rates cannot exhibit magical powers and transmission as the the policy statement routinely envisages.

- In view of observations made above, the present monetary policy framework provides no tangible economic benefits to the public. It only helps printing money/reserves to a set of wholesale money dealer banks to manage their liquidity positions lavishly on a daily basis for commercial targets. The MPB is not worried about credit and liquidity distribution for economic activities across the country or sectors to recover from the wide-spread bankruptcy. This is the direct result of the new Central Bank Act that the general public has to pay for.

- Therefore, the present monetary policy framework as announced in the MPFA is only a statistical exercise to those who believe it without any question raised on its relevance to the real economy.

Following charts show recent monetary and money market trends and the quick response to the last 25 bps rate cut.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

Comments

Post a Comment