How operationally bankrupt Central Bank murders Sri Lankan economy in the ICU? We need to stop it.

Everybody knows that Sri Lankan Central Bank (CBSL) is

non-active in its almost all national economic policy powers authorized in the

Monetary Law Act (MLA) except money printing. Therefore, it is reasonable to

state that the CBSL is an operationally bankrupt central bank in the world.

One leading economist connected to the CBSL commented in

2015 that the CBSL was a bankrupt institution similar to Sri Lankan Airline due to

the erosion or negative capital position. However, this kind of capital-based

description of bankruptcy as in the case of commercial businesses does not

apply to central banks as they can print money and make profit.

Therefore, the purpose of this article is to shed some light on how the operationally bankrupt CBSL’s money printing policy is gradually murdering the Sri Lankan economy and its people who have been in the economic ICU from the middle of 2021.

The article primarily highlights systemic risks of the economy arising from the present monetary policy strategy of the CBSL that have potential of killing the already dying economy.

Why CBSL is operationally bankrupt?

The MLA has mandated the CBSL to secure the economic and

price stability and financial system stability of the country with a view to encouraging and promoting the development of productive resources of the country through the policy

actions authorized in the MLA.

Policy actions authorized in the MLA fall in broad

operational areas. Those are open market operations (OMO), credit operations with

banks, management of foreign currency reserve and exchange rate, regulation and

supervision of banks and bank credit and fiscal agent and public debt management. The monetary

conditions of the economy, i.e., money printing, money supply and interest

rates, are the outcomes of those operations where all those operations mixed up to keep monetary conditions at desirable levels in line with economic needs.

The CBSL is now operationally bankrupt due to the loss or

inactivity of many of its authorized policy operations.

- First, foreign currency management function is lost due to the collapse of its foreign currency reserve to almost zero of liquid reserves while the CBSL has appealed to international community to provide it with foreign currency aid to finance essential imports.

- Second, banking sector soundness and prudence is at grave risks due to significant erosion of the quality of bank credit and liquid assets consequent to the present economic crisis and super-high interest rates. Therefore, bank financial statements are only continuing business accounting exercises. As such, the CSSL effectively has lost its crisis prevention and resolution measures. Accordingly, the CBSL has no option but to urge blanket government guarantee for bank deposits and loans in the event of a systemic liquidity crisis as fancy capital adequacy and liquidity ratios enforced at present are meaningless during times of economic crises. Therefore, the regulatory and supervisory function remaining is only the continuation of routine correspondence handling.

- Third, economic sector-based bank credit delivery/distribution policy is dormant due to super-tight monetary policy. Therefore, the economy is deprived of policy-driven bank credit for encouraging and promoting the development of productive resources of the country

- Fourth, fiscal agent and debt management function has been lost due to the default of foreign debt by the CBSL on 12 April 2022 and prevailing unsustainable debt pile without an orderly functioning debt market with a rollover facility.

Therefore, the remaining CBSL function is the OMO-based

money printing or monetary operations (or CBSL Treasury Operations) to assist the management of overnight inter-bank liquidity and government treasury liquidity.

In this context, Sri Lankan economy is like a patient being

murdered in the ICU due to non-treatment of prescribed macroeconomic drugs

by the CBSL while the government and CBSL top officials travel world over to

import already failed drugs from the IMF and international well-wishers.

How CBSL monetary operations are murdering already dying

Sri Lankan economy

Nobody needs economic interpretation to establish that Sri

Lanka is a dying economy, given its zero foreign reserve, inflation running

above 70%, economic contraction of 8%-10%, government bond interest rates

rising above 33% and nearly 76% of money printing to fund the government.

Therefore, given below are the early warning signs that the

death of the economy is speeded up by the CBSL’s present model of monetary

operations.

The present monetary model is the deadly weapon that targets

overnight inter-bank interest rates and government Treasury bill yield rates at

high levels to keep the bank credit conditions restrictive. Its purpose is to

contract the economy further for inflation control through the contraction of

the aggregate demand in the economy.

Accordingly, how this monetary operation prescription is

poised to murder the already dying economy is shown by following four categories

of warning signals presented in graphics. The analysis is given for the period

from mid-August 2021 to last Friday (14 October 2022) as the monetary policy

tightening during this period is considered as the murder weapon.

Risks of Soaring Interest Rates

The CBSL uses policy interest rates (SDFR and SLFR) and Treasury bill yield rates as benchmarks to drive interest rates and monetary conditions in the economy (see CH 1 below). The policy interest rates corridor is the space given for the mobility of overnight inter-bank interest rates as intervened by standing deposits and standing lending under the OMO. Meanwhile, the CBSL controls Treasury bill yields at weekly auctions by intervening in auctions through the direct purchases of Treasury bills by itself and arranging private placements to primary dealers.

Accordingly, policy interest rates have been raised from

4.5%-5.5% to 14.5%-15.5% during this period. Its super-hike (8 percentage

points) has commenced from 8 April this year. In addition, Treasury bill yields

have been driven faster from 5.25% to 33%. Such high interest rates show

considerable risks emerging the economy.

- First, investment in real business activities will collapse due to crowding out of credit to the government sector as alternative investments will carry extra-ordinary risks.

- Second, such historically high yield rates will make government domestic debt also unsustainable due to rising interest burden and rollover risk. For example, the present yields around 33% mean that discounts offered at auctions are around 30% where the government receives only Rs. 70 for each Rs. 100 worth bid accepted which is the increase in the debt causing a new debt-overhang. Therefore, it is not unreasonable to predict a near-term domestic debt default and its contagion of bankruptcy to the rest of the economy, given the heavy exposure of banks and other financial institutions including pension and insurance funds to the government debt market.

