A new fake monetary kingdom emerging in Sri Lanka - Collapse sooner or later?

The brand new Monetary Policy Board (MPB) at its infant meeting held on 4th October decided to cut policy interest rates by 1% to 10%-11% with effect from next day. (See the MPB's press release at the following link)

The objective of this short article is to highlight how a new fake monetary kingdom which does not serve the general public and the economy is due to be built by the MPB's monetary policy and to warn of underlying national risks.

Therefore, it is the public duty of the national leaders to be aware of national risks of this monetary kingdom and to prevent it before being too late.

What is the role of MPB and policy interest rates?

The MPB is a committee constituted with the sole authority to conduct the monetary policy of the country in terms of the Central Bank of Sri Lanka Act (CBSLA). The Act was certified into law on 14 September with the overwhelming support of the IMF and the government with the hope of recovering the economy of Sri Lanka from the present crisis.

The policy interest rates are the standing deposit facility rate (SDFR) and standing lending facility rate (SLFR) applied for overnight financial dealings of the central bank (CB) with commercial banks and government securities primary dealers.

- SLFR is the interest rate charged on CB's overnight lending against the collateral of government securities. The new rate is 11%.

- SDFR is the interest rate paid on overnight deposits accepted by the CB. The new rate is 10%.

These two interest rates known as the policy rates corridor were first introduced in 2013 as the key monetary policy instrument under the previous central bank Act, the Monetary Law Act (MLA), which has now been repealed by the CBSLA but same rates seem to continue under the CBSLA too.

The underlying policy concept is to keep the overnight inter-bank interest rates withing the rates corridor. In the event, inter-bank interest rates are under severe pressure, the CB buys or sells government securities to drive the market liquidity through money printing in order to reduce the rates pressure.

Accordingly, the MPB's monetary kingdom is built on the hypothesis of;

- interest rates in the economy to change in response to changes in the overnight inter-bank interest rates driven by the monetary policy through the policy rates corridor,

- flow of credit and money to change accordingly affecting the aggregate demand for goods and services and their prices in the economy, and

- inflation (annual increase in the general price level) to change accordingly in the desirable direction towards stabilizing at 5% target in the medium term.

This article does not cover the validity and controversy of the monetary policy hypothesis and outcomes.

What are the key expectations in the MPB's last policy decision?

- According to the MPB policy press release, it appears that the MPB has reviewed;

- recent monetary policy measures adopted by the former Monetary Board,

- progress of various sectors of the economy in the recent past, and

- their impact on the medium-term inflation outlook.

- Expectation of disinflation process to turnaround from September and inflation to stabilize around the targeted 5% over the medium-term.

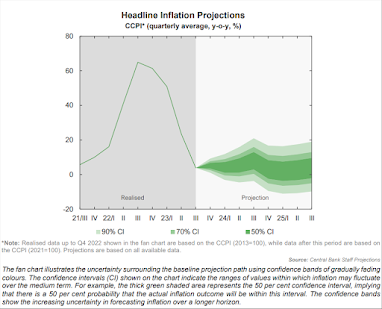

- However, the MPB adopts a highly uncertain projection for the inflation outlook in the range of negative 10% and positive 20% for the period of 8 quarters up to the third quarter of 2025 as shown below.

- The press release also states that "the MPB will continue to assess risks to the inflation outlook, among others, and stand ready to take appropriate measures to maintain domestic price stability in the period ahead while supporting the economy to reach its potential." However, the economy's potential considered in the decision is not indicated.

What are signs of a new fake monetary kingdom emerging in the country?

The MPB makes use of the public mandate over the sovereign currency monopoly built on public trust. Therefore, it is the duty of the public and national leaders to to get them convinced of the benefits that the public can really expect from the monetary policy model presented above, given collapsed living standards surrounding the lingering bankruptcy and contraction suffering the economy.

However, 10 ground facts listed below show that this monetary policy is a fake regime that the general public cannot expect specific benefits sought in the current context to improve their living standards.

1. Unlawful policy instruments

As the MPB is a statutory authority, its monetary operations should be carried out within specific provisions laid down in the CBSLA. However, as the CBSLA does not provide for following policy operations, they are unlawful, arbitrary operations.

- Non-prescription of standard unit of monetary value for money to operate as a unit of account and to carry out economic transactions in book values.

- Standing deposit facility rate

- Ceilings on bank credit products

- Secondary trade of government securities

The CBSLA prohibits the CB from lending to the government directly and indirectly except for specific occasions stipulated. The trade of government securities under monetary policy operations is involved in indirect lending to the government. Therefore, MPB's liquidity operations through the trade of government securities in the secondary market is unlawful. As per the CBSLA, it has to trade private securities such as equities and debentures for this purpose.

- Exchange rate policy

Although the CBSLA provides for powers to determine and implement the exchange rate policy for Sri Lanka, it does not provide for explicitly exchange rate determination-based policy instruments as provided for by the MLA. Therefore, present intervention in the exchange rate reported as flexible exchange rate is a highly arbitrary operation.

- Non-defined domestic price stability and inflation

- No inflation target agreement with the Minister of Finance

As there is no communication on the monetary policy framework agreement with regard to setting the inflation target for the CB as required in the CBSLA, the last monetary policy decision without the framework agreement is unlawful and arbitrary.

2. Invalidity of policy interest rates

As present standing facilities are caped, policy rates have become invalid. The present caps are 5 days a month for standing deposit facility and 90% of the statutory reserve for standing lending facility. This is the rationing of facilities against the basic economic principle of the provision of facilities limitless if it is to keep the prices at fixed rates. Therefore, policy interest rates are highly arbitrary instruments.

3. Negligibility of money printing in the monetary and financial system

The economy is largely facilitated by the creation of credit and money in book entries by the private sector participants. In that context, the money printing by the CB as estimated by the amount of reserve money is a negligible to control the flow of credit across the economy.

For example, the total amount of reserve money is about 7% of the total stock of money held in currency, deposits and government securities alone by the public. If the value of private sector securities such as equities and debentures is included, this percentage falls further. Further, reserve money stock is only about 6% of the country's GDP.

Therefore, the MPB does not have the teeth to control overall money and credit creation taking place in the economy. The present view is the creation of money depending on business environment, demand for credit and underlying risks by the private sector where money printing is only used to fill very short-term liquidity gaps of dealers.

4. Wholesale monetary trade

The MPB carries on whole sale funding operations with permitted banks and financial institutions to assist their day-to-day liquidity management intended for profit-making through the creation of credit. Therefore, the general public cannot expect any benefit from such wholesale funding as credit creation for the general public depends on various other factors.

5. Non-availability of credit distribution instruments to suit requirements of the economy

The MPB does not have instruments such as refinance and credit controls in order to distribute credit to specific sectors and activities required for targeted economic performances. In fact, the major reason for economic backwardness is the lack of development-oriented credit flows to priority sectors as credit markets operate on risk assessment-based profit margins.

6. Supply side disregarded

Present monetary policy model pursued by the MPB is a demand side control-based credit creation in the economy. In fact, it focuses on the aggregate demand control for achievement of inflation target. However, price levels and inflation are determined by the interaction of both demand side and supply side factors.

The MPB believes in low inflation controlled through the aggregate demand to encourage supply side and growth which is not practical in modern monetary economies and macroeconomic principles. Therefore, the monetary policy instruments not targeting the supply side is a big conceptual error in macroeconomics behind the monetary policy.

7. Flawed concept of monetary policy transmission

The MPB believes in the transmission of policy interest rates and other policy instruments to credit and aggregate demand through the overnight inter-bank interest rates with time lags. However, despite significant developments in empirical research in Economics, the CB does not have any empirical evidence on such transmissions. The past projections of inflation published in the monetary policy press releases show that the CB fails to predict inflation accurately even for the next month for the medium-term inflation target-based monetary policy.

8. Demand side based-domestic price stability and inflation control not established

The MPB does not have any empirical or statistical evidence to prove that domestic price stability and inflation are purely demand-side outcomes. Therefore, the monetary policy is a highly hypothetical, arbitrary exercise.

9. Annual inflation being a statistical exercise not valid for macroeconomic welfare

Annual inflation rate used for the monetary policy is the annual percentage change of the CPI. However, the inflation confronted by the general public is the increase in the general price level being the outcome of the economy's market structure during a longer period than one year.

For example, the CPI-based inflation confronted the economy for the period from the beginning of 2020 to September 2023 is about 87% although the MPB takes inflation in September 2023 as 1.2% by disregarding the current general price level and related cost of living confronted by the general public.

As such, the MPB does not talk about getting this longer-term inflation down for the domestic price stability in order to ease the demand and living standards and, therefore, inflation control concept of the MPB does not serve any purpose for the price stability or demand conditions of the economy.

10. Credit operations with private dealers against private securities at risks to public funds

Unlike under the MLA, the new monetary policy under the CBSLA is to be carried out through credit granted to banks and shadow banks (such as specialized banks, finance companies and leasing companies) and trade of private securities (such as equities and debentures) while prohibiting credit to the government.

As these are high-risk credit operations, any insolvency of the new CB is a burden on fiscal operations as the government has to mandatorily contribute to the new CB's capital from public funds to absorb the deficits.

In contrast, central banking globally is primarily built on credit to government and fiat currency issued in trust with the government. Therefore, the new CB and monetary policy will be mostly built on the private sector risks at a burden to public funds.

Warning of national risks

- What appears as highlighted above is a clear attempt of the new CB management to build a new fake monetary kingdom under the mask of the CB autonomy under the CBSLA. However, the monetary operations of the new CB are seen not new from what was done previously under the MLA.

- The monetary kingdom built under the MLA in violations of the statutory provisions and macroeconomic principles also was a fake kingdom and, therefore, it collapsed in 2021-22 causing a historic economic crisis in the country. However, the new CB management has got a new law passed by blaming the MLA for the economic crisis to cover up the collapse of its fake kingdom.

- The short presentation above shows that the new CB management under the mask of the CBSLA is in the process of building a similar fake monetary kingdom that does not serve the general public and present requirements of the economy. Instead, it is being designed largely on the already collapsed kingdom with some fabrications to explicitly serve private wholesale money dealers to help their liquidity needs for profit maximization rather than to build and regulate a modern sovereign monetary system for the economy.

- As the new kingdom is a threat to coordination and integration of public policies for national objectives, underlying risks to the stability of national governments and to the state would be huge and unmanageable, given the excessive dominance of modern monetary systems over markets, governments and general public.

- However, the new monetary kingdom also is due to collapse sooner or later, given its fake and unlawful character, causing another economic crisis in the economy unless national leaders act to correct it without delay.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment