OMO Money Printing - A failed reality show with loss to public? Nobody to correct it?

Article's purpose

- This articles highlights the falsehood of clarifications given by the central bank (CB) on public concerns raised over its OMO (Open Market Operations) money printing operations.

- Such clarifications are covered in a speech of the CB Governor (see the video here), the media interview of the OMO Head (see the interview) and a press release on 29th October (Read press release here).

- However, new concerns are raised with the request to discontinue this kind of infusion of excess OMO liquidity.

CB's clarifications

- Followings are the key points made by the Governor.

- The CB did not print money to fund the government as the new law prohibits direct lending to the government.

- OMO/monetary policy operations are similar to those of all central banks in the world.

- The CB estimates liquidity of the banking sector daily, weekly and monthly and carries on OMO accordingly to provide liquidity arising from bank lending operations.

- OMO are used for keep the call money rate at levels the CB thinks appropriate for transmitting short-term interest rates aligned to the inflation target.

- The Governor appreciated this kind of dialogue on CB operations although the CB normally disregards such public comments.

- Other press interview and press release made additional points as follows.

- The CB keeps the stability of the call money interest rate (inter-bank overnight lending rate) for inflation control purpose.

- If OMOs are not carried out, the call money rates may rise to the sky or fall to the earth.

- OMO promotes the distribution of reserves among banks by providing reserves to banks who are unable to borrow from inter-bank market.

- There is a committee called "Market Operations Committee" to decide on the conduct of such auctions.

- First, nobody questioned whether money was printed for lending to the government. The Governor is unaware that the law prohibit even indirect lending to the government. Therefore, any purchase of government securities through the OMO is unlawful as it makes the CB a lender to the government.

- Second, public concerns were only raised on the following. However, the CB did not answer.

- Why the CB prints money on a daily basis and term basis through reserve repo auctions for lending to banks while the banking system is flushed with excess liquidity, and

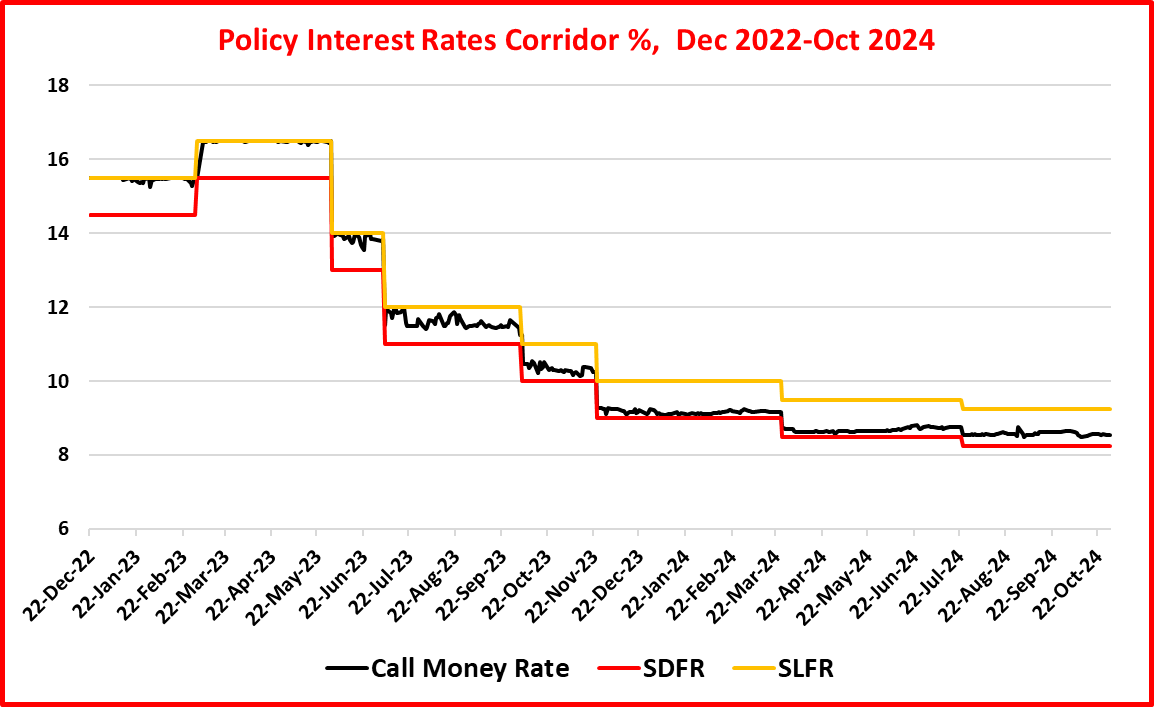

- Why such lending is provided at interest rates lower than the CB's standing overnight lending facility rate (SLFR) (9.25% at present) and closer to the floor of the CB's standing overnight deposit facility rate (SDFR) (8.25% at present).

- Third, some questioned the specific purpose of reverse repo OMO instrument when already there is a standing facility window operated with two policy rates (SLFR and SDFR) as the CB's Monetary Policy Board (MBP) approved target range for the call money rate. The very purpose of the two policy rates is to keep the call money rates within them through the limitless standing facilities (overnight lending and taking overnight deposits). Therefore, central banks operating with such realistic policy rates do not operate this type of aggressive OMOs because they do not worry over movements of call money rates as long as the rates are within the corridor. It is the monetary policy model.

- Fourth, the CB's liquidity estimates other than the daily liquidity estimate are meaningless because nobody can predict bank cash inflows and outflows for weeks and months. The best example is the LIBOR scandal of UK banks not detected by the central bank. The daily liquidity estimate also is not reliable as the CB has injected fresh reserves when the actual liquidity is in excess.

- Fifth, call money rate cannot go beyond the policy rates corridor because of the limitless standing facilities where the CB has no limit on money printing.

- Sixth, the distribution of reserves is a market-based operation within the current monetary policy model. Therefore, there is no case-by-case-basis OMO to provide reserves to weak banks. OMO auctions cannot differentiate banks by their financial strength. It will be a grave irregularity if OMO are conducted at lower interest rates for targetted banks. Further, the CB monetary policy does not consider even credit distribution disparities in the economy. Therefore, the use of OMO to correct reserve distribution disparity is a fictitious story.

- Seventh, whether reverse repo OMOs and call money rate are the effective conduits for the inflation control at current targets of 3%-7% of the quarterly average cannot be established from data.

- In fact, the country now suffers a deflation trap spreading in months ahead as predicted by the CB.

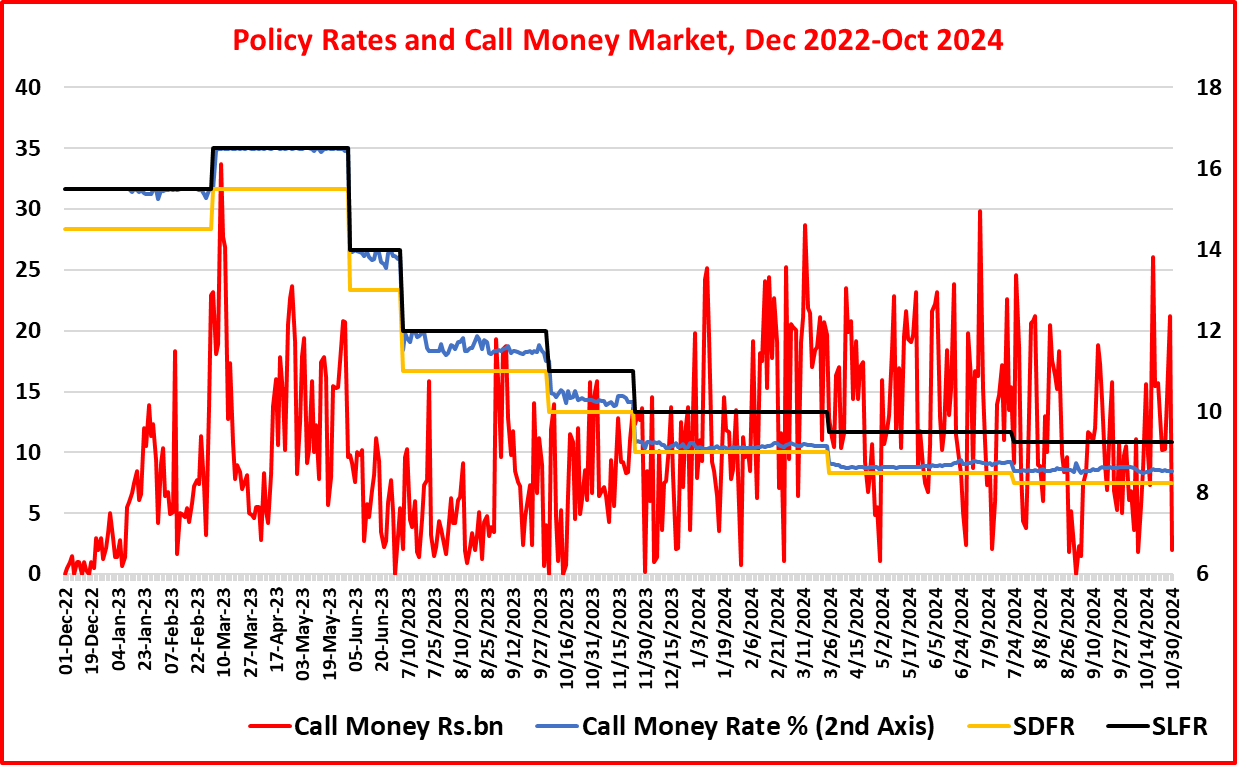

- Inter-bank call money market is mostly around Rs. 10 bn - Rs. 20 bn. Therefore, whether such a negligible credit market can control inflation is a common sense concern (see the chart below).

- Eight, Market Operations Committee is another element of money printing bureaucracy. However, this Committee has nothing to do with taking decisions on bids received at auctions. Further, who decides on acceptance of bids and interest rates is not known. This whole public concern rests on lower rates charged for accepted bids.

- Overall, only inference that can be drawn from the present form of OMO is the excessive manipulation of the call money rate towards the lower bound of the policy rates corridor through the arbitrarily use of money printing (see the chart below).

Policy irregularity revealed from CB's OMO data

- First, reverse repo OMOs were commenced in mid-January 2023 immediately after imposing limits to standing facilities liked to the policy rates. Those restrictions were the lending facility capped at 90% of the statutory reserve requirement and the deposit facility capped at five days a month. The objective was to reactivate the inter-bank loan market through banks' own liquidity which was a huge excess a that time. However, the CB commenced injecting reserves/liquidity aggressively through reverse repo auctions as the restriction strategy did not work. Further, those restrictions were removed in March 2024 but same OMO has continued causing public concerns over its rationale now.

- Second, excessive offer of reverse repo auctions on a daily basis and term basis. Total in the year 2024 so far is Rs. 9.2 tn and total from January 2023 is Rs. 22.8 tn. (see the chart below).

- Third, standing lending facility and the policy rate (SLFR) became dormant as the reverse repo funds were lent at considerably lower interest rates. In fact, 7-day reserve repo rates also were lower than the overnight SLFR (see the two charts below) which cannot be justified even in common sense of money printing.

- Fifth, the specific purpose of keeping call money rate artificially low without letting the policy rates corridor to operate is not clear. Whether MPB has authorized relevant CB officials to determine a second layer of policy rates by way of reverse repo rates is not known.

- Fourth, the loss to public funds by granting reverse repo loans at rates lower than the the standing lending rate (SLFR) alone is Rs. 22.5 bn. so far from January 2023. It is Rs.11.8 bn so far in the year 2024. If the CB wishes to see lower interest rates, it could easily cut policy rates without manipulating rates with such unnecessary losses to public.

- Fifth, while standing lending facility is dormant, the use of standing deposit facility has been rising showing the continued dormancy of the policy rates corridor (see the chart below).

- Sixth, reserves are also provided intra-day basis without any charge of interest on the top of OMO. Nearly Rs. 400 bn a day are provided to boost the daily liquidity (see the CB chart below).

- The CB manipulates both price and quantity in the call money market in a micro manner under the cover of interest rate stability. This is against basic market-based economic principles. This type of intervention leads to bureaucratic abuses. For example, there is evidence for the conduct of auctions targeted for identified counter-parties where the successful bidder is a single counter-party. Further, some OMO are motivated for pushing interest rates up or down artificially for external objectives. The present habit of pushing the call money rate to the lower bound is to postpone the next policy rate cut while telling the market that interest rates are falling further.

- In view of findings presented above, public concerns are related to the monetary policy governance as to how the CB manages public funds with arbitrary losses without any macroeconomic policy rationale. If unjustified losses are reported, the governance should be questioned irrespective of the legal independence because these are public funds.

- Therefore, relevant government authorities responsible for stabilization of the economy and living standards of the country must review whether this mode of monetary policy is appropriate for promotion of credit and money flows required for the recovery of the economy from the ongoing bankruptcy trap. No recovery can be achieved without enhanced credit flows across the affected sectors.

- However, with the IMF network governing the country, any such reviews are not feasible, given the fact that the authorities survive on the IMF and do not dare to conflict with IMF monetary and fiscal policy prescriptions.

- Therefore, present OMO seems like a popular reality show of re-singing old songs with new flavors and voices after months of practicing. Instead, what the country needs now to recover from the bankruptcy are the new and creative monetary and fiscal instruments with new designs.

- However, with present monetary policy model and CB, even if the "God Sakara" and his team takeover the government to make the country corruption free and economically prosperous, nothing can be done as they do not have modern money.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment