Policy rates cut by 1%, T bill rates cut by 0.13%? Is CB running a Ponzi scam for bankrupt government?

Yesterday, the brand new Monetary Policy Board (MPB) cut policy interest rates by 1% to 10%-11% and urged the whole financial sector to pass the benefits of the continually eased monetary conditions of the economy to individuals and businesses in order for them to rebound of the economy.

According to the CB's press release issued today, the MPB has had a divine-look on the economy before making this decision. However, the cut in Treasury bill yields by the CB Tender Board yesterday just before the MPB meeting is 0.2%, 0.04% and 0.14% for the three maturities (simple average cut of 0.13%), which are way below the policy rate cut decided by the MPB in the evening (see the CB press notice below).

In fact, the Chairman of the Tender Board is now a powerful ex-officio member of the MPB and the Director of Economic Research who submitted the policy rate cut recommendation to the MPB is a powerful member of the Tender Board.

Therefore, a legitimate public concern arises as to why the CB did not cut Treasury bill yield rates at least by 1% to be commensurate with the policy rate cut as both are at the complete control of the CB at present.

- This auction was involved in the rollover of debt raised from Treasury bills issued at yield rates of around 32%, 28% and 19% in the recent past. However, Treasury bills purchased by the CB at those rates were not available for the rollover as such Treasury bills were converted into Treasury bonds effective from 21st September. Therefore, the CB's own interest in Treasury bills is now non-existing.

- Bank fixed deposit rates have now fallen to a level of around 10% whereas govt guaranteed NSB fixed deposit rate is 9% despite Treasury bill rates remaining elevated around 13%-17% at auctions.

- Domestic debt optimization has been completed for about Rs. 5,918 bn and, therefore, the pressure on government securities market should have considerably eased, given the purpose of the optimization concept.

- In this background, while the MPB urged all the financial sector to reduce interest rates swiftly and sizably despite higher risk levels prevailing consequent to the current status of the bankrupt economy, it is strange that the MPB has not noticed the urgent need to reduce the interest rates on credit to the government. The Treasury bill auction press release was out at the time of MPB meeting in the evening yesterday.

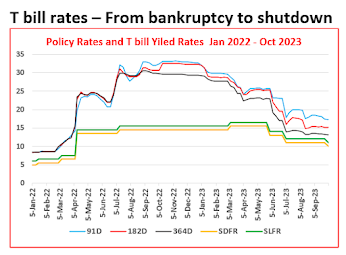

- The CB's unduly discriminating treatment on interest rates to the government as compared to movements of policy interest rates (SDFR and SLFR) in the recent past is well established as depicted in the Chart below.

- Raising Treasury bills yield rates drastically towards 33% during Apr-Aug 2022, a way above policy rates,

- keeping them at historically high levels around 32%-25% in Sep 2022-Apr 2023,

- cutting them faster while policy rates continued to be raised in March-June 2023 and

- maintaining them at elevated levels since July 2023 while policy rates were drastically cut.

- Therefore, the Chart is not explainable in the standard monetary economics or in layman/classroom economics. It will be surprised if a monetary policy-based macroeconomic story is fabricated for this divergence between policy rates and Treasury bill yield rates depicted for this period.

- The CB's conduct at the last Treasury bill auction is not new. A similar behaviour was reported from previous two instances of policy rates cuts on 31 May 2023 and 5 July 2023. Therefore, such Tender Board decisions may have commonly identified links.

- Observations listed above clearly show the specific tendency of the CB to keep government interest rates at elevated levels despite its macroeconomic story painted on policy interest rates.

- Overall, this is seen as a clear aberration of yield rates driven by the CB for hidden monetary policy agenda at a cost to the government and pubic funds while the financial profit earned on the monetary policy especially carried on government debt is not duly remitted to the revenue of the government. Unremitted profit in 2022 alone is Rs. 235 bn.

- In fact, so called domestic currency debt unsustainability arises from the burden on interest payment as compared to the income flow rather than debt stock level as debt can be rolled over at the maturity or reprofiled through liability management operations. This is true for both government and private corporates. In fact, governments or corporates that are run like Ponzi schemes funded at high interest rates no doubt become bankrupt primarily due to high interest cost involved in debt rollovers and resulting loss of investor trust in credit. High interest rates are partly a result of central bank monetary policy cycles. The global literature in this regard is well established and clear.

- The overall interest burden to the government from this Treasury bill auction alone is around 0.85% if 1% yield cut is assumed to have duly been applied for the auction in line with the policy rate cut decided on same day. This is the direct cost to public funds. The cost will be colossal if it is estimated for the elevated yield rates reported in the recent past as depicted in the chart above.

- The direct loss on the last Treasury bill auction was clearly avoidable due to several options available.

- First, as the demand for auction was very high in terms of bids, the CB had the private placement window to raise balance funding easily from those bids at the weighted average yield rates as usual. It was reported of Rs. 32.5 bn worth placements offered showing an ease ability to go for even Rs. 50 bn if auction bids were cut-off at lower yields.

- Second, the CB could have easily funded primary dealers for their bids through specifically announced reverse repo auctions and limitless intra-day interest free liquidity facility until they dispose the bills to investors.

- Third, as usual, the CB could subscribe to the issuance as the new CB Act has provided for it whereas its total Treasury bill holding (Rs. 2,556 bn) has now been converted into medium and long-term Treasury bonds effective from 21st September.

- The financial system operates on government securities as liquid assets and, therefore, desperately suffers fundamental liquidity shortages and risk management problems partly due to lower securities prices suppressed by elevated yield rates. The IMF in its latest review has recommended actions needed to address banking sector capital and liquidity shortfall to ensure financial stability. This requires lower yield rates to boost the value and to reduce the cost of bank liquidity.

- As such, the indirect cost of elevated yield rates to the economy and people would be a significant percentage of the national income as such elevated yield rates being used as risk free interest base have not provided sufficient space for credit market interest rates to ease.

- Overall, present economy cannot expect any material benefit from this policy rate cut surpassing the adverse impact of continued aberration of yield rates and harm to the government and credit markets as highlighted above. Therefore, those in the CB who determine Treasuries' interest rates should be held directly responsible for such costs and losses because costs and losses are unjustified by their public mandates in the current context of bankrupt government and severely contracted economy with increased poverty levels.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment