Fed cuts rates 75 bps. 25-50 bps cut for Sri Lanka hardly adequate.

Article's purpose and background

- The purpose of this article is to

- compare Sri Lankan monetary policy model with the Fed's monetary policy model in the current context and

- raise fundamental concerns over Sri Lankan policy model why it fails to support the recovery of the economy.

- The Fed's rate cut of total of 75 bps so far to 4.50%-4.75% with 25 bps today (7 November) and a jumbo cut of 50 bps in September confirms the global rate cutting cycle (see the policy statement hare ).

- The Bank of England (BOE) (now at 4.75%) and Swedish central bank (now at 2.75%) also added another 25 bps today to their cutting cycles.

- European Central Bank (ECB) has delivered a 110 bps cut since June (now at 3.65%).

- All confirms a soft landing in respective economies, i.e., bringing inflation back to 2% target without any adverse impact on growth and unemployment (see two charts below).

- On the sidelines of the IMF-World Bank meetings last week, Sri Lankan central bank Governor stated to the international media that there was a space for a rate cut in Sri Lanka at the next policy meeting depending on the new information available in between.

- However, Sri Lanka is not a dynamic market economy like the US economy which releases new information on a daily basis influencing the Fed's interest rate decision. The only new piece of information in Sri Lanka is the exchange rate fixed by the CB itself through its debt-financed foreign reserve while the economy continues to be bankrupt and contracted in years ahead.

- Further, only economic factor legally permitted for the CB to determine policy interest rates is the annual CPI growth (inflation) of last three months average of the previous quarter. Therefore, what the CB Monetary Policy Board (MPB) can do is to look at inflation number of the last quarter whether it was in the target range of 3%-7% and decide policy rates in what ever manner they wish.

- Sri Lankan economy is now poised for a long deflation trap and, therefore, mostly justifiable option available with the MPB is to cut policy rates.

Fed's monetary policy in brief

Its purpose is the maintenance of stable prices and maximum employment. Therefore, the monetary policy is operated for 2% inflation target that balances two objectives.

Accordingly, the policy implementation has several facets highlighted below.

- First, the target range for inter-bank overnight interest rates (federal funds rates), which is 4.50%-4.75% today. They are just targets and not operative interest rates.

- Second, it operates five instruments to observe the target range.

- Payment of interest on excess reserves of banks at a rate of 4.65%, i.e., 10 bps below the upper fed funds rate target.

- Conduct of standing overnight repos operations (i.e., lending of reserves) with a minimum bid rate of 4.75% and with an aggregate operation limit of $500 bn.

- Conduct of standing overnight reverse repos operations (i.e., moping up reserves) at an offering rate of 4.55% and with a per counterparty limit of $160 bn per day.

- Rollover at auctions of principal amounts matured on Treasury securities holdings that exceeds $25 bn a month.

- Reinvest principal amounts of agency debt and agency mortgage backed securities holdings that exceeds $ 35 bn a month into Treasury securities.

- Third, statutory reserve ratio at zero.

- Fourth, discount window of three layers to provide short-term credit to banks and depository institutions.

- Primary credit to eligible banks with no question asked from overnight up to 90-day term at interest rate of 4.75%.

- Secondary credit to depository institutions not eligible for primary credit at interest rate of 50 bps higher than primary credit rate.

- Seasonal credit to eligible depository institutions up to nine moths during a calendar year to meet seasonal credit needs of communities at interest rate of 25 bps lower than primary credit rate.

Accordingly, the Fed caters to sectoral credit needs in addition to OMO for inter-bank overnight reserve market. As a result of all money printing operations, the Fed's balance sheet consists of nearly 94.4% (i.e., $ 6,626 bn) in Treasury and government related securities ranging from overnight to more than 10 years.

Therefore, Fed's monetary policy is largely a sectoral credit distribution policy despite the capitalist market-based model of the economy.

The Fed Chairman at the press conference today responding to a question whether the Fed will tolerate any inflation undershoot (or deflation) to facilitate price declines, given the public is burdened with high cumulative prices over past few years, stated that as the Fed would not tolerate it as Fed's current framework was the 2% inflation target and the lower inflation also could be a problem. This contrasts Sri Lankan central bank permitting deflationary trend at present.

However, the IMF or other international monetarists do not raise any concerns over this monetary model or its direct benefits to the fiscal front. Instead, they want central banks of our countries to operate as enemies of governments while the Fed is entitled to facilitate the fiscal front through the trade of government securities and yield rates control.

Sri Lankan monetary policy

Its objective is the domestic price stability on the inflation target of 3%-7% based on monthly averages on a quarterly basis.

- Standing lending facility rate (SLFR) to lend to banks overnight of any amounts secured by government securities. 9.25% at present.

