Economy in a deflation trap. A rate cut of 200 bps urgent. Monetary policy non-responsive or failed?

The purpose of this short article is

- to provide highlights on central bank (CB) monetary policy operations during 1st three quarters of 2024, raising serious concerns over deflationary economy in years ahead and monetary policy failure to maintain the domestic price stability and

- to recommend

- an emergency rate cut of at least 200 bps and

- a timely injection of fresh reserves of at least Rs. 3 trillion in years ahead to promote a fair distribution of credit across priority sectors such as exports and domestic foods to recover the economy before the second round of default possible in 2028 consequential to the commencement of foreign debt service on restructured terms.

- However, finding the leadership with capacity and energy to understand and implement the recommendation above is extremely difficult in the present IMF economic governance system.

Leading highlights are as follows.

- Early signs of the economy being pushed to a deflationary trap indicative of monetary policy failure to boost the aggregate demand actively.

- Flexible inflation target being breached consecutively for six months from April.

- Upward pressure of money market interest rates notwithstanding the excess liquidity in the banking sector and significant disinflation path of likely permanent nature.

- Early warning of significant and systemic contraction of the monetary base in years ahead when outstanding credit to government starts maturing without any rollovers.

Policy interest rates

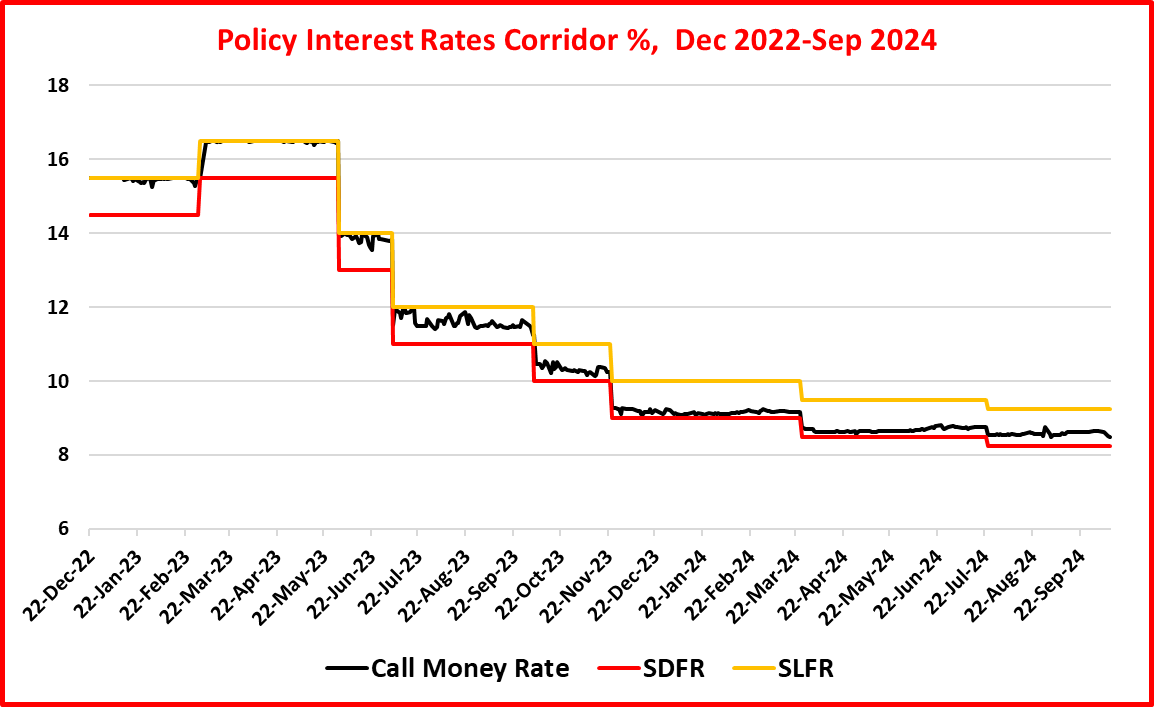

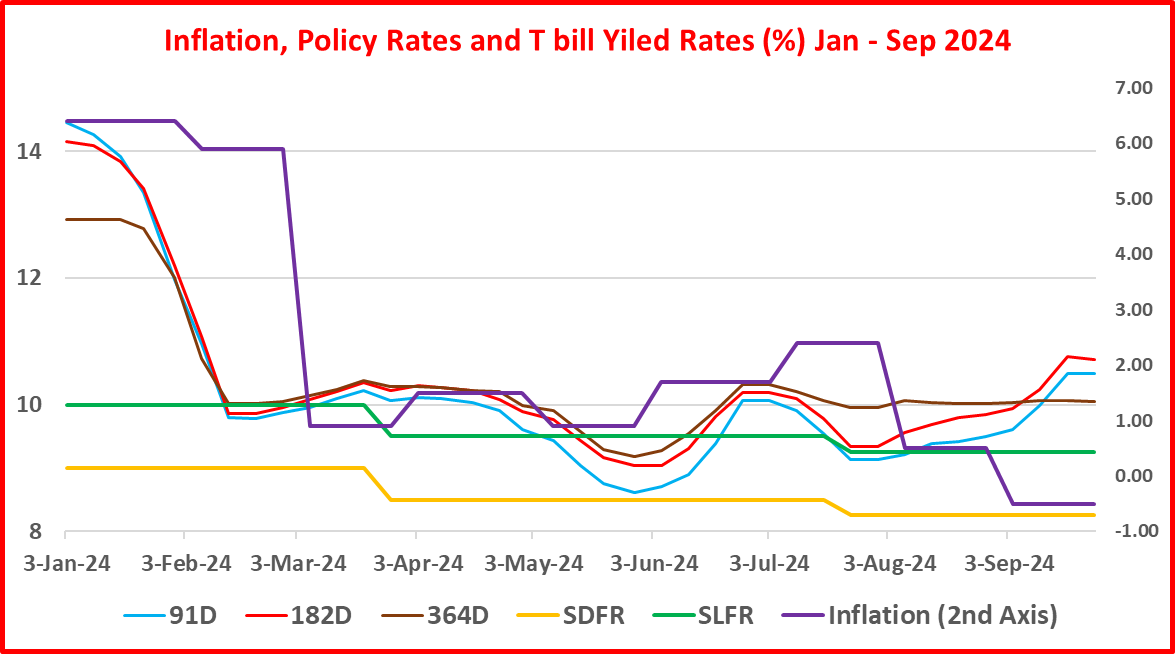

- Policy rates cut twice by a total of 75 bps, i.e., standing deposit facility rate (SDFR) to 8.25% and standing lending facility rate (SLFR) to 9.25% (see the Chart below).

- Further injection of reserves to the economy on the top of the prevailing excess liquidity to support the policy rates corridor.

- Continuation of reverse repo window, mainly on overnight and 7-day basis as the major source of fresh reserves to support the policy rates corridor (see the Chart below).

- Injection of a total of nearly Rs. 6.9 trillion on the offer of Rs. 8.4 trillion at 220 reverse repo auctions with rising volumes in September.

Standing facility window

- Active use of standing deposit facility to park bank excess reserves at risk free interest rate (SDFR) while standing lending facility remaining highly inactive from the third quarter (see the Chart below).

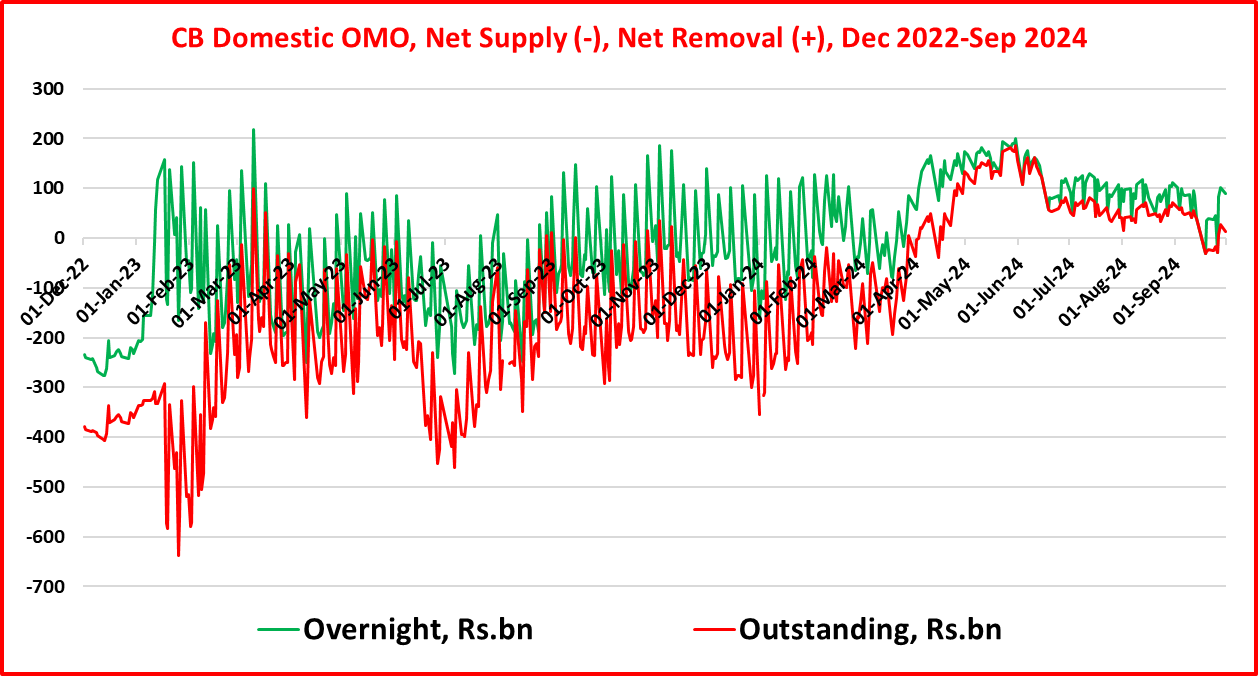

Overall OMO

- Domestic OMO resulting in an overall removal of reserves on overnight as well as outstanding basis with a high volatility reported in September (see the Chart below).

- Overall bank reserve position being not commensurate with the present policy rates cutting cycle as there has been an overall removal of reserves after the month of May instead of injection of reserves.

- Inter-bank overnight lending rate, the key monetary policy operating target, rising towards the upper bound of policy rates corridor since July from being closer to the lower bound during prior months (see the Chart below).

- While overnight inter-bank repos rising in highly fluctuating volumes, call money volume being mostly below Rs. 20 bn tending to fall below Rs. 10 bn in August and September (see the Chart below).

- Two inter-bank rates mostly moving closer to each other within the policy rates corridor, despite significant deviations and volatilities in volumes.

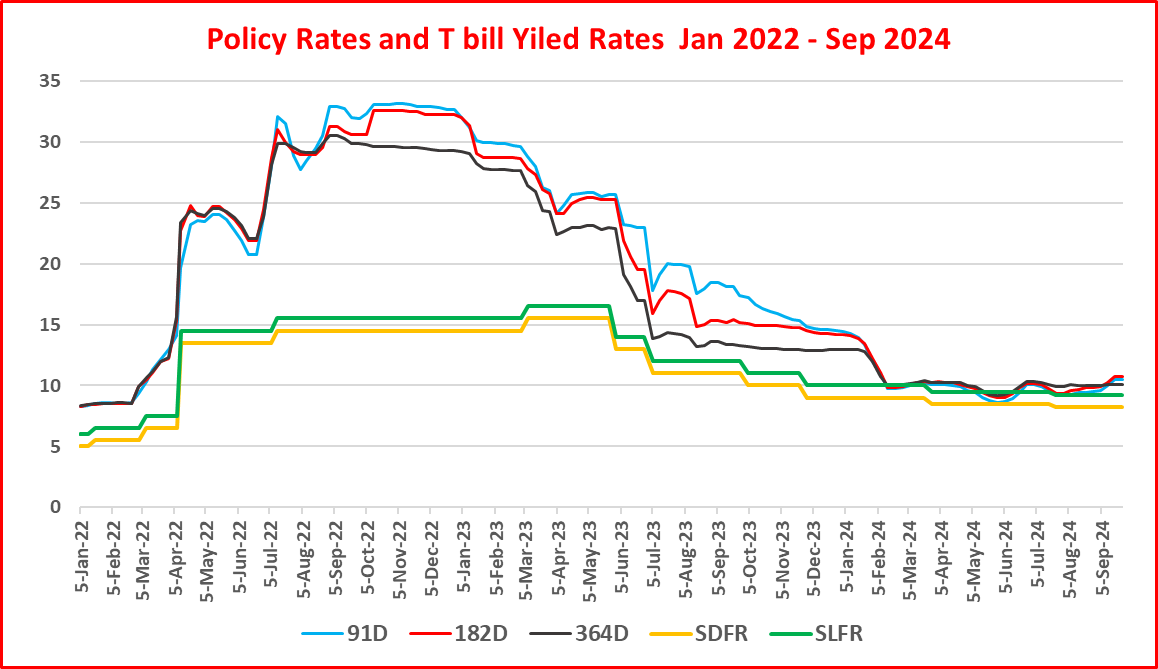

- Yields which dropped to the policy rates corridor in May and June showing an unjustified upward movement in since July, despite rising market liquidity and improved confidence in fiscal stance under the close IMF watch and deflationary movement (see the Chart below).

Foreign currency operations

- Foreign reserve rising closer to US$ 6 bn largely through concessionary debt flows resulting a temporary surplus BOP which helped monetary operations targeting a transitory period of currency appreciation after the overshoot in 2022 (see the Chart below).

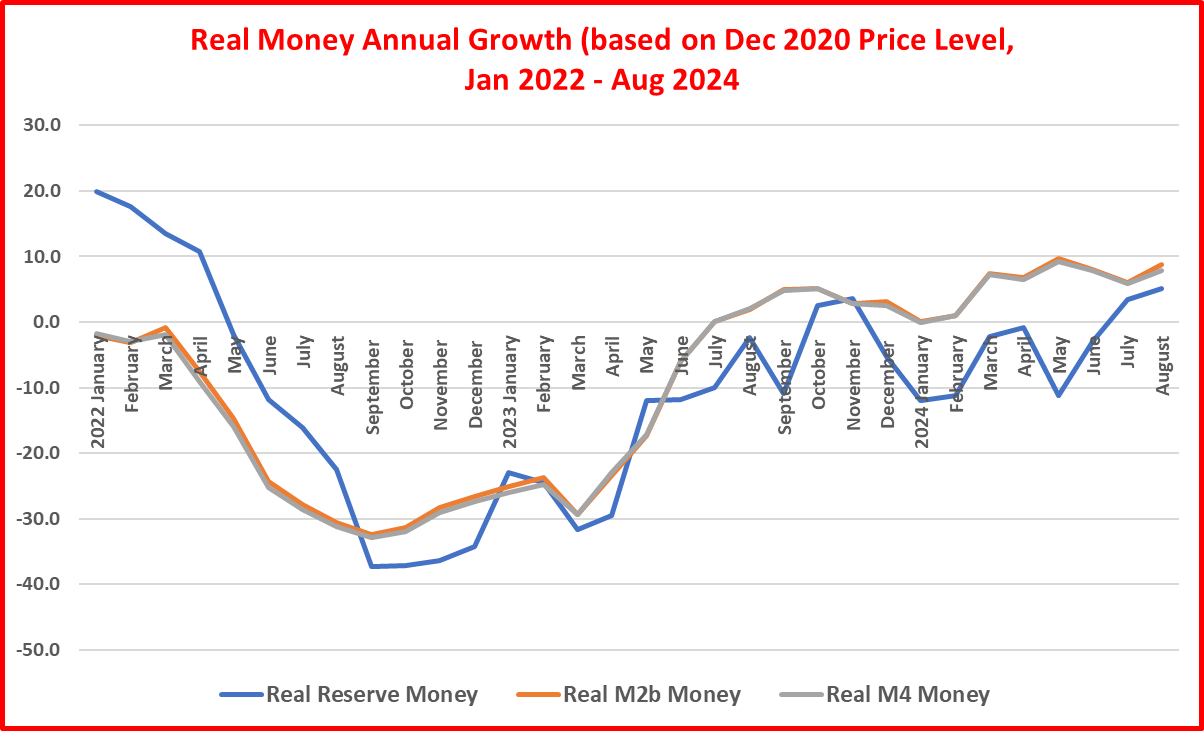

- Annual monetary growth which collapsed in 2022 and 2023 on the sugar high interest rate policy picking up slightly towards 10%, despite the unacceptably high volatility of reserve money growth (see the Chart below).

- Real money growth remining low below 10% not sufficient to stimulate the aggregate demand although it recovered from its burst in 2022 (see the Chart below).

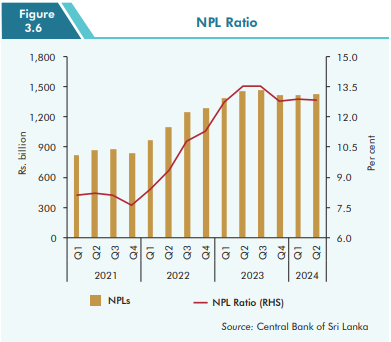

- Private sector credit picking up slowly but high NPL ratios around 13% as reported in the CB Financial Stability Review 2024 concern the systemic limitation of the monetary sector to support the revival of the economy (see the two Charts below).

- The dollarization in reserve money gradually picking up with the newly borrowed foreign reserves while the absolute impact remains with the holding of government securities continuing at Rs. 2.5 trillion on restructured basis (see the two Charts below).

- Serious early warnings on a possible systemic contraction of reserve money when these securities are redeemed on restructured terms in years ahead.

- Overnight reverse repos offering at interest rates lower than the SLFR despite the same credit quality and terms, casing a loss to the CB around Rs.10.6 bn for far in 2024 (see the Chart below). In many cases, overnight reverse repo rate was lower than the call money rate too violating the policy rates corridor principle.

Domestic price stability

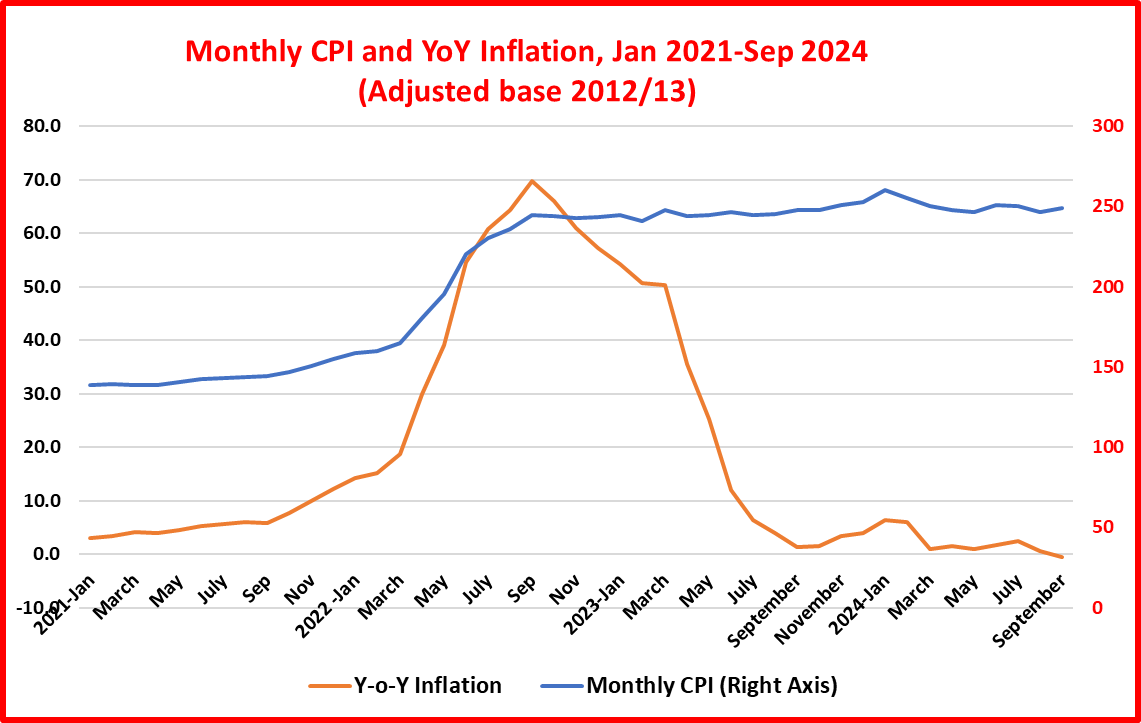

The CB's objective for the domestic price stability is the quarterly average of the percentage increase of the Colombo Consumer Price Index (CPI) targeted at 3%-7% termed as flexible inflation target. This statistical inflation target is questioned on several grounds (see the two Charts below).

- Consumer prices remaining at elevated levels significantly above the pre-inflation period although rate of price increases has decelerated to negative levels (deflation trap).

- Inflation target being breached consecutively for six months.

- Inflation reaching deflationary territory over a period of 7 months with ample prior warnings.

Remarks on an emergency jumbo rate cut of 200 bps

- As pointed out above, a salient upward pressure on interest rates is clear from the second quarter, despite a significant disinflation path to deflation territory and 75 bps policy rate cut (see two Charts below) so far in the year.

- At the last monetary policy decision on 26 September, the CB also predicted and accepted a deflationary path in the near-term without taking any pre-emptive actions.

- Deflation is worse than inflation.

- First, it causes losses to producers and sellers pushing them to cut production activities that will have spiral effects on employment, wages and prices.

- Second, resulting debt service problems cause additional risks to the financial system on the top of already high non-performing loans.

- Present deflation is largely the direct oitcomr of expenditure cuts due to significant macro-economic contraction caused by the super tight monetary policy and currency crisis since early 2022.

- An emergency prevails for a Jumbo policy rate cut of at least 200 bps to reverse upward pressure of market interest rates to pre-empt deflationary trap before it getting worse, given the belief of the monetary hypothesis.

Overall remarks

- The outright failure of the monetary policy to keep the domestic price stability.

- Inappropriateness of non-risk-taking policy interest rates-based monetary policy model in view of the insignificant volume of call money to respond to policy rates decisions.

- Re-commencement of dollarization of the monetary system back to borrowed foreign reserves from credit to government. This is an early signal of another currency crisis in few years ahead.

- Emergency for a jumbo policy rate cut of at least 200 bps to correct monetary and financial conditions.

- A medium-term need of fresh reserves at least Rs. 3 trillion to promote distribution of credit across the priority sectors with a target to generate a sizable foreign currency surplus in order to prevent the second round of default eminent in 2028.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment