T bill yields unduly pressurized? A 25-50 bps or 75 -100 bps policy rate cut on Friday to ease yields and reduce cost to public?

Article's background

- The next policy interest rate decision of the Monetary Policy Board (MPB) is due on this Friday at 7.30 morning. It is a general fact that the MPB looks at the quarterly average inflation number based on Colombo Consumer Price Index (CPI) with a target of 3%-7% and changes the Central Bank policy interest rates (SDFR and SLFR) in order to keep the inflation in the target range.

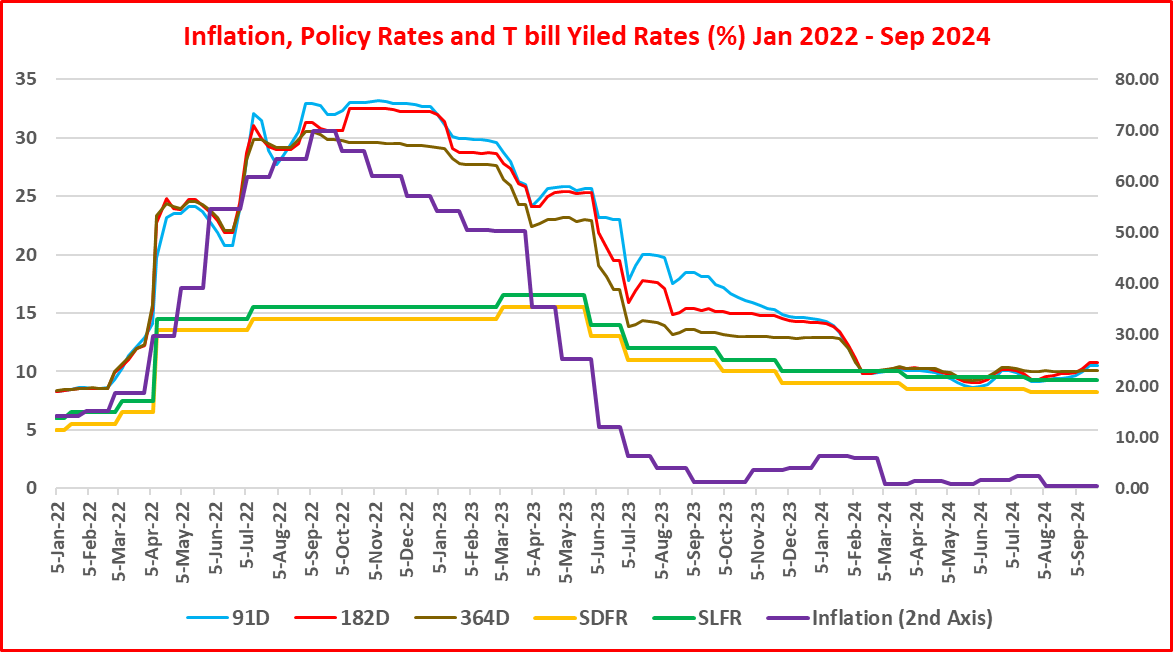

- Accordingly, from May 2023, policy interest rates have followed a steady cutting cycle with inflation falling closer to zero below the lower bound target (see the Chart below). Quarterly average inflation has been continuously below 3% from April this year whereas it has been below 7% from September 2023.

- However, policy rate cuts have been sluggish and rates now remain at 8.25%-9.25% as compared to 15.5%-16.5% level in May 2023.

- In this background, it is highly likely that the MPB may cut policy rates by 25-50 bps on Friday in view of supporting the economic growth and employment within the space of zero bound annual inflation remaining from March this year and also to show a goodwill to the new government.

- This may also be induced by the commencement of the policy rate cutting cycle by central banks in developed countries where the US Central Bank (Fed) announced a jumbo rate cut of 50 bps on 18th in surprise to markets which speculated mostly a 25 bps cut, despite the Presidential Election due on 5 November.

- Immediately after the Fed rate cut, the President Joe Biden appeared before the media and commented that the Fed rate cut was the evidence for the economic progress achieved by the incumbent Government. He also mentioned that he did not meet the Fed Chairman for the past two year after the appointment.

- It is certain that a global interest rate cutting cycle led by the Fed will remain in next two - three years in pursuit of higher growth and employment as inflation is believed to be sustainability around 2% target.

- In contrast, the MPB may still opt to keep policy interest rates unchanged as the rate decision is a highly arbitrary judgement although it is cited as highly data dependent. The MPB may state that risks to inflation outlook remain elevated in the medium-term due to prevailing uncertainties and, as a result, inflation expectations which are now well-anchored may slip in the near-term.

- Therefore, the purpose of this article is to raise concerns over results of the Treasury bill auction held today in consideration of the present monetary policy outlook in the event of a policy rate cut at the MPB meeting due on Friday.

- Globally, policy interest rates and market interest rates are driven by the yields of government securities. It is no secret that the central banks conduct the monetary policy through the trade of government securities and yield rates.

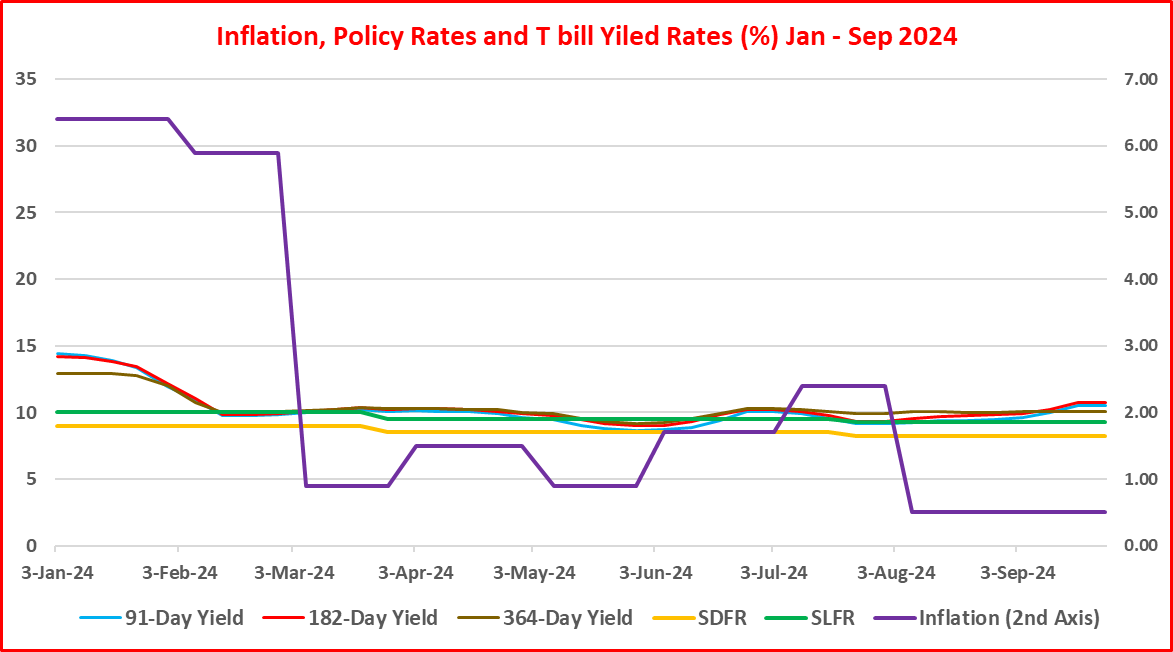

- How yield rates in Sri Lanka in the recent past have been driven by policy interest rates are shown in the the two Charts below.

- The puzzle here is why yield rates have been in rising trend since June this year in opposite to inflation and policy interest rates, despite the IMF-based prudent fiscal consolidation with favourable debt restructuring and well-managed market liquidity under the prudent monetary policy.

- In addition, inter-bank interest rates also have been moving up for the past month towards the upper bound of policy rates, despite abundant liquidity provided by the Central Bank at lower interest rates through overnight reverse repo auctions (see the Chart below).

- Therefore, current behaviour of key market interest rates is not consistent with the inflation close to zero, the space of the policy rate cutting cycle so far and abundant supply of reserves by the Central Bank.

- In this background, 25-50 bps policy rate cut or even 75-100 bps cut would be necessary on Friday to align monetary and inflation data to policy rates.

- Auction results show that funds were fully raised at average yield rates around the last auction (see the Table below). Therefore, yield rates rise has been prevented at this auction. The announcement of a lower amount for this auction than amounts offered for recent auctions also has contributed to keep the rates flat today.

- However, the concern is about the loss to the government if the MPB cuts policy rates on Friday (27th). If so, inter-bank rates and central bank lending rates will immediately decline in the morning itself. Specific concerns are as follows.

- The settlement of bids of this auction takes place on 27th, the day of the MPB meeting. Therefore, dealers can borrow at lower rates and pay for Treasury bills as per bids. The Central Bank also will offer reverse repo auction at lower rates to provide reserves to dealers.

- As market yields will be lower or Treasury bill prices become higher on 27th, dealers can sell Treasury bills obtained from this auction at higher prices to investors.

- Therefore, dealers will make two rounds of profit, i.e., lower cost of borrowing and higher Treasury bill prices.

- Therefore, the Tender Board and the Governor should have accepted bids at lower yield rates at this auction and raised the balance funds from its post-auction private placement window. Any way, even if the announced amount was fully raised from auction bids, all three bills have been open for the placement window. Therefore, placement bidders also will secure higher yields than market yields on 27th. This is a form of market fixing.

- The Tender Board mandate is the maintenance of cut-off/average auction yields within the monetary policy requirements and trends. It has no debt management mandate. It is the duty of the Superintendent of Public Debt and Treasury to ensure adequate fund raising at most favourable terms to the state. Therefore, the Governor and the most of Tender Board members today knew the policy rates outcome due on Friday. By the time of Tender Board meeting, internal Monetary Policy Committee's (MPC) recommendation to the MPB should be known to the MPC members who also are the members of the Tender Board. If the Governor says that he has no idea of the monetary policy decision one day after, he may not be fit for such a public policy post. The MPB decision does not come from the ceiling of the Board room but is made on the recommendation of the MPC and guidance of the Governor and Deputy Governors in the MPB.

Remarks

- If concerns are raised as above, the Central Bank may respond that government securities are part of markets and it only operates market-based monetary policy.

- If so, there is no purpose of the Central Bank to drive market interest rates through printing of money and no need of a Central Bank Tender Board to decide on yield rates at auctions of government securities on the prevailing monetary mandate.

- Even Adam Smith, the father of free market philosophy, advocated for regulation of interest rates at levels favourable to support production activities and wealth creation, given the economic role of money as capital. Accordingly, no sensible person can support risk free interest rates of 8.25%-9.25% (policy rates) on money printing in a country like Sri Lanka suffering from acute bankruptcy and sky-rocketed cost of living at least for next decade. Therefore, a jumbo policy rate cut of 50-100 bps should be delivered at the Friday MPB meeting.

- In contrast, if policy rates will be kept unchanged, concerns raised over the Treasury bill auction held today will not arise.

- However, in the event of keeping policy rates unchanged despite inflation and monetary policy outlooks locally and globally and current conditions of country's poor production and living standards as highlighted above, serious concerns will be raised as to the rationale of the present system of the Sri Lankan monetary policy concept and its specific advantage to the general public. If the system is just IMF-compliant, Sri Lanka does not have a system of monetary policy advantageous to Sri Lankan public but to the relationship with the IMF. However, the only-option -IMF moto has now been defeated by the public vote at the Presidential election on 21 September.

This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics which have no intension to personally or maliciously discredit characters of any individuals.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

Comments

Post a Comment