- Third, protracted high interest rates disrupt spending in modern monetary economies and cause contraction and recession in economies.

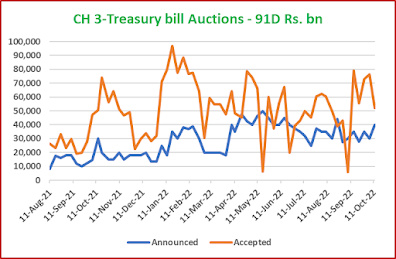

Risks shown by Treasury bill Auctions

Two major risks are highlighted here.

- First is the market preference for shorter tenor bills that heightens debt roll-over risks. Accordingly, almost all bids accepted are of 91-day maturity (see CH 2-5) to raise more than the total amount of all maturities offered for each auction.

Therefore, the face value of 91-day bids accepted is several

times greater than the offered amount pushing 91-day yields unnecessarily high

and causing financial loss to the government through higher discounts in line with same allegations

leveled against auctions of Treasury bonds in the recent past.

- Second is the excessive concentration risk in government debt portfolio as well as private investment portfolios in shorter tenor in the economy. This shows existence of a considerable liquidity risk that will end up in bankruptcy-threatened default risk in view of the present economic crisis.

Risks of excessive money printing to suppress Treasury

bill yields

As government securities yield rates have been a major de facto

monetary policy benchmark, the CBSL has conventionally been preventing market transparency

and suppressing yields in line with the monetary policy requirement. One instrument

used in this regard is the money printing through direct purchase of Treasury

bills by the CBSL outside the auctions.

Therefore, Treasury bill holding of the CBSL shows an

excessive increase since the commencement of high interest rates policy where

the increase is exorbitant after 8 April 2022 (see CH 6 below). The increase in CBSL

holding of Treasury bills during this period of nearly 96% or from Rs. 1,186 bn

to Rs. 2,323 bn.

If not for such CBSL intervention through direct purchases

of Treasury bills, yields may have increased to even 50%-60% and caused a complete

bankruptcy of both the government and economy by now. However, the continuous rise in yields

above 30% is a grave early warning of the near-term bankruptcy.

Such an increase in money printing in a contracting economy with a default of government foreign debt and over 70% rate of inflation is indicative of two major risks.

- First is the excessive inflationary pressures caused by money printing for financing government consumption.

- Second is the heavy dependence of the CBSL assets/balance sheet on government securities, i.e., nearly 70% at present. This level of exposure is like to result in financial bankruptcy of the CBSL too in the event of domestic debt restructuring discernible in the near future.

- Third is the legal risk in the monetary policy as the direct purchase of Treasury bills by the CBSL outside OMO is a direct violation of the MLA.

Risks of disintermediation in the economy

Rising volumes of standing deposits and standing lending (CBSL monetary operations with banks) while the inter-bank market has become virtually non-operative during the past

two months show a considerable disruption in the bank-based financial intermediation

in the economy and connected systemic risks.

The non-operative inter-bank market shows two major systemic risks.

- First, bank treasury operations have been lost primarily due to the lack of trade finance, prime lending operations and default of foreign debt.

- Second, inter-bank trust has been lost due to huge banking risks being smoked under ashes arising from the present economic crisis.

Standing deposits and lending have been considerably increasing (see CH

7 below) with a faster increase in standing lending. For example, standing deposit volume has risen to Rs. 379 bn. from blow Rs. 100 bn in early August 2021 whereas standing lending volume has sharply increased to Rs. 800 bn. from the level close to Rs. 100 bn. in early August 2021. Therefore, this OMO trend is reflective of an acute problem of bank disintermediation in the economy with several

systemic risks.

- First, banks earn risk free profit by mobilizing savings and normal fixed deposits below 13% and parking funds overnight at 14.5% at the CBSL. The CBSL accepting deposits is not a part of the credit-based intermediation.

- Second, banks borrow at 15.5% overnight from the CBSL and finance gaps in business of investment in Treasury bills with yields above 30%. The majority of proceeds of bank deposit mobilization is also channeled to Treasury bill investments weekly. This has replaced the bank credit business with the private sector due to heightened credit risks.

- Third, the non-operative overnight inter-bank market shows the loss of the overnight inter-bank interest rate target-based monetary policy model presently adopted by the CBSL because the money market does not have overnight inter-bank interest rates to operate within the policy rates corridor. As such, banks use financing facilities under policy rates for managing their short-term investments in government securities.

- Fourth, standing deposit business is not a policy action authorized in the MLA. Therefore, the legal risk exposed to the present monetary policy model of the CBSL cannot be lightly taken.

Final Remarks

The above presentation highlights major early warnings of systemic

risks of the government and economy as revealed from published aggregate statistics

behind the monetary policy operations.

As the CBSL economists have ample disaggregate statistics

monitored by a number of departments such as economic research, macroprudential

surveillance and resolution and enforcement assisted by several expert committees,

they must know where the triggers exist for the economy’s death possible in the

near-term.

Meanwhile, it is surprised that the top officials of the government and the CBSL appeal financial aid by way of foreign currency grants and debt relief from the international community led by the IMF and World Bank to recover the economy from the risk of the near-term death. For this purpose, the government has even degraded the country to low income category to seek humanitarian aid.

It is revealed that the domestic fiscal and monetary policy autonomy also has been compromised for this purpose to meet with conditions imposed by the international community as shown by super-high interest rates monetary policy

and unbearable tax hikes despite the widespread economic contraction.

Therefore, early warnings for systemic economic risks presented above would help the policy-making authorities and general public to be more cautious despite the differences of opinions as early warnings are not mathematically formulated facts but information and knowledge-based hunches.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment