Fed's delay of rate cuts, central banks perplexed of what next, economies in disarray with high interest rates? Can the unquestioned faith in old monetary theory save the world?

Article's Background

Except central banks in Japan and China, almost all central banks tightened monetary policies since early 2022 by hiking interest rates competitively as usual. The reason was to control four-decades-high inflationary pressures that erupted from the mid-2021.

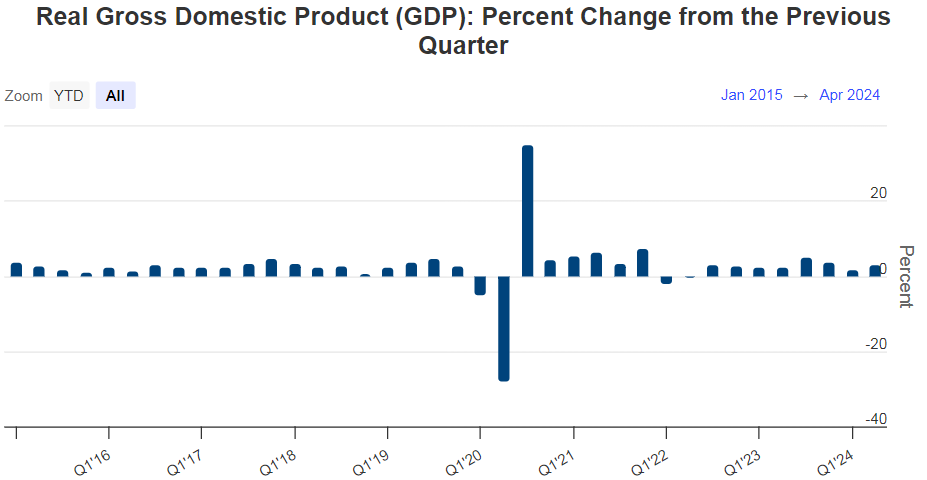

The cause of inflation was the reponing of economies from the Corona pandemic with severely contracted supply side due to disruption in global supply chain and capacity shrined by the pandemic. However, central banks read this as being driven by the excess demand created by the lavish printing of money they did at interest rates close to zero during the pandemic.

Such loose monetary policies were justified as policy measures taken to forestall any financial instability that could arise from the high demand for reserves and spending during the pandemic. Although central banks at the beginning of inflationary pressures attempted to label it as transitory, they suddenly started raising interest rates competitively while inflation too was rising fast.

Now, nearly after two and half years of high interest rates, inflation has come down to around targets. However, central banks are seen reluctant to commence the rate cutting cycle as yet. They state that they are not still confident that inflation is sustainably around the target and, therefore, they want to see more good economic data before any next step.

In contrast, economists and market analysts tend to predict that the tightened monetary policy for such an extended period could cause a hard landing soon. Therefore, markets worldwide have commenced gambling on significant policy rate cuts this year and next year.

The high interest rate drive of the Fed, Bank of England and European Central Bank being the lead central banks in the world is shown in two charts below.

Therefore, this article shows evidence that all central banks are perplexed as to what they should do to balance between inflation and growth from now onwards as data and market developments show diverse outlooks that are no consistent with the expectations of the old monetary theory.

Early signs of rate cutting cycle

- European Central Bank (ECB) cut rates by 25 bps on 6 June 2024. However, it at the next policy meeting held on 16 July 2024 held rates unchanged unexpectedly. The ECB President expressed that the monetary policy was data dependent and not data point dependent. This statement has now become the newest colour of all central banks.

- Bank of Canada cut rates by 25 bps on 24 July 2024.

- Central Bank of China cut rates by 10 bps, i.e., 7-day repo rate to 1.7%, one year loan prime rate to 2.35% and 5-year loan prime rate to 3.85%, on 25 July 2024 in order to consolidate the economy's recovery momentum.

- Bank of England (BOE) cut rates by 25 bps to 5%. The BOE was the first in the hiking drive from December 2021.

The Fed's position on next move

The Fed Chairman at the last policy press conference declined to send any signal or forward guidance on a possible rate cutting cycle. Instead, he indicated that the Fed has received good data so far and a rate cut would be on the table for the September policy meeting if the economy would evolve as expected.

All media around inquired on the possible rate cut outlook, underlying factors and possible hard landing if the rate cut is further delayed.

1. Key macroeconomic data published by the Fed in its website are as follows.

- Policy rates: At present 5.25%-5.50%. An increase by 500% bps since March 2022. The present rate level has remained for the past one year.

- PCE inflation: Target 2%. Latest 2.5% in June 2024. An increase from 2.7% in March to 7.1% in June 2022 and a steady decline to 2.5% at present.

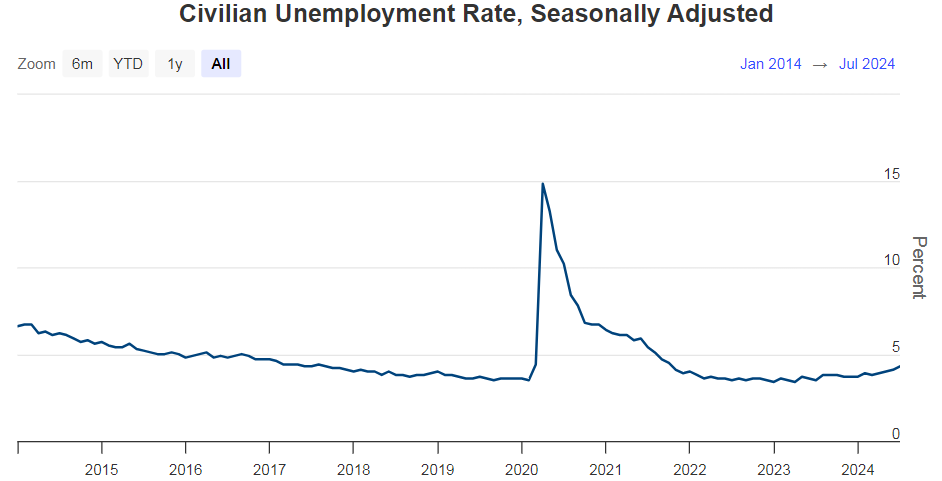

- Unemployment: Latest 4.3% in July. An increase from 3.6% in March 2022 to 4.3% in July 2024, identified as the adverse impact of tightened monetary policy.

2. Selected response of the Fed Chairman at the press conference is noted below.

- The Fed's mandate is the price stability and maximum employment. Despite high interest rates, economy grows at solid phase with historically low unemployment.

- If the labour market weakens unexpectedly, the Fed will respond. The Fed does not wish to see further labour market cooling. However, the current labour market is not a source of material inflationary pressures.

- Good data have been received. However, all data are not confident. More good data are required to commence rate cuts.

- Inflation data are better. A policy rate cut is on the Table in September if the economy evolves as expected.

- Upside risks to inflation and downside risks to labour market are low.

- The pandemic has broken so many economic rules and theories. It is a challenging judgement for the timing of rate cuts. The Fed is closer to it but not there yet.

- The Fed has no plans or forecasts on political outcomes with the pending Presidential election in November.

- To a query whether the Fed has kept high rates for longer time causing a hard landing, the Fed Chairman responded that the monetary policy is the mandate given by the Congress to the Fed and it is implemented accordingly.

Markets across the world speculate fast rate cuts by the Fed from September 2024 through 2025. As a result, speculative trades are dominant in markets. For example, a global equity selloff was reported today with around 5% decline in equity prices in the US.

Public concerns

- The most of central banks follow overnight policy interest rates-based money printing model to keep price stability, growth and other economic objectives.

- Except the Central Bank of China, all other central banks state the goal of the monetary policy as the inflation targeting through the control of the demand side of the economy. Central banks in developed countries consider 2% as the inflation target. Other central banks use diverse numbers for the inflation target. For example, it is quarterly average 3%-7% in Sri Lanka. However, the Central Bank of China uses a broad policy package to drive the monetary and credit system to suit the real side of the contemporary economy.

- Policy rates are the targets for inter-bank overnight lending rates. They are expected to transmit policy interest rates with diverse lags on everything under the sun to control the overall demand of the economy to keep inflation at targets. This is only an old hypothesis without any empirical support.

- However, when inflation outlook is commented, all central banks talk about trends of categories of prices of goods and services in the consumer price index used for inflation calculation. This is an unwarranted practice as the monetary theory is on the trend of overall demand and price level and not about the interest sensitivity of prices at micro markets.

- Policy rates are highly arbitrary price controls kept through monopoly money printing without limits. However, its effects are dependent on the extent of the use of reserve money in the financial system. For example, the US economy is about 27% fractional reserve money system. Therefore, Fed's policy rates are influential across the world. In contrast, many developing countries are dollarized economies with a lower domestic currency reserve, e.g., 8%-9% in Sri Lanka, and, therefore, policy rate decision is not economically material.

- However, all central banks tell same story for the conduct of the monetary policy in cycles although its effects on the economy among other factors are not specifically traced. They claim credit for low inflation and pass the blame for high inflation to fiscal policy. In fact, both inflation and growth as well as monetary system are effectively driven by the fiscal policy.

- At present, all central banks are confused of the next step and sequencing of the policy cycle because they are not sure of public response to policy rates and eventual macroeconomic outcomes. Their inflation or other macro forecasts are also now discredited. Central banks in developed countries talk about the challenge of balancing risks between the inflation and growth. However, central banks in developing countries confront a third risk to foreign debt and foreign reserve in order to control the exchange rate. The impossible trinity confronted by central banks in these countries is well known, given the extent of the economy's dollarization, although they all talk about western styled, independent monetary policy for the domestic price stability.

- In contrast, markets are fighting for lower cost of funds through policy rate cuts as early as possible because the productivity improvement to offset higher interest rates prevailing for about two years is now difficult, given global geopolitical factors such as the wars in Ukraine and Gaza Strip, debt problem in many developing countries and elections.

- Once central banks move on the next rate cutting cycle sooner or later, markets across the world will confront another bubble of asset prices and businesses that will not detected until it would burst, given the historic lessons.

- Therefore, governments/lawmakers have to invent a new central bank model deviating from the old monetary theory of money and inflation used for physical cash economies in the past as the modern money and inflation is a digital era.

- Otherwise, central banks with independent mandates of old moneys will only be another shock to economies and governments.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

Comments

Post a Comment