IMF trying a new outfit to survive trade turmoil? Its economic bureaucracy model to collapse soon?

Article's Purpose

This short article is to highlight how the IMF changes its outfit to show the support to the US President Donald Trump's new economic policy which is to be driven on the US trade deals negotiated with countries based on its new tariff policy announced on 2nd March 2025.

- The article's source is the presentation made by the IMF Managing Director Kristalina Georgieva at the "2025 IMF-World Bank Spring Meetings" on 17 April 2025 on the title of "Outlook for the Global Economy and Policy Priorities." (Access the Video presentation here).

- As the most part of the presentation is the IMF's normal economic management rhetoric, the article will select only the statements or ideas relevant to the article's topic.

The presentation's key message sent across to the IMF members and the World covers;

- supporting the Trump's new economic policy based on the present unfair global economic system,

- rejecting the idea of a possible global recession predicted due to the Trump's trade war,

- recommending even developed countries to reform the economies to get own house in order by cutting fiscal deficits and debt,

- recommending interest rate cuts by central banks independently to deal with growth concerns arising from new economic uncertainties.

Selected 8 Highlights of the IMF Presentation

Highlight 1. Trade tensions is like a pot bubbling for long time and now boiling over.

- This is due to the erosion of the trust in the international system and the trust between the countries.

- The global economic integration has not benefitted everyone. Many blame the the international economic system for the perceived lack of fairness in their lives.

- Trade distortions, tariffs and non-tariff barriers have fed negative perceptions of a multilateral system seen to have failed to liver the level-playing field. Following two graphs were presented as evidence for trade distortions.

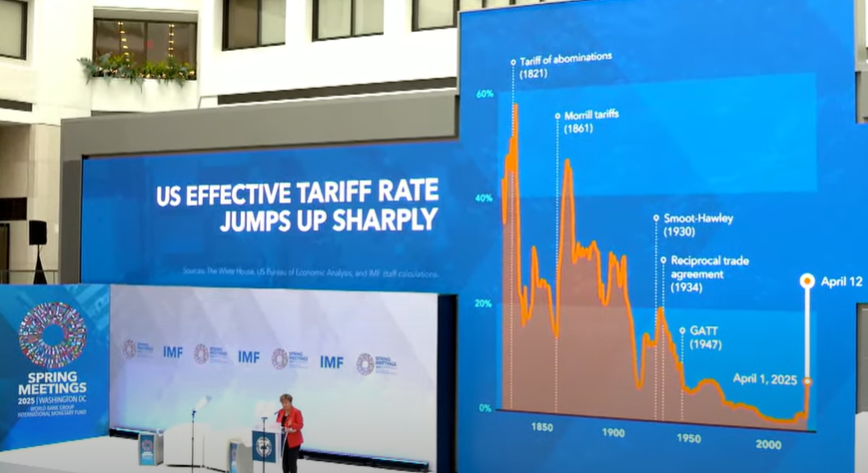

- While first two decades of this century, the world saw a good convergence to the US low and stable effective tariff rates, the progress stalled in the last decade.

- Based on the number of the net new domestic subsidy measures by major jurisdictions, the broad direction of non-tariff barriers is on the rising trend.

- Trade imbalances steer trade tensions.

- National security logic. In a multi-polar world, strategic products such as computer chips and steel must be made home worth paying more than importing them at low cost. The self-reliance comes back.

- The US effective tariff rate has jumped to a level of several lifetimes ago.

- China, EU and USA, despite having low import/GDP ratios, are the three largest importers. The size matters. Their actions impact the rest of the world.

- First, all IMF views presented above have been tailor-made to suit the new US trade policy advocated by the President Donald Trump and his administration. The US's non-stop allegation is that the world has ripped the US off under the present trade and economic system.

- Second, the key manager behind the present international economic system from the Bretton Woods agreement in 1944 to the present is the IMF. It is the IMF that built the US dollar to be the most popular global reserve currency and competitive multilateral trade and payment system on the dollar so that the US became the world's anchor economy privileged to run excessive trade/current account deficits and thereby to consume excessively more than the national production.

- Third, in that context, if the cause of present trade tensions is the failure of the present international economic system, the IMF must take the blame. However, present tensions are singularly created by the US geopolitics citing the world economic system being unfair to the US as measured by the US's successive trade deficits.

- Fourth, the IMF has been operating bailout buffers to emerging market economies to run as import-trade dependent countries in the world economic system with the support dollar reserves to resolve fundamental BOP deficits/crises. The IMF Managing Director pointed 48 countries on present bailout supports.

- Fifth, the IMF so far has not made any such unfavorable views on the international economic or trade system. All statements have been on the health and resilience of the system whereas debt-ridden developing countries were bailed out to strengthen the global system. In the recent past, developed countries or advanced emerging market economies did not ask for any financial support from the IMF. Therefore, the IMF statement on the failure of the international economic system as the cause for the current trade tensions initiated by the US is baseless.

My Comments

- This is against free market economic principles developed and followed globally mediated by the IMF. Therefore, this view has been created to support the new US tariff policy because the US is an economy with a large domestic market and high competition.

- However, if the dollar's reserve currency position is lost due to the new balanced trade and economic policy, the US economy cannot be a large completive market as at present.

Highlight 3. New growth projections will include notable markdowns but not recessions and there will be markups of inflation for some countries.

My Comments

- This is a view favoring the US new trade policy in contrast to projections of majority researches. Their projections are generally 40%-70% probability of the US recession and a worldwide spread of inflationary pressures. If the US confronts a recession, the world also confront a recession as the US is the world anchor economy. The trade dispute here is not a small number but about US$ 1.2 trillion. If this is to be zero, many economies will sink in bankruptcy.

- The World Trade Organization (WTO) last week released a forecast of a contraction of the world economy by 0.8% this years and nearly 7% contraction in the long-run (see WTO presentation here) consequent to the ongoing trade turmoil.

Highlight 4. All countries must double efforts to put own houses in order through reforms to economic and financial stability and improved growth potential. Most countries with high debt burden must take resolute actions to rebuild the fiscal space.

My Comments

- The IMF reform talks earlier which were confined to debt-ridden developing countries are now extended to even developed countries with high debt level. This is a normal talk.

- However, if dollar inflows to countries are slowed down, they have to expand the fiscal spending and debt through domestic currency creation to keep the growth and living standards. Mark Carney, a former Governor of the Bank of Canada and the Bank of England who was dead against fiscal expansion at that time, now as the Prime Minister of Canada has proposed for deeper fiscal deficits to fund infrastructure and tax cut in the present context to reduce the country's dependence on the US which will require money printing to finance deficits.

Highlight 5. To protect the price stability, monetary policy should be maintained credible supported by strong commitment to central bank independence.

My Comments

This is an inappropriate statement. In current tensions in trade and dollar flows, many countries will need fiscal expansion supported by the monetary policy to fund deficits at lower interest rates. Therefore, present central bank independence will be a myth in the new global economic system. The Fed, the most independent central bank in the world, is now under immense pressure of the Trump Administration to cut interest rates without delay to support the new trade policy and rumors are spreading of the removal of the present Fed Chair if rate cuts are delayed.

Highlight 6. All countries must rebalance internally, externally and globally to reduce vulnerability to capital flows. This means domestic savings-investment equality and zero BOP current account deficit from current disparities presented in the two graphs below.

My Comments

- This is a highly conceptual statement recommending to go back to the closed and controlled economies in the past. The IMF also accepted that this was not an easy task. Present US trade talks involve in only balanced merchandise trade targets for countries with the US and not on the current account balance.

- If such balances are to be achieved, the IMF will have no role as at present.

- In trade talks, the US has expressed its willingness to provide US investments to countries as part of trade agreements to facilitate the country growth and rebalancing. It will facilitate the countries to run current account deficits and investments higher than domestic savings. If so, the IMF's country bailout role will be taken over by the US government based on trade agreements.

- The IMF's total credit outstanding from member countries at present is around US$ 112 bn at an average interest rate of 4.543%. Therefore, the US taking over the IMF's funding facilities to trade-partner countries as part of trade agreements will not be a material burden to the US. Therefore, the US authorities have proposed that the US is willing to back the IMF as long as it implements reforms and its management and staff are accountable to its core functions.

- While significant reforms to China and EU are proposed by the IMF, it has only proposed the US to reduce federal deficits significantly to put federal debt on declining path in order to help reduce the US current account deficit. However, the Trump Administration is already implementing a radical policy agenda through the newly established Department of Government Efficiency (DOGE) to cut wasteful federal spending, deficit and debt stock. Further, the US current account deficit is a result of the dollar dominance as the global reserve currency and not due to the US national debt stock.

Highlight 7. At the post-presentation interview, the IMF Managing Director stated that the US holds 17.4% of the IMF whereas the IMF has paid nearly US$ 3.1 bn to the US during last two years from interest income it received on lending business out of member savings and, therefore, the US has been a strong partner of the IMF.

My Comments

This statement is to please the US government that the IMF is an agency beneficial to US tax payers. However, this profit remittance for a year is only 1.4% return on the 17.4% SDR quota equity held by the US and, therefore, the IMF is only a highly under-performed agency to the US tax payers.

Highlight 8. At the post-presentation interview, the IMF Managing Director observed no big swings in the direction of inflation on either side while some countries who experience a slow down in disinflation process while some other countries are affected by the weaker growth. Accordingly, she recommended to cut interest rates if the growth is weakened and central banks should not fall behind the curve. She praised the European Central Bank for cutting interest rates prematurely.

My Comments

- This is a recommendation contrasting the IMF requirement imposed on debt-ridden countries to faster increase in interest rates in 2022/23 to 30%-40% levels despite severe economic contraction caused by the Covid-19 supply chain disruptions and connected debt service problems. Many countries went bankrupt due to such interest rate hikes. A similar contraction is expected from many countries due to current trade tensions and connected economic reforms. Therefore, the interest-cut recommendation at this time is contrasting the Covid-19 IMF recommendation.

- Debt-ridden countries such as Sri Lanka who have delayed interest rate cuts from the Covid-19 high interest rate regime to attract foreign capital for the foreign reserve will now cut interest rates in the due course by following the above IMF recommendation while stating that such rate cuts are needed to meet inflation targets not affected by low growth concerns. Almost all central bank Governors and Finance Ministers attended the IMF presentation.

Concluding Remarks

- Selected highlights of the IMF Managing Director's presentation as commented above show that the presentation has been compiled to favour the new economic policy of the Trump Administration. Therefore, she blames the present unfair international economic system for the current trade tensions though it has been created suddenly by the US new Administration.

- However, the IMF has never commented on this kind of unfairness or defects of the international system. Instead, it was created and operated through the surveillance and functions of the IMF. For example, the dollar dominance as the global reserve currency which is the core of the present international system is a byproduct of the IMF under the Bretton Woods monetary system in 1944.

- In fact, the IMF macroeconomic management model created based on dollar reserves and hot capital mobility of many countries arranged by the IMF agency network has been a key element in the global stability system. Therefore, almost all countries have confronted economic crises several times and ran to the IMF for reserve/rescue support for more than 15 times in the past five decades. As a result, many countries which record an economic and human history of more than 2,000 years became trapped in the IMF-run international economic system through its informally maintained global agency network.

- In this context, the Trump Administration has raised concerns over the existing role of the IMF and World Bank. Yesterday, the US Treasury Secretary Scott Bessent at a public forum heavily criticized the IMF and World Bank and expressed that the US would back them as long as they get reformed and their management and staff hold accountable to the role ((Watch the speech here).

- Therefore, such superficial presentations and statements made by the IMF will not help continuation of its operating model as at present. This requires member countries now trapped in the IMF economic model to make a systemic risk assessment and search for sustainable models within the country means at least in the next decade. Meanwhile, many countries may go bankrupt during the trade transition period, depending on the level of the support provided by the US Administration. Therefore, the IMF agency network will not be able to mislead country leaders and general public any more and country leaders should refrain from painting rosy stories on trade talks with the US authorities, given the complexities and grave uncertainties connected with geopolitical factors involved in.

P Samarasiri

(Former Deputy Governor, Central Bank of Sri Lanka)

(Former Deputy Governor, Assistant Governor, Secretary to the Monetary Board, Compliance Officer and Director of Bank Supervision of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment