Is govt debt market disrupted? What is its domino effect? Who is responsible for?

Background

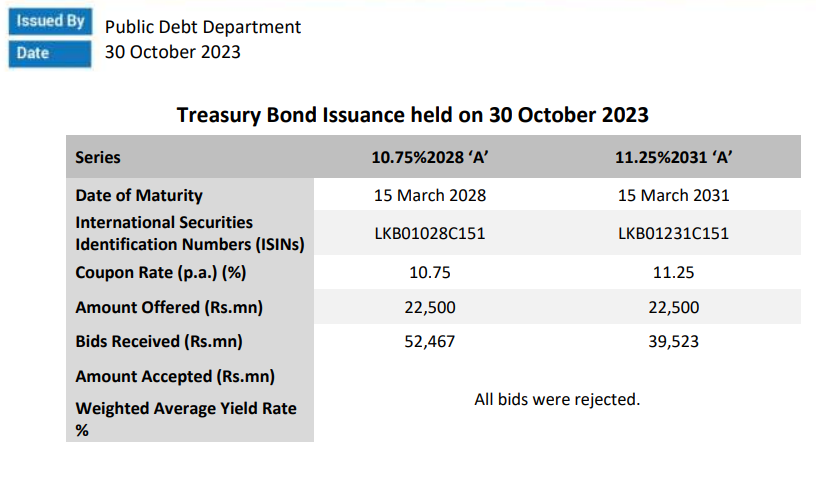

In the previous article, technical background for rejection of all bids for the T bond auction held on 30 October 2023 was presented (see T bond auction).

However, at the next T bond auction held on 13 November 2023, the CB has accepted bids worth (face value) 29.3% of total amount of three bonds offered for the auction.

Meanwhile, the CB has been able to accept bids for total amount offered for the T bill auction held on 15 November 2023.

Therefore, this article highlights the disrupted conditions of the government securities market as revealed from auctions results, consequent to inappropriate monetary and debt management policies, and warning of a possible collapse in debt market catastrophic to the fiscal, monetary and financial system.

T bond auction announced held on 13 November 2023 - A failure

This auction was a rollover of T bond maturity of face value Rs. 180.6 bn and balance coupon payment due on 15th this month. As existing investors are generally willing to rollover the maturity proceeds of bonds in normal times, a sizable volume of bids would be available for the auction at current market interest rates. However, auction results given below show unusually low demand for bonds.

- Accepted bids for the total amount offered (Rs. 60 bn) for the short-tenure bond.

- Accepted only 7% in total for other two bonds of the medium-term maturity (i.e., March 2028 and March 2031).

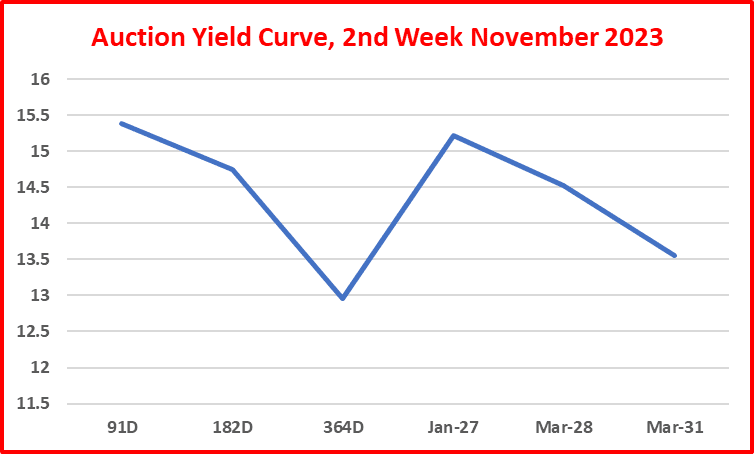

- Reduced weighted average yield over longer maturities, i.e., from 15.22% to 13.56%.

- Questionable coupon rates, i.e., the lowest for the medium-term bond (i.e., 10.75%) and the highest for short-term bond (i.e., 11.4%).

- Offered same two bonds that were rejected at the last bond auction (see Table below) and accepted only a small amount of bids (i.e., Rs. 13.2 bn) at weighted average yields of 14.52% and 13.56%. Therefore, the rejection of bids at the last auction has not helped this auction.

- Failed auction, i.e., acceptance of bids only worth 29.3% of total amount offered, despite the excessive funding requirement for the repayment of the bond maturing on 15th this month. The maturing bond carried a very low coupon rates of 6.3% as it was issued in low interest rate policy environment in November 2020 (i.e., policy interest rates 4.5%-5.5%).

- The usual post-auction private placement window was not open, despite the huge funding deficit.

Signs of disruption of govt debt market

- Poor demand prevails for Treasury bonds. This is due to the fear of restructuring of Treasury bonds due to the IMF conditions. Although bonds held by the EPF amounting to Rs. 3,204.5 bn have been restructured, this is only 27% of bonds outstanding at present. Therefore, a great uncertainty prevails over investments in Treasury bonds.

- Therefore, the demand for government securities prevails for short tenures, i.e., 91 days and 182 days, as investors are not willing to take restructuring or default risks. For example, T bill auction held two days after the above bond auction was fully subscribed (see table below) through 91D and 182D bills where post-auction private placement window also was open for additional subscriptions, possibly to be used for cover-up funding for the maturing bond stated above. Many investors in the maturing bond on 15th may be investing their maturity proceeds in the T bills to be settled on 17th. The demand comes mainly from banks and financial institutions as they are required to invest in government securities for meeting the liquid asset regulation. If not for this regulation, the government securities market would be dead or running at exorbitant interest rates by now.

- The inverted yield curve (downward shape) prevails due to the CB's attempt to fix low interest rates for longer-term securities for the monetary policy purposes (see three charts below). Th yield curve is the plot of yield rates across the maturities of government securities. The CB's long-term practice has been to run the monetary policy on auction yield rates fixed by the CB as policy interest rates are ineffective. Therefore, if market forces were permitted, the yield curve would be much steeper or upward sloping, given risks involved in government securities. Therefore, this kind of manipulated yield curve is a threat to debt management and financial system stability.

- The yield curve inversion in developed market economies is believed a strong signal of future recession and reduction in interest rates by central banks. This feature is seen during the monetary tightening cycle. However, the yield curve inversion in the bankrupted and contracted economy of Sri Lanka is a result of manipulation of yield rates, given the dormant securities market consequent to the declared bankruptcy of the government and debt restructuring uncertainties.

- Information presented above is evidence for disruption prevailing in government securities and debt market. Therefore, auction twisting highlighted above does not work in current market conditions although it worked in the past with debt supply chains supported by foreign debt and monetary financing. As such, present debt market disruption is a grave risk to the stability of the country's fiscal, monetary and financial system as their core is the govt debt market and trust.

- The disruption has led the government to fund the fiscal deficit through shorter tenure debt which restricts the implementation of the fiscal policy for its due role in the crisis-hit economy. As a result, fiscal policy has become the policy of financing the political leadership.

- In 2024 govt budget, the fiscal deficit to be funded through borrowing is estimated as Rs. 2,851 bn. For this purpose, the gross borrowing limit has been increased to Rs. 7,350 bn, i.e., an increase of Rs. 2,371 bn from 2023 borrowing limit (Rs. 4,979 bn.). The estimated debt service alone in 2024 is Rs. 6,919 bn based on artificial debt restructuring assumptions. Therefore, the borrowing limit should further rise if debt restructuring assumptions do not materialize. Therefore, how the government will manage such a magnitude of borrowing in the disrupted debt market is not a difficult question to understand.

- In this context, debt market disruption should further get aggravated due to day-to-day borrowing through short-tenure promissory notes and continued interest rate manipulation by the CB where debt restructuring complexities will continue to disrupt the investor trust.

- If things evolve in this manner, the country may confront a near collapse in debt market and a monetary and financial system catastrophe. In the economy of inactive debt market and non-existing growth, the domino effect of fiscal financing through unproductive money creation is well-established in macroeconomics. Further, debt scandals are unavoidable in such tight financing environments although debt can be raised somehow. Therefore, fiscal and monetary managers should be mindful of new precedence now available in regard to fundamental rights of the public on monetary, fiscal and debt management operations if they remain in their public seats in unpublic manner.

- In this context, unless fiscal authorities are able to disconnect from tribal concepts-based monetary policy dominance and innovate the fiscal policy based on modern supply side economics, Sri Lankan economy and public will be driven to an economic Gaza strip in the world economy.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

Comments

Post a Comment