Sri Lanka facing a deflation trap! Monetary policy failed? What is the solution?

Article's background

The purpose of this article is;

- to prove through the monetary theory how the super tight monetary policy pursued from April 2022 has caused the present deflationary condition of the Sri Lankan economy and

- to recommend an urgent need of at least 300 bps policy interest rate cut to pre-empt deflation risk.

- In the last monetary policy press release on 27 September, the Central Bank (CB) reported a deflationary path in the near-term without taking any monetary policy action to arrest it in advance. The CB stated that deflation path was due to the downward revision of administered prices.

- Therefore, it appears that the CB currently does not believe the CPI based inflation statistics for the conduct of inflation targeting monetary policy although its inflation target of 3%-7% is set on quarterly average CPI inflation basis.

- In the monetary policy theory, inflation is always everywhere a monetary phenomenon, that is, the excess money drives inflation, i.e., too much money chases after too little volume of goods and services. Therefore, central bank only action to control inflation is the control of the quantity of money in supply. The increase in the interest rate (policy interest rate) on central bank money printing is the prime weapon used for this purpose in fractional reserve monetary systems.

- Therefore, the reverse is applicable to deflationary situations. However, the CB exhibits a lukewarm attitude to use the monetary policy to forestall the ongoing deflation risk and resulting macroeconomic instabilities.

Inflation trend and cost of living

- Inflation overshoot during the political crisis in 2022 and early 2023 and deflation risk now emerging visibly.

- The cost of living still prevails high at 2022 levels although its increase (inflation) has fallen since 2023.

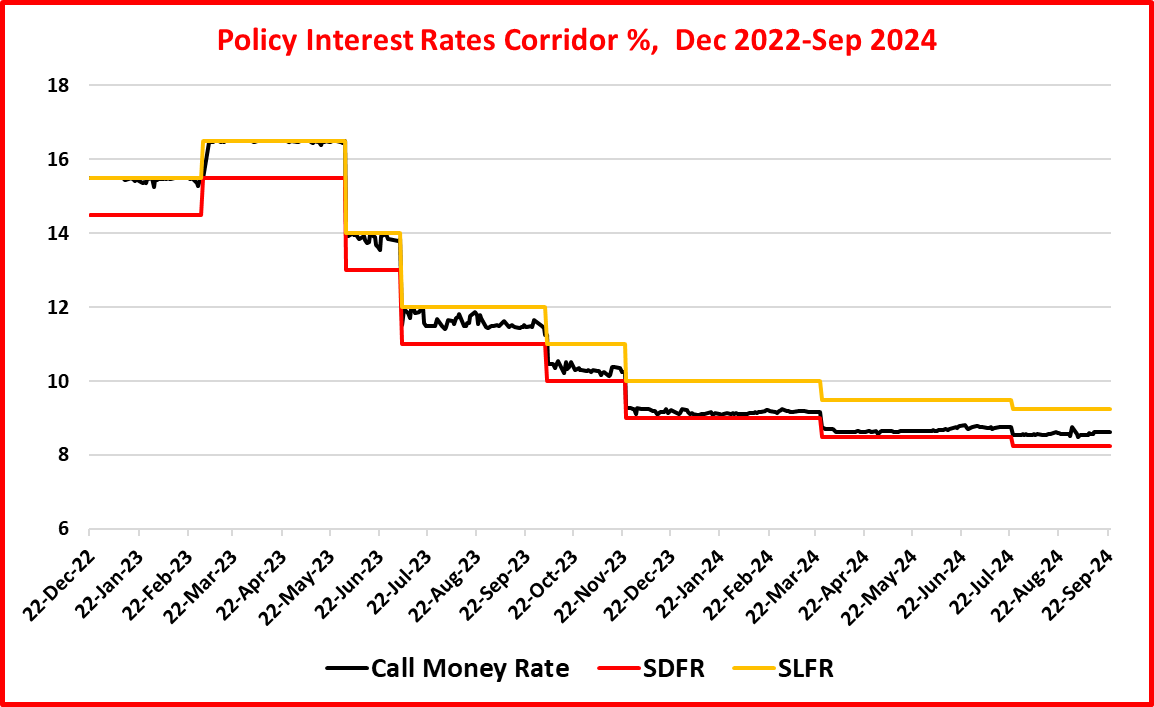

Policy rates path

Above two charts show:

- The policy interest rates that were raised to control high inflationary pressures in 2022/23 still remain at elevated levels despite deflationary fears.

- Real policy rates (extraordinarily negative) that discouraged lending significantly in 2022/23 still remain at low levels below 5% not sufficient for risk-taking to encourage lending amidst considerable macroeconomic and market uncertainties.

Market interest rates

- Inflation, policy rates and market interest rates are not consistent.

- Despite deflationary path, market interest rates have tended to move up for the last quarter making credit conditions tight.

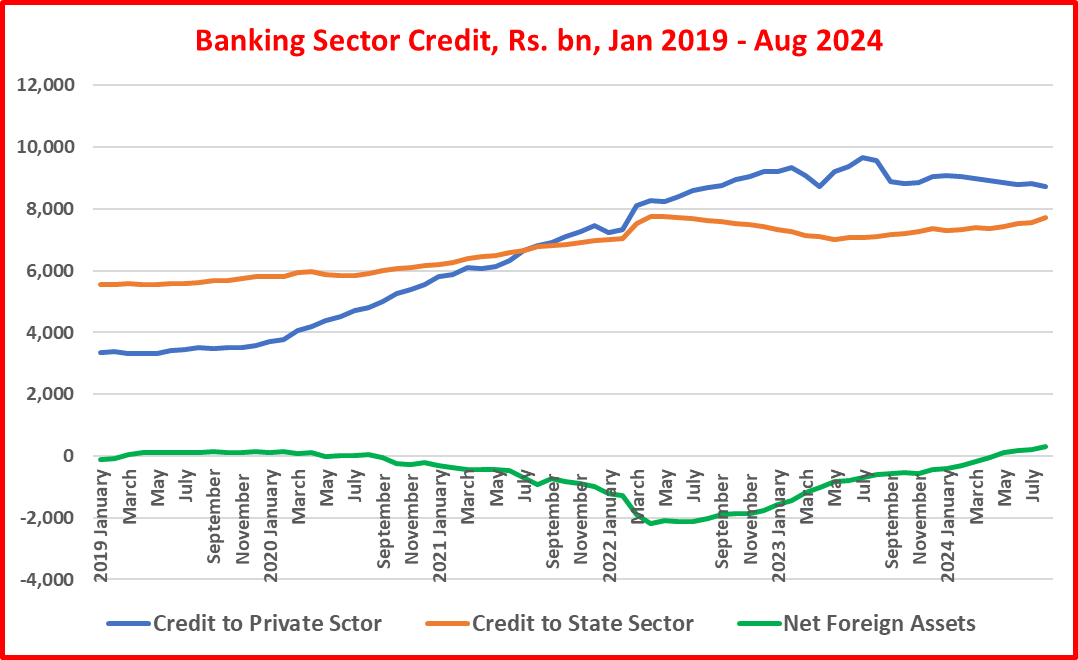

Behavior of money stocks and monetary operations

- Banks increasingly parking reserves daily at CB standing deposits at risk free interest rate (8.25% at present) while hardly borrowing of reserves due to sluggish credit demand and high credit risk arising from macroeconomic risks and uncertainties.

- Growth and level of money stocks highly tight.

- Real money stocks remain flat suppressing the demand side of the economy.

- Real money growth which was high negative in 2022 and early 2023 represents lagged effects as current real reserve money growth has has been low and slow.

Concluding remarks

- The evidence highlighted above proves that unnecessarily tight monetary policy in the bankrupt and contracted economy has caused a deflationary risk, assuming that the monetary theory as believed by central banks operates on inflation through interest rates, money stock and aggregate demand.

- The suppressed real money stock, especially the real reserve money, is the key indicator of the excessive demand control pushing the economy into deflation trap. The exodus of labour to foreign countries and the increased poverty also have contributed to lower credit demand and depressed aggregate demand. However, the fact of the matter is that the deflation is the result of the deficit demand caused by the deficit money in opposite to inflation. Therefore, the problem as well as the solution lies in the monetary policy.

- However, the CB still kept policy interest rates unchanged at 8.25%-9.25% level wrongfully at its policy meeting held on 26 September while noting the deflation path developing since early this year (Read my article here) although I predicted up to 100 bps rate cut in current circumstances (Read my article here) including global policy rates cut cycle that has now commenced.

- I predicted at least 100 bps rate cut (Read my article here) at the policy meeting held on 23 July in view of the close to zero inflation and other macroeconomic requirements whereas only a rate cut of 50 bps was announced. After that, no rate cut was announced despite the deflationary trend.

- Deflation is worse than inflation. First, it causes losses to producers and sellers pushing them out of production activities that will have spiral effects on employment, wages and prices. Second, resulting debt service problems and default cause risks to the financial system. In this regard, there is ample real world experience.

- Therefore, it is urgent that the CB implements a policy rate cut of at least 300 bps to relax financing conditions and to boost credit and demand side of the economy in order to stimulate production activities and employment generation.

- However, presently relaxed sitting mode of the Monetary Policy Board while looking at deflation drive is strange as it contravenes the monetary policy theory as well as the monetary policy framework agreement with the Minister of Finance. Therefore, it is the public duty of the new Minister of Finance to ensure that the Monetary Policy Board delivers its public duty of inflation keeping in the statutory target of 3%-7% to the letter and spirit.

- If the public is to suffer from high inflation and deflation cycles from time to time, there is no purpose of having a central bank to carry out an inflation target monetary policy for price stability. Markets will do it better through invisible hand.

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(35 years of staff grade service in the Central Bank, a former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 13 Economics and Banking Books and a large number of articles published.)

Comments

Post a Comment