- Standing deposit facility rate (SDFR) to accept deposits from banks overnight of any amounts. 8.25% at present.

- Additional OMOs carried out at auctions to inject fresh reserves (reverse repos) or absorb reserves (repos) to drive inter-bank overnight rates within the corridor at specific locations as relevant officials consider fit. This effective policy rate path is not approved by the MPB.

- Statutory reserve ratio of 2%. This is a dormant, administrative instrument.

Do we have a recovery friendly monetary policy?

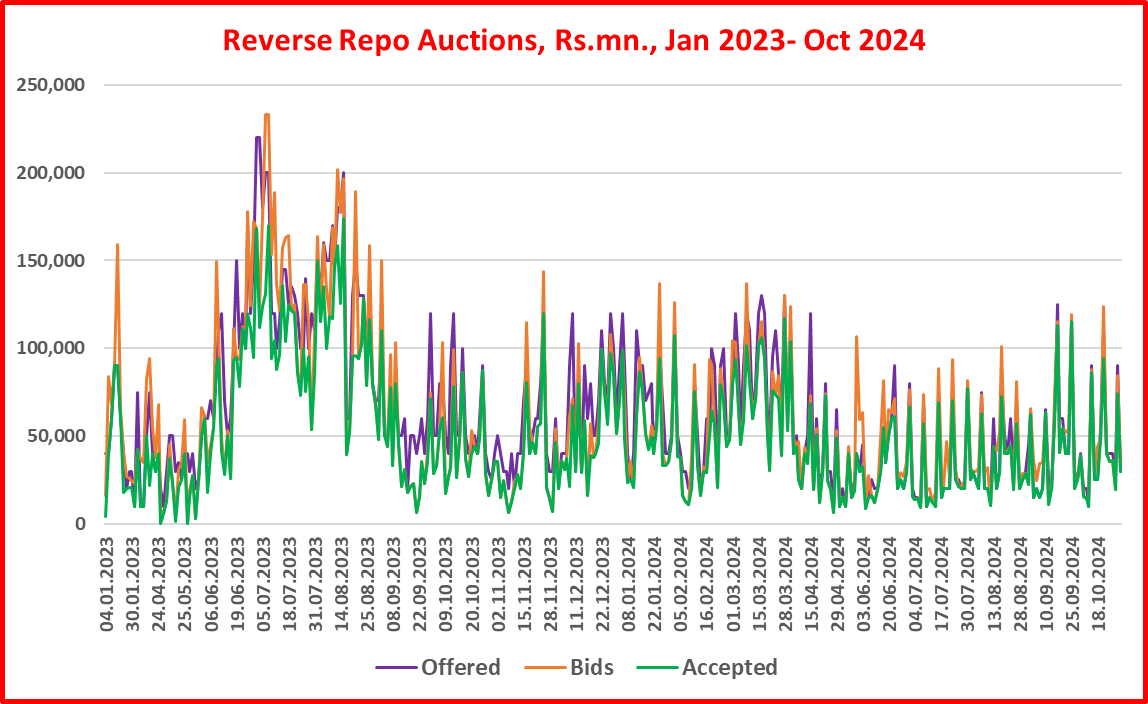

- During last two weeks, grave public concerns were raised over excessive money printing through the OMO window (reverse repo auctions) that has been injecting fresh reserves at interest rates lower than SLFR and inter-bank rates while bank reserve level or liquidity stands at excess levels.

- The economy is seen to be trapped in deflation as the eventual result of the contraction caused by the supper tight monetary policy and pubic debt bankruptcy.

- However, the MPB does not seem to worry about this fundamental problem. Instead, it continues with the policy status quo (see the chart below) with suitable wordings to justify what ever decision.

- Therefore, mostly 25-50 bps rate cut can be expected at the next policy meeting due on 26 this month at the usual phase. It could even be 100 bps to please the new government. A lesser rate cut is also possible to send a message to money market and media that the MPB continues in a relaxed policy mode.

- In contrast, it is also possible that same rates can be maintained by stating that the deflation is transitory and short-lived while inflation will reach the target in the medium to long-term due to long-term inflation expectations well-anchored by the monetary policy.

- However, given the arbitrariness and monopoly of the rate decisions of all central banks, analysts have no basis to predict such rate cuts reliably. In contrast, markets can bet and drive rates to push central banks for their preferred outcomes.

- Therefore, Sri Lankan monetary policy will have no national macroeconomic economic purpose in the pendent context unless the MPB,

- announces at least 200-300 bps rate cut at the next meeting to signal the stimulation of the economy that would attract foreign investments on real growth expectations rather than hot capital speculations at present and

- designs a plan for infusion of fresh reserves of at least Rs. 3 trillion to support credit expansion and distribution focusing on a sectoral based recovery of the economy over a period of five years ahead in coordination with the fiscal policy of the government.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment